POST-MARKET REPORT

The record run continued on Dalal Street on September 25 as the Nifty index managed to close above 26,000 for the first time led by energy, metal, and media names.

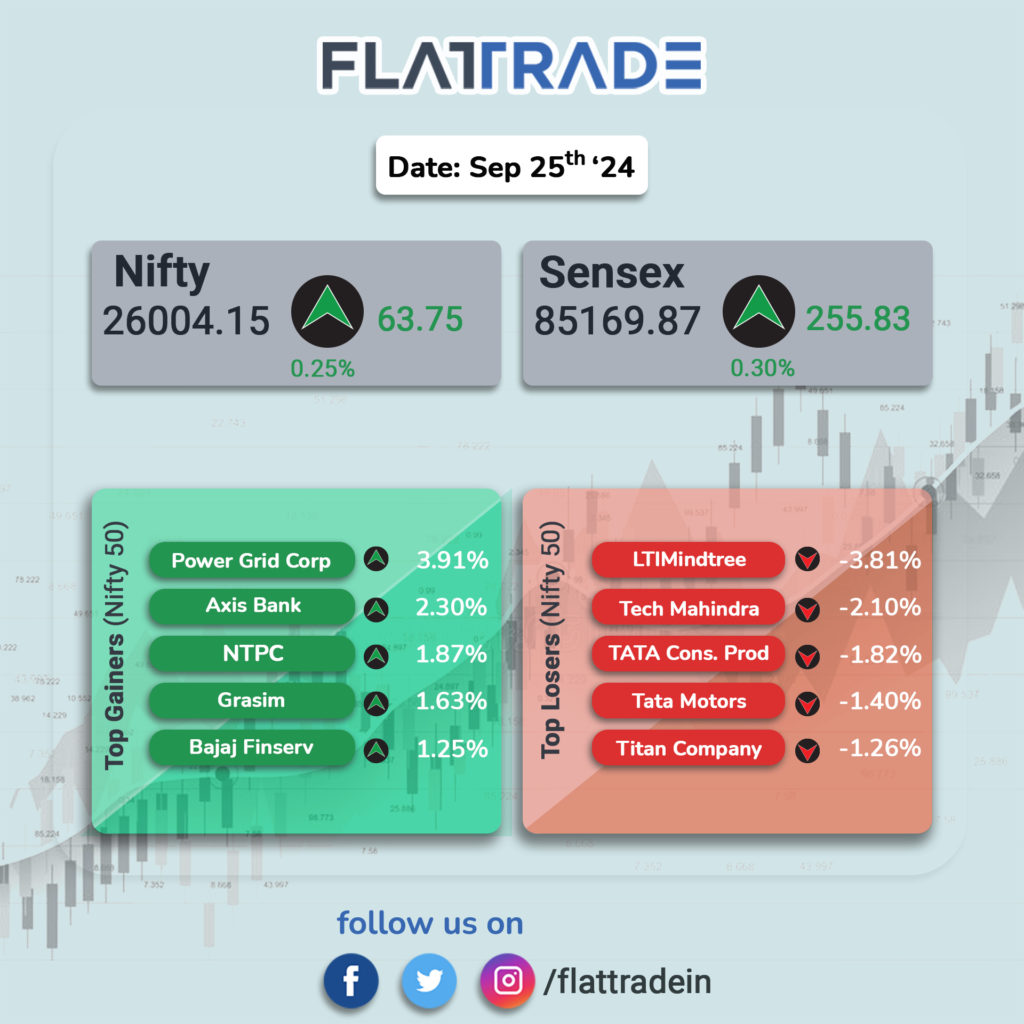

At close, the Sensex was up 255.83 points or 0.30 percent at 85,169.87, and the Nifty was up 63.75 points or 0.25 percent at 26,004.15. BSE Sensex and Nifty touched fresh highs of 85,247.42 and 26,032.80, respectively.

Power Grid Corp, NTPC, Axis Bank, Grasim Industries, and Bajaj Finserv were among the top gainers on the Nifty, while losers are LTIMindtree, Tech Mahindra, Tata Consumer, Tata Motors and Titan Company.

On the sectoral front, power, metal, media, and realty indices were up 0.5-3 percent, while FMCG, PSU Bank and IT were down 0.5-1 percent.

BSE Midcap and Smallcap indices are down 0.5 percent each.

STOCKS TODAY

Zee Media Corporation: The stock surged 13 percent on September 25, a day after the private news broadcaster said its board of directors will meet later this week on Friday to evaluate various fundraising avenues. The company plans to raise funds through the issuance of permissible instruments or securities in one or more tranches.

Delta Corp: Shares of the company soared more than 3 percent on September 25 following the announcement of a significant restructuring initiative. The board of directors of the gaming and hospitality firm approved the demerger of its Hospitality and Real Estate businesses into a newly formed entity, Delta Penland Private Limited (DPPL).

Piramal Pharma: Shares rose 4 percent after the company outlined its ambitious roadmap at a recent analyst meeting, targeting $2 billion in revenue by CY30. Following this, Jefferies increased Piramal Pharma’s target price to Rs 260, projecting a 20 percent upside from its previous closing price of Rs 216.

Exxaro Tiles: Shares jumped 4 percent, marking a second consecutive session of gains. The stock has soared 28 percent over two days, following news that the board will meet on October 14 to discuss a potential stock split. Trading volumes skyrocketed yet again with a remarkable 33 lakh shares exchanging hands today.

Reliance Power: The stock surged 5 percent as a block deal involving shares worth Rs 357 crore of Reliance Power took place on the exchanges on September 25. Around 8.6 crore shares, representing a 2.1 percent stake in Reliance Power changed hands at a floor price of Rs 42 apiece, implying an upside to the previous closing price.

Dabur Ltd: Shares shares slipped over 4 percent after Swiss brokerage UBS downgraded the FMCG major to ‘hold’ from ‘buy’ earlier. UBS listed key concerns regarding Dabur India’s lofty valuations, along with a possible risk to beverage sales growth. The rising growth of cola drinks, along with increasing competition in the coconut oil space poses as a downside risk to its sales.