POST MARKET

Indian equity benchmarks extended their previous session’s gains on February 17, supported by broad-based buying across sectors with strong interest in IT, FMCG, and banking stocks. However, profit booking in metal and realty counters capped the upside.

At close,

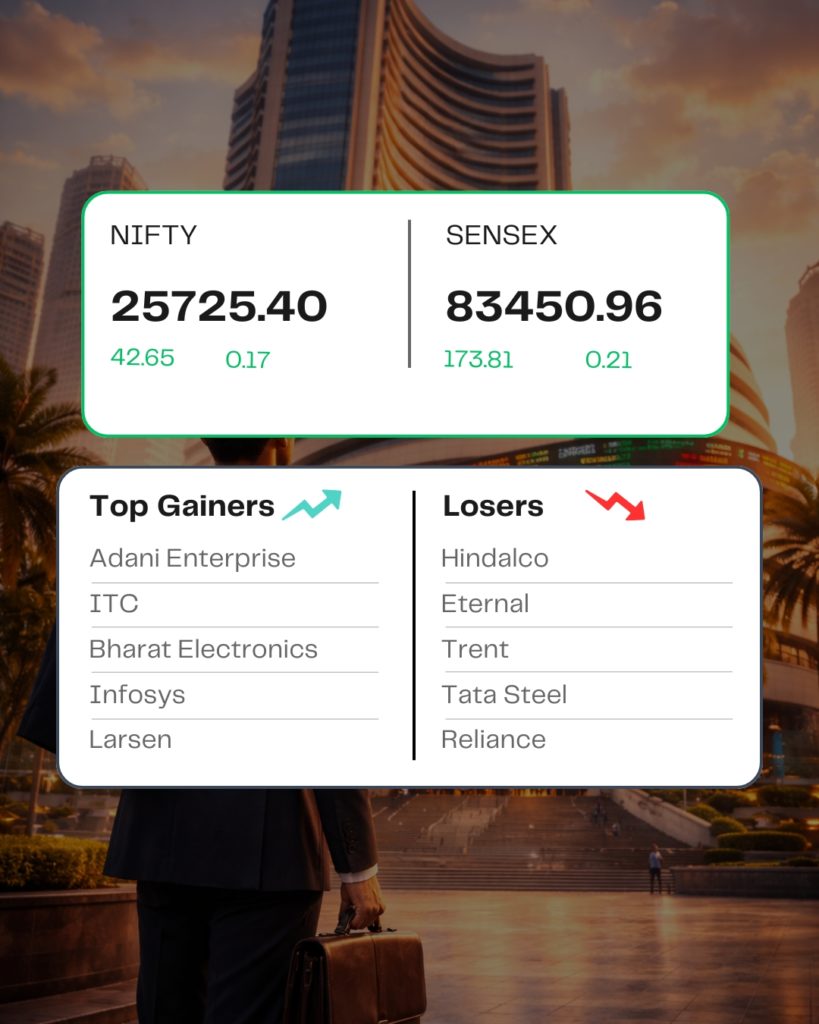

Sensex ↑ up 173.81 points or 0.21 percent at 83,450.96,

Nifty ↑ up 42.65 points or 0.17 percent at 25,725.40.

About 2297 shares advanced, 1730 shares declined, and 142 shares remained unchanged.

On the sectoral front, the PSU Bank index is up 2 percent, the IT index up 1 percent, the media index rises 0.6 percent, the auto index up 0.5 percent, while metal is down 1 percent and the realty index down 0.3 percent.

Adani Enterprises, ITC, Bharat Electronics, Infosys, and L&T were among the major gainers on the Nifty, while losers are Eternal, Trent, Hindalco Industries, Reliance Industries, and Tata Steel.

Among the broader market indices, the Nifty Midcap index rose 0.3% and smallcap index added 0.5%.

STOCKS IN NEWS

Infosys

The shares of IT company gained almost 2 percent on February 17, extending gains for the second consecutive session after a sharp decline. This came after the company announced a strategic partnership with Anthropic, amid worries around AI-led disruption in the sector.

Cochin Shipyard

Shares of Cochin Shipyard rose 3.45 percent on February 17 after the company was named the lowest bidder for an Rs 5,000-crore order from the Ministry of Defence. The order is to build five next-generation survey vessels for the Indian Navy. Shares of the company rose after falling for four days, during which they shed 4%.

Maruti Suzuki

The shares of Maruti Suzuki India gained almost 1 percent after the company announced the launch of its first electric vehicle e VITARA BEV with a battery rental plan in India.

Adani Enterprises

Adani Enterprises’ share went up over 2.5 percent on February 17, after the company said that the conglomerate will invest $100 billion to build renewable energy-powered AI-ready data centres by 2035.

Source – Moneycontrol