POST-MARKET REPORT

The Indian equity market managed to close higher with Nifty closing above 24,700, continuing the winning run for the fifth consecutive session amid buying across the sectors barring realty names.

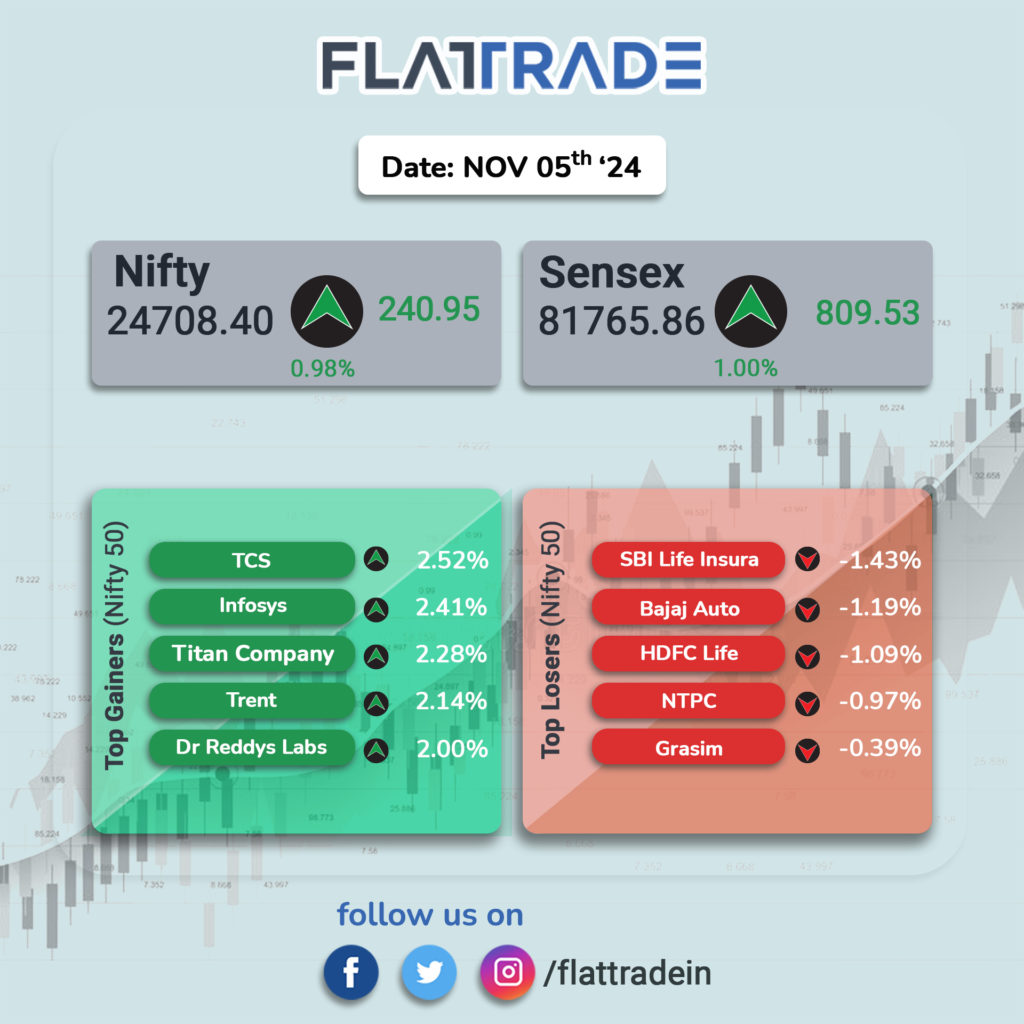

At close, the Sensex was up 809.53 points or 1 percent at 81,765.86, and the Nifty was up 240.95 points or 0.98 percent at 24,708.40.

The biggest Nifty gainers included TCS, Infosys, Titan Company, Trent, and Dr Reddy’s Labs, while losers were SBI Life Insurance, Bajaj Auto, HDFC Life, NTPC and Grasim Industries.

Except for realty and PSU Bank, all other sectoral indices ended in the green with the Information Technology index being the biggest gainer by rising nearly 2 percent.

The BSE midcap and smallcap indices ended with marginal gains.

STOCKS TODAY

Genus Power: Shares ended locked at a 5 percent lower circuit of Rs 449 after officers of the Directorate of Enforcement searched the company’s corporate office and Chairman’s residence two days back. The management stated that the business operations remained unaffected and continued as usual. “The company has extended full cooperation to the officials and promptly provided all requested clarifications and details during the search proceedings,” said Genus Power in its exchange filing.

Indraprastha Gas: Shares ended 6.5 percent higher after the city gas distributor announced that the board will consider the proposal for a bonus share issue on December 10. The bonus ratio has not been announced by the company and is likely to be declared on the day of the board meeting.

Divi’s Laboratories: Shares dropped around 3 percent as Novartis failed to persuade a US appeals court on Wednesday to halt MSN Pharmaceuticals’ proposed generic of Novartis’ blockbuster heart drug Entresto. The US Court of Appeals for the Federal Circuit upheld a Delaware federal judge’s August decision that found Novartis failed to prove it was likely to win a patent lawsuit against MSN over the drug, removing a roadblock for MSN’s launch of what would be the first US Entresto generic. Divi’s Labs has a CDMO contract with Novartis for Entresto.

Lancer Container Lines: Shares surged 5 percent following the company’s partnership with Dubai-based Ocean Voyage Shipping Line LLC (OVSL) to enhance its global presence. The company, with a market capitalization of Rs 874 crore, saw its shares decline 54 percent year-to-date, significantly underperforming the Nifty 50 index, which has gained 12 percent in the same period. The stock had reached its all-time high of Rs 110 in February.

Indus Tower: Shares of Indus Towers worth Rs 2,802 crore were sold in a block deal on December 5, with UK’s Vodafone Group Plc being the likely seller in the transaction. As much as 8 crore shares, making up a 3 percent stake in the telecom equipment company changed hands on the exchanges at an average price of Rs 354 per share. Shares of the telecom equipment company ended 2 percent higher following the transaction.