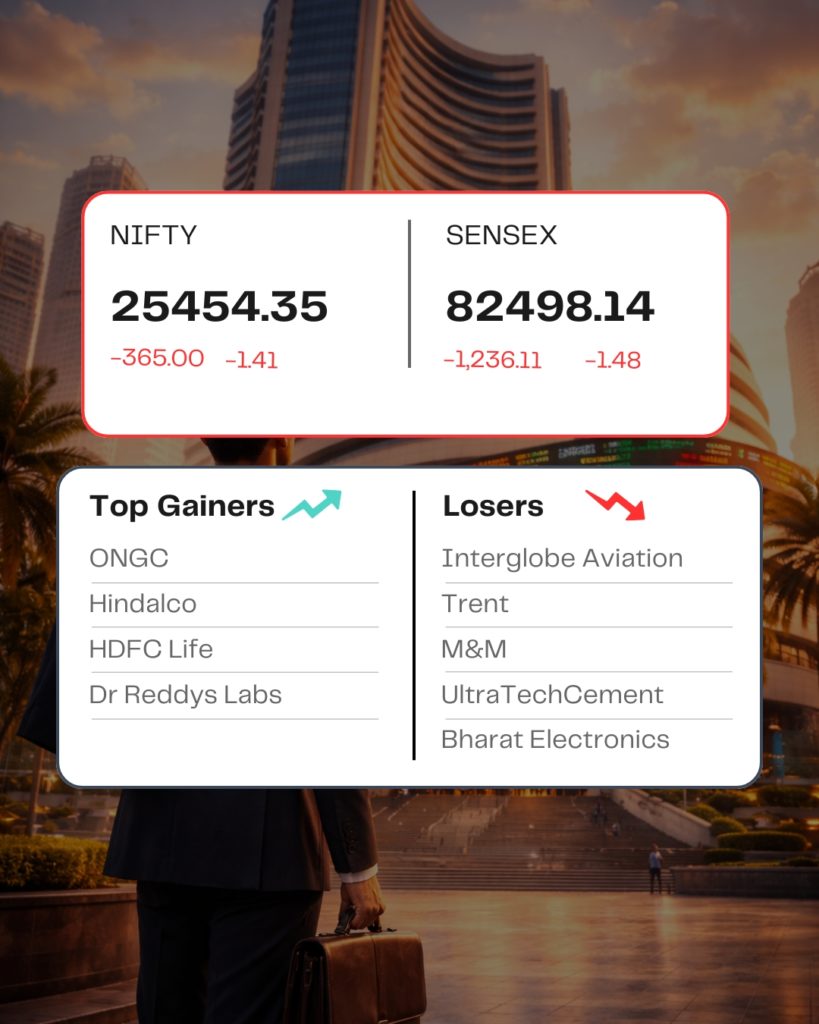

POST MARKET

Indian equity markets failed to sustain their early momentum and snapped a three-day gaining streak on February 18. Amid broad-based selling across sectors. Escalating tensions between the US and Iran further weighed down investor sentiment.

At close,

Sensex ↓↑ down 1,236.11 points or 1.48 percent at 82,498.14,

Nifty ↓ down 365 points or 1.41 percent at 25,454.35.

About 1248 shares advanced, 2790 shares declined, and 149 shares were unchanged.

Top losers – Interglobe Aviation, M&M, Bharat Electronics, UltraTech Cement, and Trent,

Top gainers – Dr. Reddy’s Laboratories, ONGC, HDFC Li,fe and Hindalco Industries.

All the sectoral indices ended in the red with Auto, Capital Goods, Realty, Power, Consumer Durables, and Media down 2% each.

Among the broader market indices, the Nifty midcap index shed 1.6 percent, and the smallcap index fell 1.3 percent.

STOCKS IN NEWS

Swiggy

Food and grocery major Swiggy shares went down 2.32 percent, after the company decided to shut Snacc, a dedicated app it launched for 15-minute food deliveries, just a year after the offering was launched, as the company struggled to make orders profitable.

ONGC

The shares of oil refinery Oil and Natural Gas Corporation (ONGC) gained 3.65 on February 19 as crude oil prices rose amid a rise in global geopolitical tensions between the US and Iran.

Interglobe Aviation

Indigo parent company Interglobe Aviation shares went down 3.28 percent, after a major technical disruption on February 19, 2026, led to widespread chaos at airports across India after a key third-party aviation server went down, impacting check-in and boarding systems of several low-cost carriers.

Dixon Technologies

Shares of Dixon Technologies (India) Ltd fell over 2.5 percent on Thursday as CLSA downgraded the rating, following a prolonged phase of underperformance. The global brokerage flagged mounting risks from rising memory prices amid AI-led demand and deteriorating medium-term growth visibility.

Source – Moneycontrol