POST-MARKET REPORT

Indian markets closed higher tracking gains in Europe and Asian equities ahead of the key US Federal Reserve’s interest rate outcome, which is due later on Wednesday.

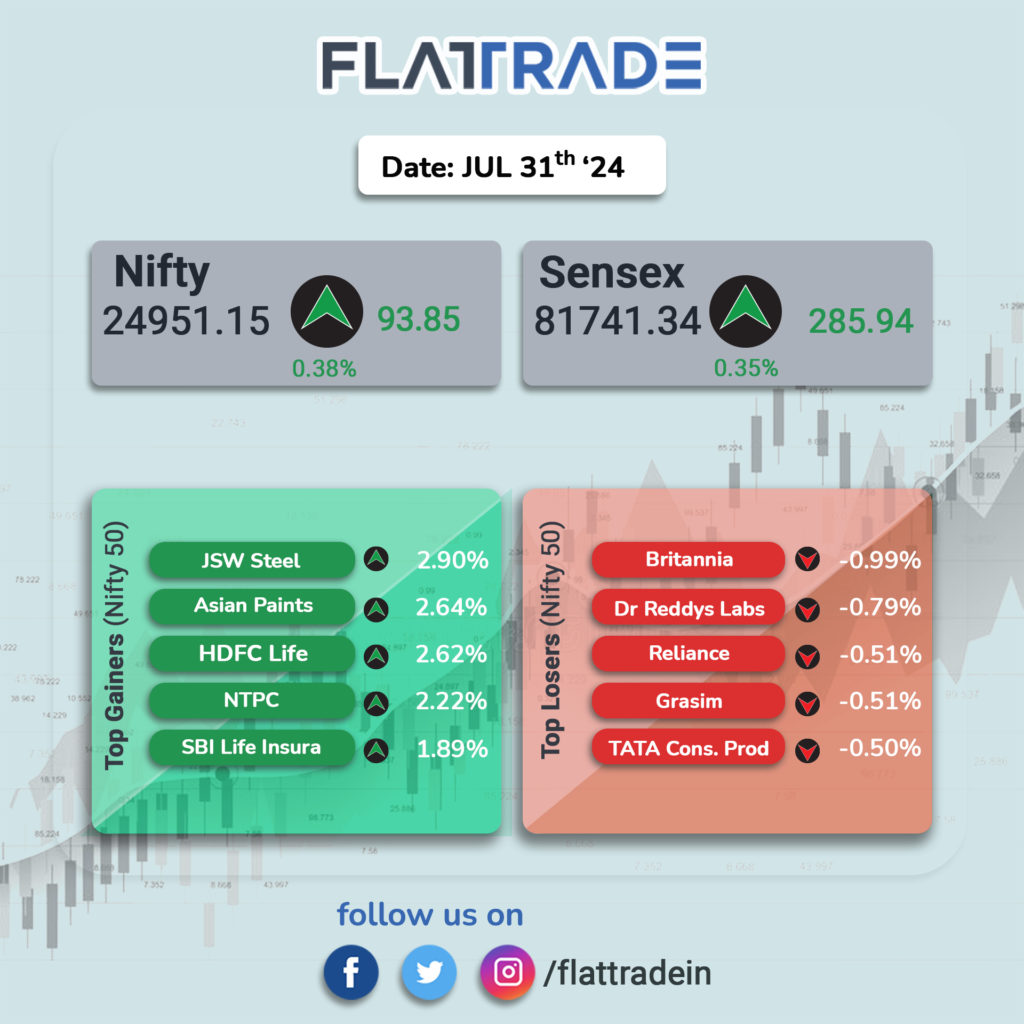

At closing, the benchmark Sensex rose 0.35 percent (286 points) to 81,741 points, while the Nifty50 Index settled 0.38 percent higher at 24,951.15 points.

NTPC, Asian Paints, BPCL, JSW Steel, and Tata Motors were among the top gainers on the Nifty, while losers were Britannia Industries, Dr Reddy’s Labs, Tata Consumer, Reliance Industries, and Grasim Industries.

Among sectoral indices, Nifty Metal was the top gainer, up 1.2 percent, followed by Nifty Pharma and Media, each up over one percent. Nifty PSU Bank and Nifty Realty were the losers, both down 0.4 percent.

The BSE midcap index added nearly a percent while the smallcap index ended on a flat note. The Nifty Midcap index continued to make fresh high as it tested 59,116, intraday and closed 0.63 percent higher at 58,990.90.

STOCKS TODAY

Maruti Suzuki: Maruti Suzuki India Ltd reported its Q1 FY25 net profit grew 47 percent on-year to Rs 3,650 crore, beating market expectations, as softer input prices boosted profitability. India’s largest carmaker’s April-June revenue rose 10 percent to Rs 35,531 crore from Rs 32,327 crore in the same quarter a year ago.

Adani Power: Power generation company Adani Power has reported a 55 percent fall on a year-on-year basis in its net profit at Rs 3,900 crore, compared to Rs 8,759 crore in the same period last year. The company’s revenue came in at Rs 14,717 crore, an increase of 36 percent YoY from Rs 11,005 crore in the previous year’s corresponding quarter.

Torrent Power: Shares of Torrent Power soared on July 31 to hit a fresh record high of Rs 1,898 on NSE after the integrated power utility of the diversified Torrent Group reported stellar earnings for the quarter that ended June 2024. Its net profit surged 87.2 percent on-year jump in net profit at Rs 996.3 crore and its revenue from operations increased 23.3 percent YoY to Rs 9,033.7 crore in Q1FY25.

IndiaMART: IndiaMART InterMESH shares tumbled almost seven percent on July 31 after the firm reported an addition of just 1,500 subscribers during the quarter ended June, falling sharply under the Street’s estimates. on July 30 reported a net profit of Rs 114 crore in the first quarter of FY25, recording a growth of Rs 37.18 percent growth.

Trent: Shares extended gains for the eighth consecutive session, rising over 4 percent to reach a new record high of Rs 5,826 per share. This uptick is driven by expectations that the retail firm will be included in the Nifty 50 index during the September reshuffle.

Nilkamal: Shares fell over 5 percent after the company’s net profit and revenue fell over 18 percent and 5 percent. respectively, in the June quarter.