POST-MARKET REPORT

Indian equity indices ended lower for a third straight session on July 23, with a mix of announcements by Finance Minister Nirmala Sitharaman in her Union Budget speech.

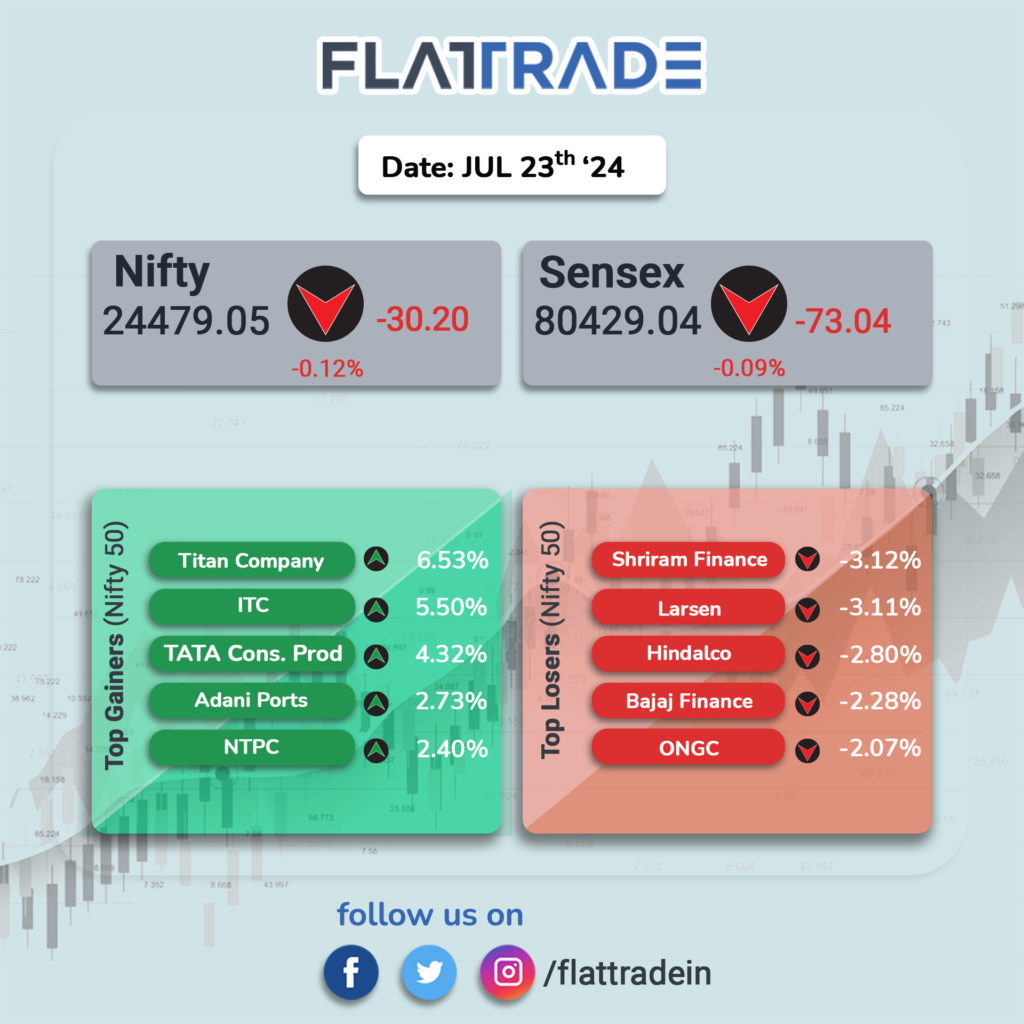

At close, the Sensex was down 73.04 points or 0.09 percent at 80,429.04, and the Nifty was down 30.20 points or 0.12 percent at 24,479.

Titan Company, Tata Consumer, ITC, NTPC, and Adani Ports were among the top gainers on the Nifty, while losers included L&T, ONGC, Hindalco, Shriram Finance, and Bajaj Finance.

Among sectors, FMCG, healthcare, media and IT indices were up 0.5-2.5 percent. However, banks, capital goods, metal, oil & gas, and reality were down 1-2 percent.

The BSE midcap index shed 0.7 percent, while the smallcap index ended on a flat note.

STOCKS TODAY

Bajaj Finance: Bajaj Finance reported on Tuesday, 23 July that its Q1 FY25 net profit rose 14 percent on-year to Rs 3,912 crore, missing street expectations. India’s largest non-banking finance company’s April-June net interest income (NII) grew 25 percent on-year to Rs 8,365 crore.

HUL: Hindustan Unilever reported on Tuesday, 23 July that its Q1 FY25 net profit rose 1.5 percent year-on-year to Rs 2,538 crore, beating analysts’ estimates by a slight margin. The FMCG firm’s total sales for the April-June quarter rose 2 percent on-year at Rs 15,523 crore.

ITC: Jefferies India upgraded ITC Ltd to a buy rating, raising the target price to Rs 585 per share, up 25 percent from the current market price, after tobacco taxes remained unchanged in the 2024 Union Budget presented by Finance Minister Nirmala Sitharaman on July 23. Earnings per share were also increased by 1-2 percent.

Gravita India: Gravita India surged 20 percent to its highest level since November 2010 after the Finance Minister announced that the central government would establish a Critical Mineral Mission that will focus on domestic exploration, mineral recycling, and the overseas acquisition of critical mineral assets.

Banking stocks: Barring Federal Bank, all banking stocks nosedived in the sea of red on July 23 after the 2024 Budget failed to announce any major reforms for the sector. Shares of Axis Bank, ICICI Bank, HDFC Bank, SBI, Bank of Baroda, and IndusInd Bank slipped up to 1 percent.