POST-MARKET REPORT

Indian indices ended on a strong note on August 26 with the Nifty back above 25,000 and also inched closer to its record high, after Fed Chair Powell at its latest meeting hinted at interest rate cuts in the near future.

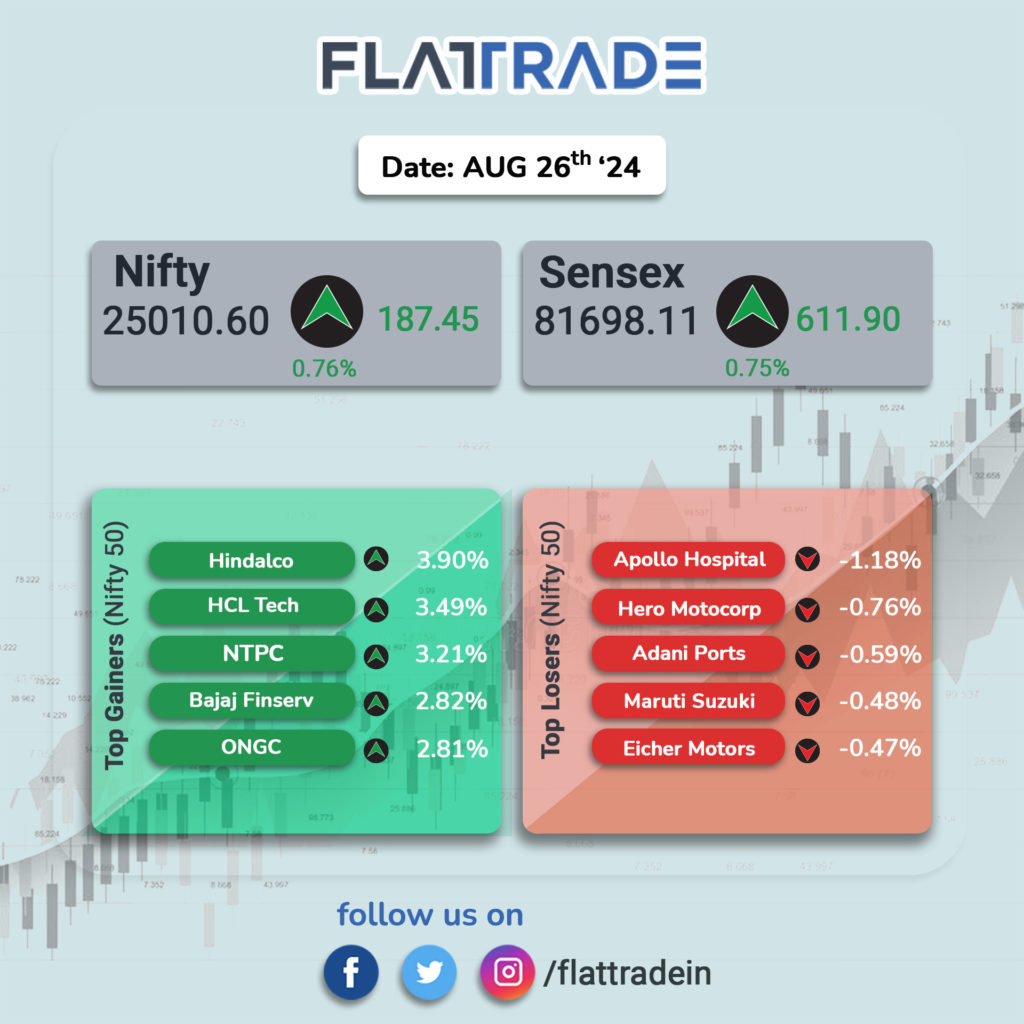

At close, the Sensex was up 611.90 points or 0.75 percent at 81,698.11, and the Nifty was up 187.45 points or 0.76 percent at 25,010.60.

The biggest Nifty gainers were Hindalco, NTPC, HCL Technologies, Bajaj Finserv and ONGC, while losers included Apollo Hospitals, Hero MotoCorp, Adani Ports, Eicher Motors and Maruti Suzuki.

Except for PSU Bank (down 0.5 percent), all other sectoral indices ended in the green with Information Technology, Metal, Oil & Gas, and Realty up 1-2 percent.

The BSE midcap index was up 0.6 percent and smallcap index was up 0.2 percent.

STOCKS TODAY

Emcure Pharmaceuticals: Shares rose x percent after the Namita Thapar-backed drugmaker bagged its first ‘buy’ tag since its market debut more than a month ago. Global brokerage Jefferies has assigned a price target of Rs 1,600, which implies a potential upside of 15 percent from Friday’s closing price.

KEC International: Shares jumped nine percent after the company bagged new orders valued at Rs 1,079 crore in its transmission & distribution (T&D) and cables businesses. The new orders for the T&D segment include a 765 kV/400 kV transmission line project from a prominent private developer in India. 230/132 kV transmission line projects in Saudi Arabia and Oman.

Honasa Consumer: Shares of Mamaearth, The Derma Co, and BBlunt parent surged around 14 percent to hit an all-time high after NCLT, Chandigarh approved the scheme of amalgamation between Just4Kids Services Private Limited, Fusion Cosmeceutics Private Limited, and Honasa Consumer.

Apollo Hospitals: Shares fell over one percent in trade after Japanese brokerage Nomura downgraded the stock to neutral, from buy. Nomura said Apollo Hospitals’ digital segment is underwhelming and its valuations are at a premium to its industry peers. There also is a limited room for the firm to expand capacity in existing hospitals.

Mangalam Drugs: Small-cap pharma player Mangalam Drugs and Organics saw its share price jump 8 percent to a fresh 52-week high on August 26 after the firm was awarded a grant by The Medicines for Malaria Venture (MMV). The grant award by MMV amounts to $274,800 and is designated for the research and development of Pyronaridine, an antimalarial drug.

Max Estates: Shares jumped over six percent after the company received approval from the Noida authorities to develop a project. The Noida authorities granted approval for the development of the ‘Delhi One’ project on a land parcel measuring 34,697 square meters, located in Sector 16B, Noida. This project adds 2.6 million square feet of development potential to the portfolio of Max Estates.