POST-MARKET REPORT

Indian benchmark indices closed higher for the 3rd straight session, with the 30-stock BSE Sensex touching a fresh all-time high.

RBI Governor Shaktikanta Das’ announcement of holding unchanged interest rates at 6.5% for the eighth time in a row. The RBI governor also announced the revised GDP growth projection for FY25 at 7.2%.

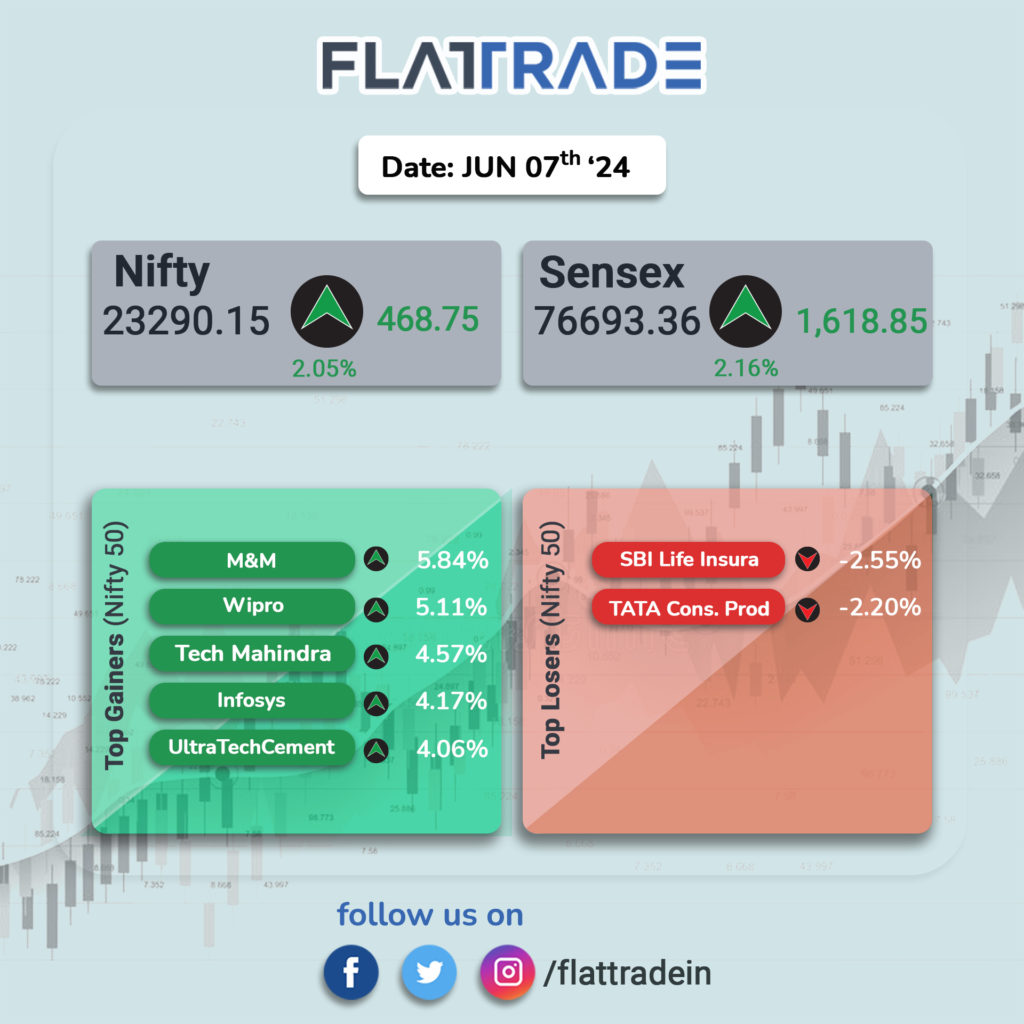

At close, the Sensex was at 76,693.36, up 1,618.85 points, or 2.16% while the Nifty was at 23,290.15, up 468.75 points, or 2.05%.

Gainers and Losers on Nifty: Only two stocks, SBI Life and Tata Consumer Products, out of the 50 on the Nifty 50 were trading in the red, while Mahindra & Mahindra, Wipro, Tech Mahindra, Infosys, and UltraTech Cement, were the top gainers.

Gainers and Losers on Sensex: All the 30 stocks on the BSE Sensex were trading in the green, with Mahindra & Mahindra, Wipro, Tech Mahindra, Tata Steel, and Bajaj Finance, were the top gainers.

Sector Indices today: All the sectoral indices were green, with the IT index leading the pack (up 3.37%) followed by the Auto, Oil & Gas, Metal, and Realty indices, which were up more than 2% each. The rest of the indices were all up more than 1% each.

Broader market indices today: The broader market was higher, with the BSE SmallCap gaining 2.16% and the BSE MidCap climbing 1.20%.

STOCKS TODAY

Dixon Technologies: Shares closed over 2 percent higher post hitting a fresh record high after the company informed that it inked a term sheet to form a joint venture (JV) with HKC Corporation. It became a five-digit stock as the share price crossed the Rs 10,000 mark after the latest surge.

RVNL: The stock ended with 2 percent gains after the company secured an order worth Rs 495 crore from National Thermal Power Corporation (NTPC). Under the terms of the contract, RVNL will be responsible for the execution of balance civil & HM works of the barrage complex including part HRT package of the Rammam hydroelectric project stage III.

Bajaj Finance: Shares of Bajaj Finance gained around 4 percent after the board approved the sale of Rs 3,000 crore shares in Bajaj Housing’s initial public offering (IPO). Meanwhile, Bajaj Housing Finance IPO will raise around Rs 4,000 crore via fresh issues and offer-for-sale components separately.

Mastek: Shares of the company closed over 8 percent higher after the Sunil Singhania-backed company announced that its cloud-native platform icxPro has partnered with NVIDIA AI Enterprise to boost CX (Customer Experience) management for different sectors.

IRB Infra: Shares settled around 11 percent higher after the company reported a spike in toll collections in May. The company’s toll collections in May rose 30 percent on year to Rs 536 crore. Brokerage firm CLSA also named IRB Infra as one of the key beneficiaries of the return of the Modi government to power and its subsequent push on infra capex.

Tata Chemicals: Shares fell after the company’s subsidiary Tata Chemicals Europe was fined £1.1 million by the Chester Crown Court in the United Kingdom. The fine is related to a safety incident that occurred back in 2016 resulting in the injury and subsequent unexpected death of a contractor. Morgan Stanley downgraded the stock as ‘underweight’ and slashed its price target for the stock by around 7 percent to Rs 843.