Amagi Media Labs IPO is a bookbuilt issue of ₹1,788.62 crores. It combines a fresh issue of 2.26 crore shares aggregating to ₹816.00 crore and an offer for sale of 2.69 crore shares aggregating to ₹972.62 crore.

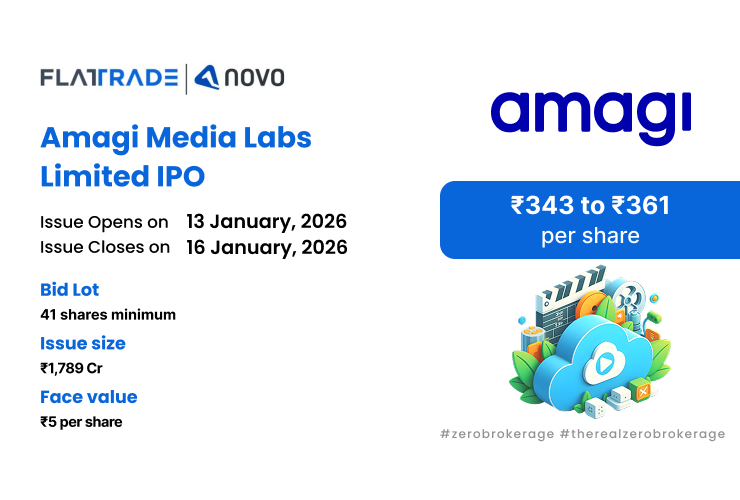

The IPO opens for subscription on January 13, 2026 and closes on January 16, 2026. The allotment is expected to be finalised on Monday, January 19, 2025. The price band for the IPO is set at ₹343 to ₹361 per share, and the minimum lot size for an application is 41 shares.

Company Summary

Amagi Media Labs Ltd. is engaged in cloud-based broadcast and connected TV technology. Founded in 2008 and headquartered in Bengaluru, India, Amagi provides end-to-end solutions for content creation, distribution, and monetisation across traditional TV and streaming platforms.

The company enables broadcasters, content owners, and streaming platforms to launch, manage, and monetise live linear channels on Free Ad-supported Streaming TV (FAST) platforms such as Pluto TV, Samsung TV Plus, Roku Channel, and others. Amagi’s suite of products includes cloud playout, content scheduling, ad insertion, and data analytics tools.

With a strong presence in the U.S., Europe, and Asia, Amagi serves over 700 content brands and delivers more than 2,000 channel deployments across 100+ countries. Its innovative SaaS offerings have significantly reduced the infrastructure costs for media companies while increasing flexibility, scalability, and revenue opportunities.

As of March 31, 2025, the company employed 884 full-time staff worldwide. Of these, 652 worked in technology and engineering at hubs in Bengaluru, the US, Croatia, and Poland. Additionally, 181 employees were in customer-facing roles, emphasising the focus on engagement, delivery, and support.

Company Products and Services

Amagi offers a comprehensive range of cloud-based products and services designed for TV broadcasters, content owners, and streaming platforms.

- Amagi CLOUDPORT: A cloud-based playout platform that enables broadcasters to manage and deliver linear TV channels globally without traditional infrastructure. It supports UHD/HD/SD playout with automated scheduling and media asset management.

- Amagi PLANNER: Content blocks through an intuitive interface.

- Amagi THUNDERSTORM: A server-side ad insertion platform that delivers personalised, targeted ads on live and on-demand content. It supports monetisation for both OTT and FAST platforms.

- Amagi ON-DEMAND & FAST Solutions: Enables content owners to launch 24/7 channels on platforms like Samsung TV Plus, Roku, and Pluto TV. It includes channel creation, playout, and revenue-sharing partnerships with FAST platforms.

Company Strengths

- One-stop glass-to-glass solutions provider.

- Positioned within a three-sided marketplace to leverage strong network effects.

- Proprietary, award-winning technology platform with artificial intelligence capabilities.

- Trusted by global customers with long-term relationships.

- Visionary founders with strong leadership and a culture of innovation.

Company Financials

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 1,352.16 | 1,425 | 1,308.08 | 1,405.96 |

| Total Income | 733.93 | 1,223.31 | 942.24 | 724.72 |

| Profit After Tax | 6.47 | -68.71 | -245 | -321.27 |

| EBITDA | 58.23 | 23.49 | -155.53 | -140.34 |

| Net Worth | 859.34 | 509.45 | 496.8 | 644.49 |

| Reserves and Surplus | -25.57 | 227.73 | -379.4 | -372.68 |

| Total Borrowing | 0 | 0 | 0 | 0 |

| Amount in ₹ Crore | ||||

Objectives of IPO

- Investment in technology and cloud infrastructure.

- Funding inorganic growth through unidentified acquisitions and general corporate purposes.

Promoters of the Company

The promoters of the Company are Baskar Subramanian, Srividhya Srinivasan, and Arunachalam Srinivasan Karapattu.

IPO Details

| IPO Date | January 13, 2026 to January 16, 2026 |

| Listing Date | January 21, 2026 |

| Face Value | ₹5 per share |

| Price Band | ₹343 to ₹361 per share |

| Lot size | 41 shares |

| Total Issue size | 4,95,46,221 shares (aggregating upto ₹1789.00 Cr ) |

| Fresh Issue | 2,26,03,878 shares (aggregating upto ₹816.00 Cr ) |

| Offer for Sale | 2,69,42,343 shares of ₹5 (aggregating upto ₹973.00 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 19,37,35,066 shares |

| Share Holding Post Issue | 21,63,38,944 shares |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 41 | ₹14,801.00 |

| Retail (Max) | 13 | 533 | ₹1,92,413.00 |

| S-HNI (Min) | 14 | 574 | ₹2,07,214.00 |

| S-HNI (Max) | 67 | 2,747 | ₹9,91,667.00 |

| B-HNI (Min) | 68 | 2,788 | ₹10,06,468.00 |

Allotment Schedule

| Basis of Allotment | Mon, 19 Jan, 2026 |

| Initiation of Refunds | Tue, 20 Jan, 2026 |

| Credit of Shares to Demat | Tue, 20 Jan, 2026 |

| Tentative Listing Date | Wed, 21 Jan, 2026 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Net Issue |

| Retail Shares Offered | Not more than 10% of the Net Issue |

| NII Shares Offered | Not more than 15% of the Net Issue |

Source – SEBI, Chittorgarh

To check allotment, click here