POST-MARKET REPORT

Indian benchmark indices extended the previous session’s gains to end at a fresh record high on August 29, led by heavyweights including Reliance Industries after the company announced to consider a bonus share issue on September 5.

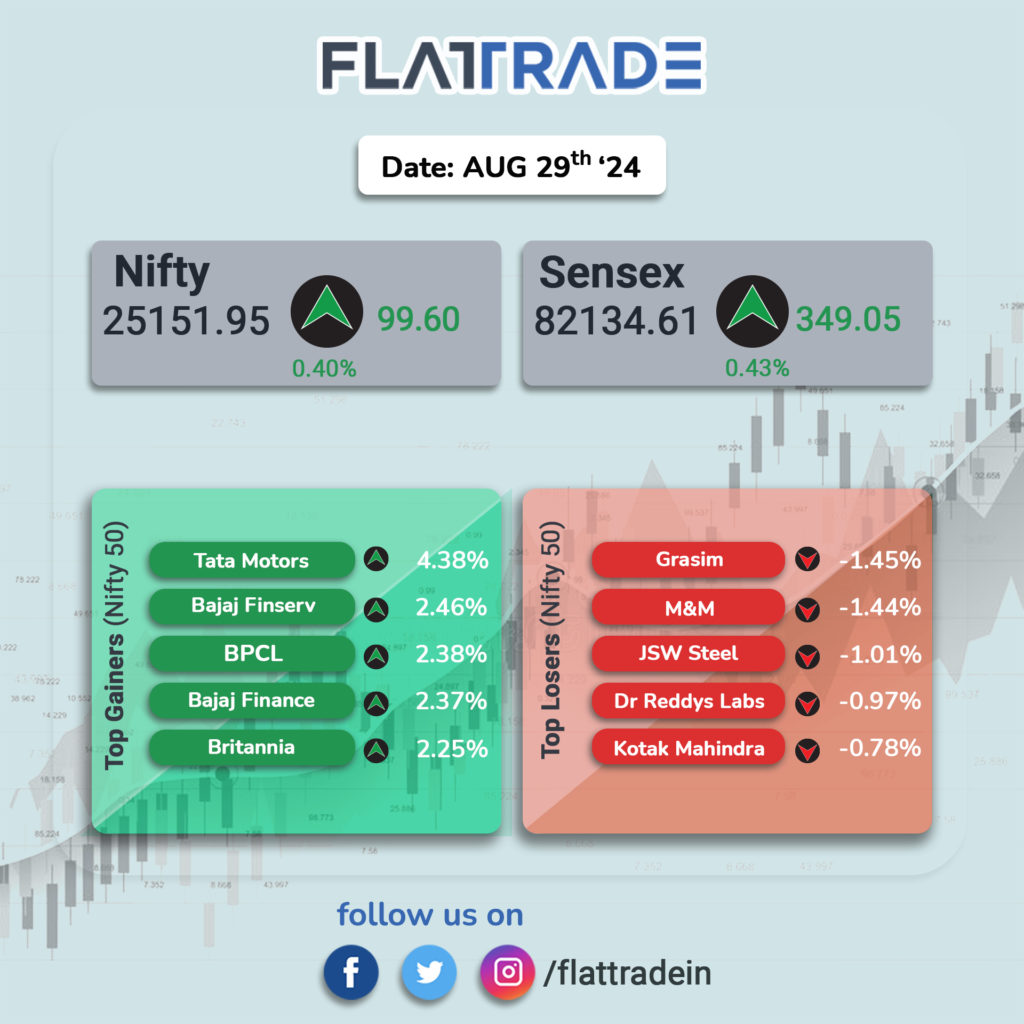

At close, the Sensex was up 349.05 points or 0.43 percent at 82,134.61, and the Nifty was up 99.60 points or 0.40 percent at 25,152.

On the sectoral front, auto, oil & gas, telecom, IT, and FMCG rose 0.5-1 percent, while capital goods, pharma media, metal, and power were down 0.3-0.7 percent.

The biggest Nifty gainers were Bajaj Finserv, Bajaj Finance, Tata Motors, Britannia Industries and BPCL, while losers included Grasim Industries, M&M, JSW Steel, Kotak Mahindra Bank, and Dr Reddy’s Laboratories.

BSE Midcap index shed 0.3 percent and Smallcap index was down 0.7 percent.

STOCKS TODAY

Reliance Industries: Shares rose nearly 2 percent after India’s most valuable conglomerate announced that its board will consider a 1:1 bonus share at on September 5. The announcement comes ahead of the 47th annual general meeting today (August 29). With this bonus issue, the Mukesh Ambani-led conglomerate aims to reward shareholders for its strong financial performance and business expansion.

JM Financial: The stock surged 5 percent on high volumes. So far in the day, around five crore shares of the company changed hands on BSE and NSE combined as against a 1-month average trading volume of 69 lakh shares. For the quarter ended June 30, 2024, it reported a 6.2 percent on-year (YoY) dip in net profit at Rs 60.4 crore.

Zen Technologies: Shares hit a 5 percent lower circuit on August 29 as profit booking persisted. The company’s market cap dropped to Rs 14,525 crore. The stock had previously surged nearly 20 percent between August 6 and August 26, prompting investors to lock in gains since.

Concord Biotech: surged nearly 6 percent to hit an all-time high on high volumes. So far in the day, around 24 lakh shares of the company changed hands on BSE and NSE combined as against a 1-month average trading volume of 79,000 shares. The company’s earnings for the quarter ended June 2024 came in slightly below expectations.

Genus Power: Shares surged to a new all-time high of Rs 466 each on August 29, hitting the 5 percent upper circuit limit. This remarkable gain came after the company announced its arm secured new orders worth Rs 4,469 crore. With these new contracts, the company’s total order book now stands at a robust Rs 32,500 crore.

Sonata Software: Shares rose 6 percent following its multi-year, multi-million dollar IT outsourcing contract from a US-based premier healthcare and wellness company. The company’s primary focus is delivering personalized, high-quality care that addresses the unique needs of vulnerable patients and underserved populations in challenging clinical environments and other behavioral health settings.