POST-MARKET REPORT

Indian equity indices managed to recover some of their previous session losses and ended on a positive note in the volatile session on January 7 amid buying across the sectors barring IT names.

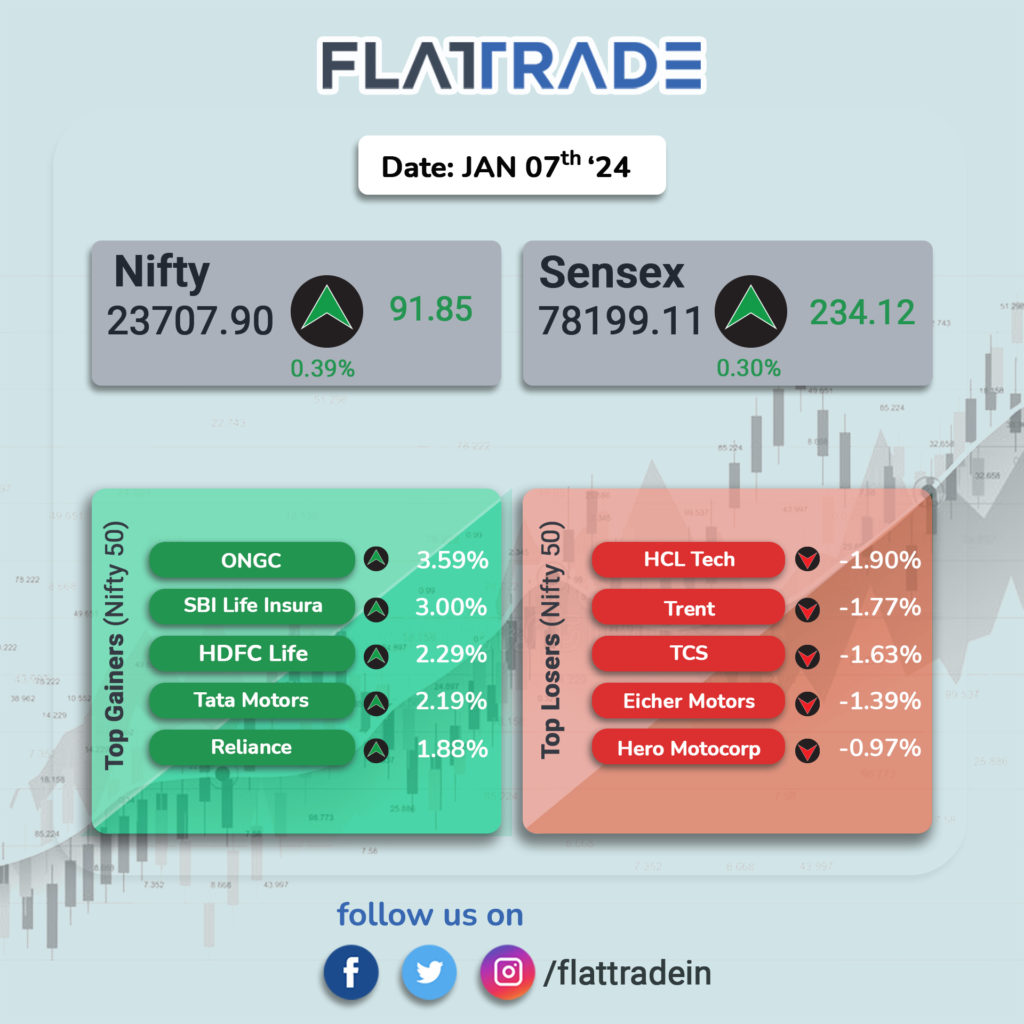

At close, the Sensex was up 234.12 points or 0.30 percent at 78,199.11, and the Nifty was up 91.85 points or 0.39 percent at 23,707.90.

ONGC, SBI Life Insurance, Tata Motors, HDFC Life, and Reliance Industries were among the top gainers on the Nifty, while losers were HCL Tech, TCS, Eicher Motors, Hero MotoCorp, Trent.

Among sectors, except IT, all other sectoral indices ended in the green with oil & gas, realty, energy, bank, metal, and pharma up 0.5-1 percent.

The BSE midcap index rose 0.7 percent and the BSE smallcap index added 1.7 percent.

STOCKS TODAY

Paras Defence and Space Technologies: Paras Defence and Space Technologies Ltd shares hit the upper circuit, as it bagged permission to manufacture MK-46 and MK-48 Belt-fed light machine guns from the Department for Promotion of Industry & Internal Trade (DPIIT), under the Arms Act.

Berger Paints: Berger Paints is actively looking to buy Akzo Nobel’s India stake as the latter’s promoters look to exit the India market with the sale of their 74.6% stake. As a result, shares of the Dulux paint maker surged 7% in trade.

Zydus Lifesciences: Zydus Lifescience’s share price advanced over 5 percent in trade today after the company announced an agreement with US healthcare firm CVS Caremark to add its diabetes combination products to its template formulary.

Ashoka Buildcon: Ashoka Buildcon stock surged following the announcement that its wholly-owned subsidiary signed a concession agreement with the National Highways Authority of India (NHAI). The agreement is for the development of a four-lane economic corridor in West Bengal.

SH Kelkar and Company: Shares of SH Kelkar and Company faced intense selling, slumping as much as 8 percent after the company’s gross margins came under pressure in Q3 amid supply constraints. The company revealed that its gross margins faced pressure during the October-December quarter, largely due to supply constraints for strategic raw materials.

ITI: Shares of ITI were locked in the 10 percent lower circuit, snapping a two-day winning streak. Before today’s fall, the stock was locked in the 20 percent upper circuit for two consecutive sessions, giving investors plenty of leeway to cash out partial profits.