POST-MARKET REPORT

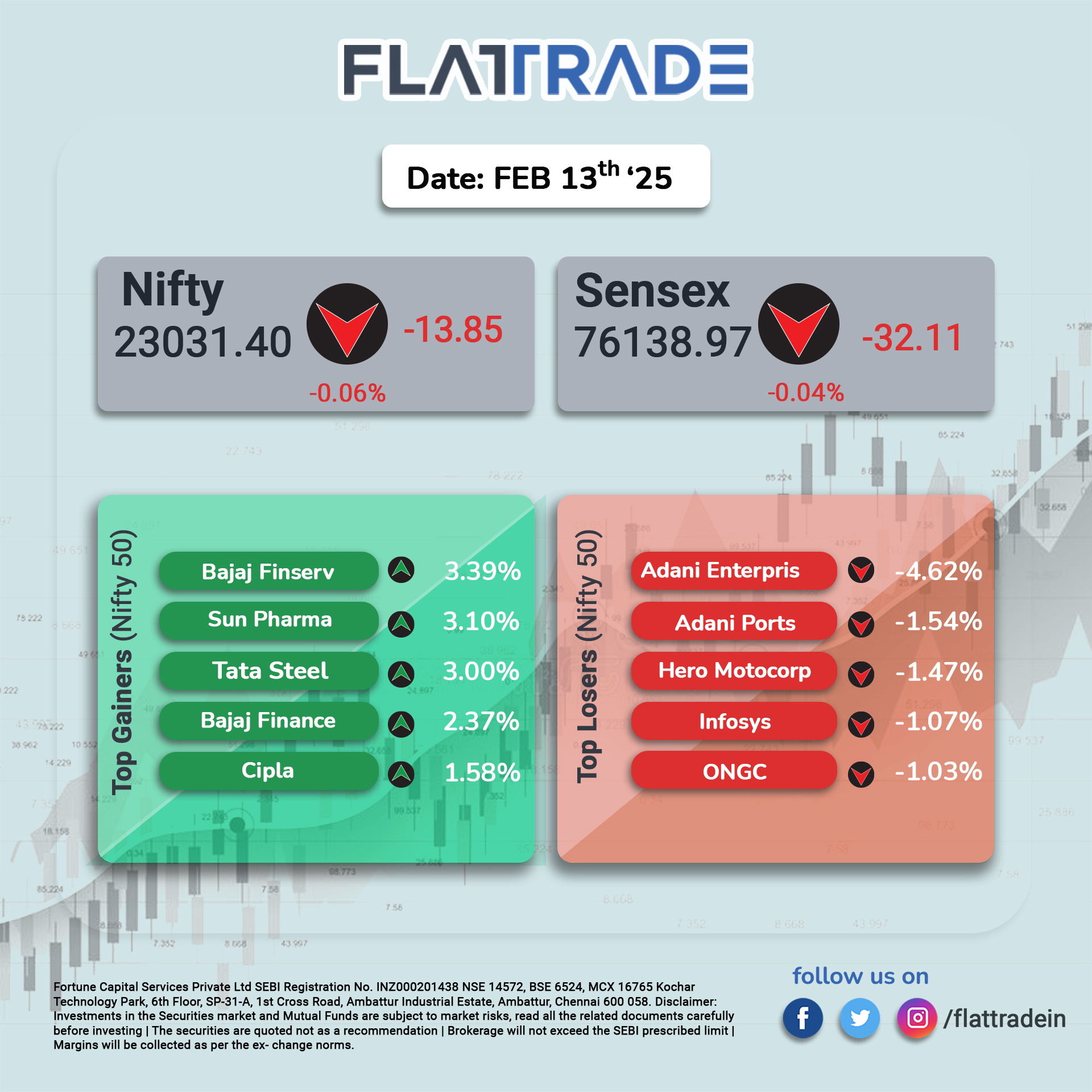

The Indian Benchmark indices closed lower for the seventh consecutive session on Thursday, February 13, as early gains were erased amid mid-session selling, dragging both the Nifty 50 and Sensex into the red.

The Nifty 50 ended the session with a minor drop of 0.06% at 23,031, while the Sensex closed at 76,138, down 0.04% compared to Wednesday’s close.

On the sectoral front, Nifty Pharma emerged as the top performer, gaining 1.35%. Realty stocks also bounced back strongly and ended with a gain of 0.81%.

Other sectoral indices, such as Nifty Media, Nifty PSE, Nifty Metal, and Nifty CPSE, all ended in the green with gains ranging between 0.26% and 0.86%.

Considering the Broader indices, The Nifty Smallcap 100 index fell by 0.37% to 15,973 while the Nifty Midcap 100 index, however, ended the day with a gain of 0.25%, closing at 50,881.

STOCKS TODAY

HAL: The company delivered a robust performance for the third quarter of FY25. Market sentiment remained upbeat, with 15 out of 17 brokerages maintaining a “buy” rating and setting a target price of Rs 5,297. HAL reported a 14 percent year-on-year (YoY) jump in net profit to Rs 1,440 crore in Q3FY25 supported by strong demand for its aircraft from defence ministry. The company’s revenue from operations also rose by 15 percent YoY to Rs 6,957 crore in Q3FY25.

Power Finance: On February 12, the company reported a net profit of Rs 4,155, which is an increase of almost 23 percent from Rs 3,377 crore reported in the corresponding quarter of the previous fiscal year, PFC disclosed in an exchange filing. The Shares then gained almost 4 percent today.

Vodafone Idea: Shares climbed as much as 7 percent as upbeat management commentary lifted sentiment. The Mumbai-based telecom company suggests that it will invest Rs 10,000 crore in expanding its network by the end of March, nearly matching its total capital expenditure for the first nine months of the fiscal year.

Kotak Mahindra Bank: Shares of Kotak Mahindra Bank gained over 2 percent to hit a fresh 52-week high after the Reserve Bank of India lifted curbs on its digital banking operations. Nearly 10 months after the embargo was imposed, the bank can once again issue new credit cards and onboard customers via its website and mobile app. Brokerages responded positively to this development, seeing it as a major catalyst for growth.

Natco Pharma: Shares of Natco Pharma plunged as much as 18.5 percent as investors dumped the stock following its disappointing Q3 earnings performance. The drugmaker’s net profit for the quarter gone by dropped 38 percent on year to Rs 132.4 crore in Q3, sharply down from the Rs 212.7 crore that it clocked in the same period last fiscal. Revenue also fell over 37 percent to Rs 474.8 crore in Q3, down from Rs 758.6 crore in the year-ago period.