POST-MARKET REPORT

Indian markets closed higher for the fourth consecutive session on January 31, ahead of the crucial Union Budget on Saturday.

Investor optimism grew after Prime Minister Narendra Modi invoked the Hindu goddess of wealth, signaling potential government measures to support consumption, particularly for the poor and middle class, in the upcoming budget.

Speculations are rife that Sitharaman may reduce personal income taxes and increase welfare for rural areas, as consumption remains subdued due to rising prices and stagnant wages.

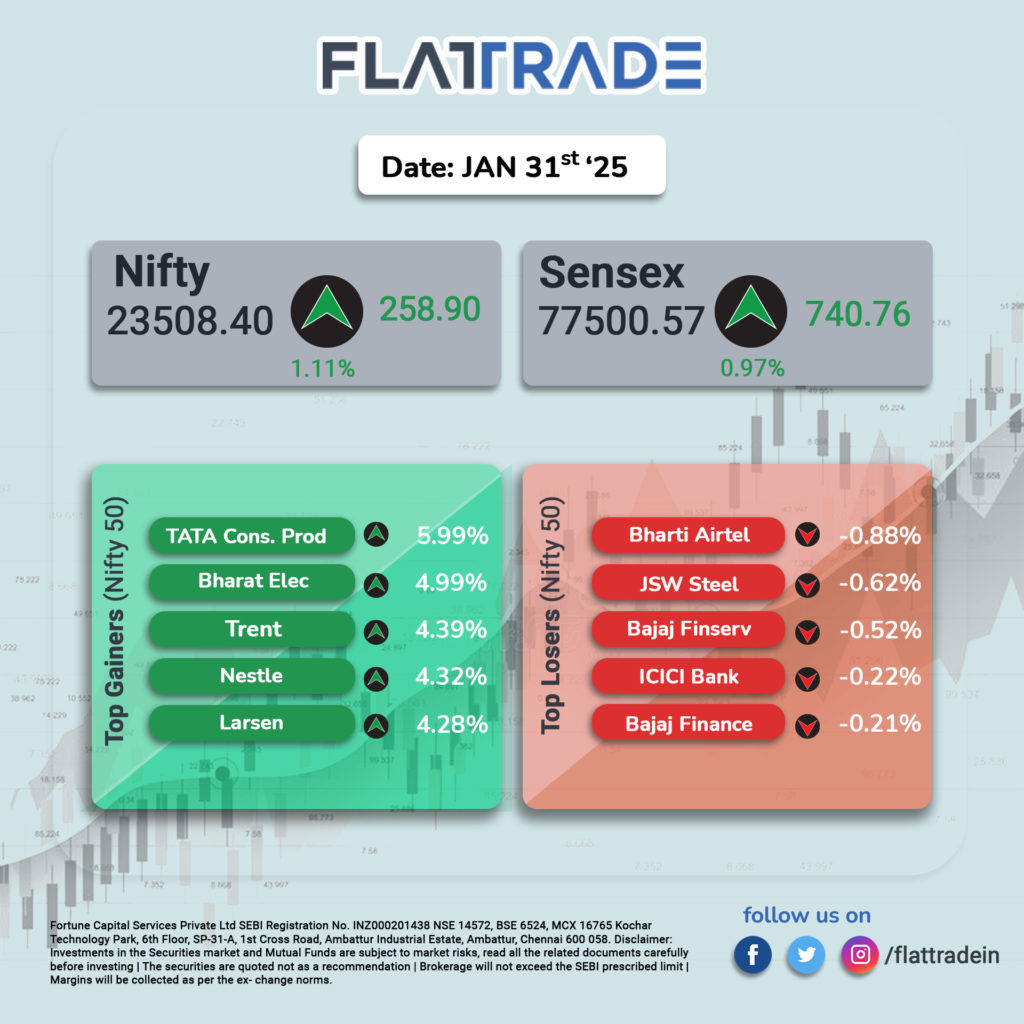

At the close of trading, the Sensex rose by 0.97%, ending at 77,500 points, while the Nifty gained 1.11%, closing at 23,508.4 points.

The broader markets saw even stronger gains, with the BSE MidCap and SmallCap indices climbing over 3.5% each.

STOCKS TODAY

Defense Stocks: Shares of defence companies such as Hindustan Aeronautics, Bharat Electronics, Bharat Dynamics, Data Patterns, and Paras Defence surged by 3-5 percent, driven by growing optimism ahead of the 2025 Union Budget. Investors are hopeful for a potential increase in budgetary allocations for the defence sector, which has resulted in a sharp uptick in stock prices.

Marico Ltd: Shares of Marico gained 4.2 percent following the company’s Q3FY25 earnings announcement. Marico reported a year-on-year increase in consolidated net profit to Rs 399 crore, along with a 15 percent growth in revenue to Rs 2,794 crore. The positive stock movement came despite rising input costs and margin pressures, driven by higher sales volumes both domestically and internationally.

Gail India: Gail’s stock price climbed over 6 percent on January 31 after the company reported a 28 percent increase in its consolidated net profit for Q3FY25. The revenue from operations also saw a healthy 6.23 percent rise year-on-year, boosting investor confidence and driving the stock higher.

Tata Consumer Products: Shares of Tata Consumer Products rose above 6 percent on January 31, following the release of its Q3FY25 earnings report. Despite a 6 percent decline in group profit due to inflationary pressures in the tea business and high-interest costs, the stock saw a notable uptick, likely driven by market sentiment and investor focus on the broader performance of the Tata Group.

Whirlpool of India: Shares of Whirlpool of India continued their losing streak, extending to the fifth consecutive session with a 33 percent decline in value during this period. While the stock has been in the red for five days, the majority of losses were concentrated in the previous session when the stock hit the 20 percent lower circuit.