POST-MARKET REPORT

Indian benchmark indices closed higher for the second day running, buoyed by positive cues from global markets in anticipation of interest rate cuts by the Federal Reserve in September, along with progress on the formation of a new government by Narendra Modi-led BJP’s alliance NDA.

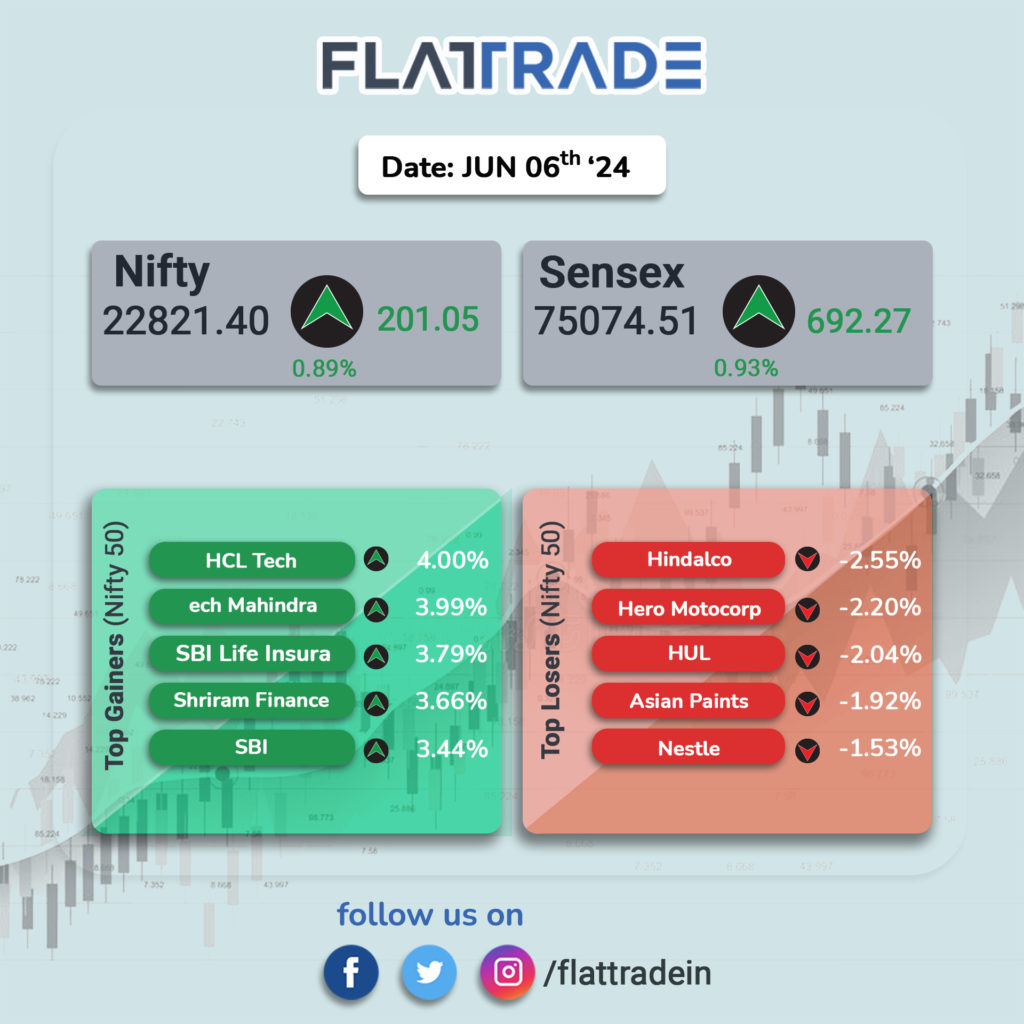

At close, the Sensex was at 75,074.51, up 692.27 points, or 0.93% while the Nifty was at 22,821.40, up 201.05 points, or 0.89%.

Gainers and Losers on Nifty: 13 of the 50 stocks on the Nifty 50 were trading in the red. Hindalco Industries, Hero MotoCorp, Hindustan Unilever, Asian Paints, and Nestle India, were the top gainers, while HCLTech, Tech Mahindra, SBI Life, Shriram Finance, and SBI were the top gainers.

Gainers and Losers on Sensex: Eight of the 30 stocks on the BSE Sensex were trading in the red. Hindustan Unilever, Asian Paints, Mahindra & Mahindra, Nestle India, and IndusInd Bank, were the top drags, while Tech Mahindra, HCLTech, SBI, Infosys, and NTPC, were the top gainers.

Sector Indices today: Barring FMCG, Pharma, Health, and Private Bank, all the other sectoral indices were trading in the green. The Realty index had gained the most, followed by Media, PSU Bank, and Oil & Gas indices. Other heavyweight indices like Auto, Bank, Financial Services, and IT were also ahead between 0.4% to more than 2%.

Broader market indices today: The broader market was in the green, with the BSE SmallCap index gaining 3.01% and the BSE MidCap gaining 2.15%.

STOCKS TODAY

Heritage Foods: Shares surged another 10 percent after it became certain that Telugu Desam Party (TDP) leader Chandrababu Naidu will become Chief Minister of Andhra Pradesh after the recently concluded assembly elections. The dairy products manufacturers Nara Bhuvaneshwari and Nara Lokesh are the wife and son of the Chief Minister-elect respectively.

BHEL: Shares closed 9 percent higher after it announced a major order win of over Rs 3,500 crore from Adani Power. The order is to set up a 2×800 MW thermal power plant (TPP) in Raipur, Chhattisgarh, and as per the contract, BHEL will supply equipment. In addition, value buying after the sharp correction in the stock also helped in the gains.

Uno Minda: Shares closed 13.5 percent higher as the company inked a deal with China’s lnovance Automotive to boost the electric four-wheeler product portfolio. The development assumes importance as the management suggests that this will ‘significantly’ expand its e-4W product portfolio, enabling it to effectively cater to the growing Indian EV market.

Amara Raja Energy and Mobility: Shares closed over 5 percent higher after hitting a fresh all-time high of Rs 1,333 as investors turned bullish on the counter following Telugu Desam Party’s massive victory in the local assembly elections, consequently becoming a major player in national politics. Amara Raja’s Managing Director Jay Dev Galla was a former MP from the party. The two-time MP and head of the Amara Raja group decided not to contest Lok Sabha elections this year.

Hindustan Unilever: Shares fell 2 percent as investors rushed to book profits after the stock’s outperformance amidst the recent market meltdown. Shares of FMCG companies bucked the market correction and moved higher earlier this week as investors reallocated bets to defensive sectors.

Century Textiles: Shares closed over 14 percent higher after its arm, Birla Estates signed a pact to enter into a joint venture (JV) with Barmalt India to develop a land parcel for a luxury residential group housing at a marquee location in Gurugram. The land parcel spans 13.27 acres, with a development scope of around 2.4 million square feet, projecting a revenue potential of around Rs 5,000 crore.