POST-MARKET REPORT

The Indian benchmark indices continued their winning streak on the second day of the new calendar year with Nifty crossing 24,200, intraday, on the back of buying across the sectors led by auto stocks after December sales numbers.

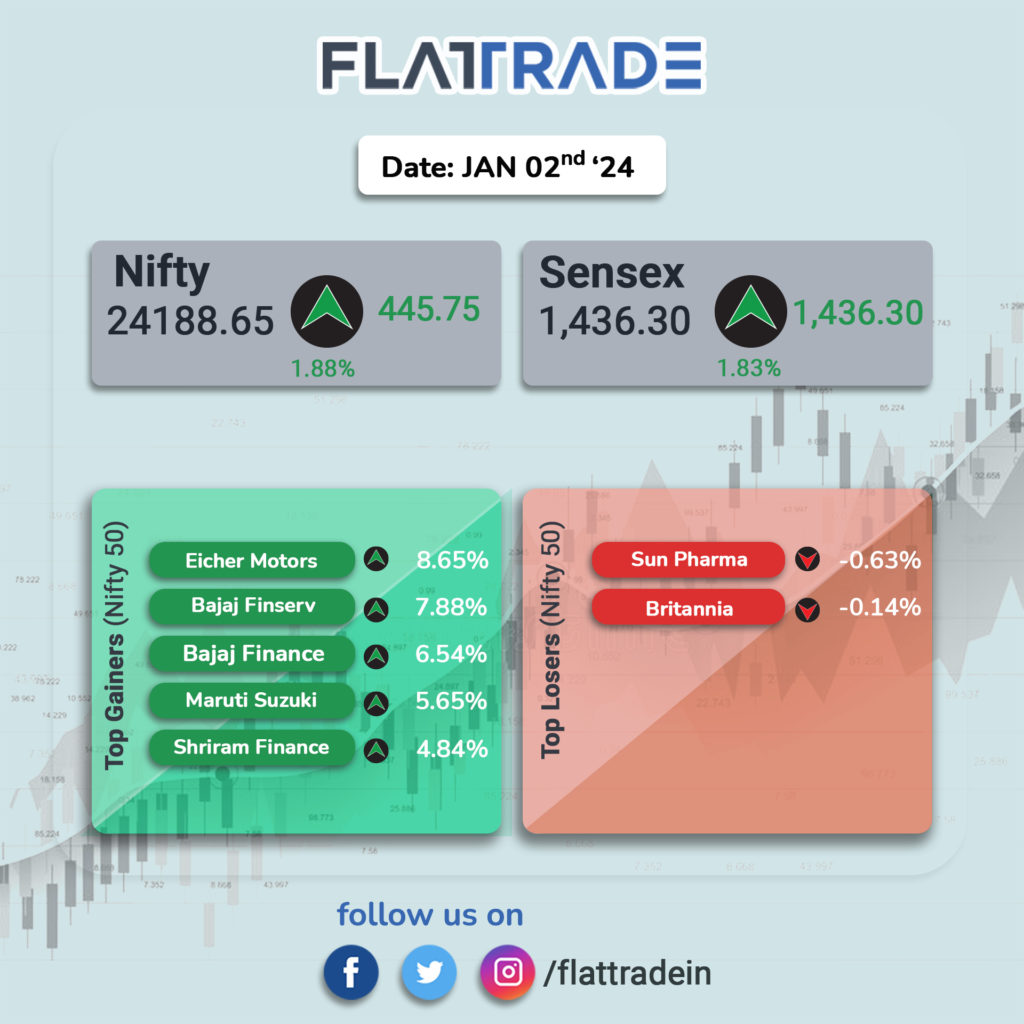

At close, the Sensex was up 1,436.30 points or 1.83 percent at 79,943.71, and the Nifty was up 445.75 points or 1.88 percent at 24,188.65.

In today’s up move, investors’ wealth increased by around Rs 5.8 lakh crore, as the market capitalization of BSE-listed companies rose to Rs 450.32 lakh crore lakh crore, from Rs 444.43 lakh crore in the previous session.

All the sectoral indices ended in the green with the auto index up 3.5 percent, the IT index up 2 percent, while FMCG, Metal, Oil & Gas, PSU, Realty, and Bank up 1 percent each.

The biggest Nifty gainers were Bajaj Finserv, Eicher Motors, Bajaj Finance, Maruti Suzuki, and Shriram Finance while losers included Britannia Industries and Sun Pharma.

BSE Midcap and Smallcap indices added a percent each.

STOCKS TODAY

Bajaj Finance: The company’s share price surged over 5 percent in Thursday’s trade after analysts at the brokerage Citi reiterated its ‘Buy’ rating on the stock. Over the past two sessions, Bajaj Finance shares have gained nearly 7 percent.

Ashok Leyland: Shares of Ashok Leyland surged 5 percent to Rs 233 per share on January 2 after December sales figures turned out to be better-than-expected. The company’s total sales jumped by 5 percent year-on-year (YoY) to 16,957 units in December, whereas medium and heavy commercial vehicle sales rose by 8 percent YoY to 11,474 units led by the truck segment.

South Indian Bank: Shares surged 3 percent to Rs 26 per share on January 2 after it reported a steady October-December quarter (Q3FY25) business update. The lender’s gross advances rose by 12 percent year-on-year (YoY) to Rs 86,965 crore in Q3, while deposits grew by 6.2 percent YoY to Rs 1.05 lakh crore. CASA ratio, meanwhile, fell to 31.1 percent during the quarter as compared to 31.8 percent in the year-ago period.

Kotak Mahindra Bank: Private sector lender Kotak Mahindra Bank Ltd. shares emerged as the top gainers on the Nifty 50 pack in trade, after receiving an upgrade from international brokerage Citi Research on January 2. Citi Research upgraded Kotak Mahindra Bank to a ‘buy’, with a target price of Rs 2,070 per share, indicating an upside of nearly 16 percent from the previous session’s closing price.

RailTel Corporation: In December 2024, the company received a work order worth Rs 37.99 crore from Central Warehousing Corporation and a work order worth Rs 24.5 crore from Haryana State Electronics Development Corporation for CAMC. Also, Haryana State Electronics Development Corporation work amounting to Rs 24,50,00,000.