POST-MARKET REPORT

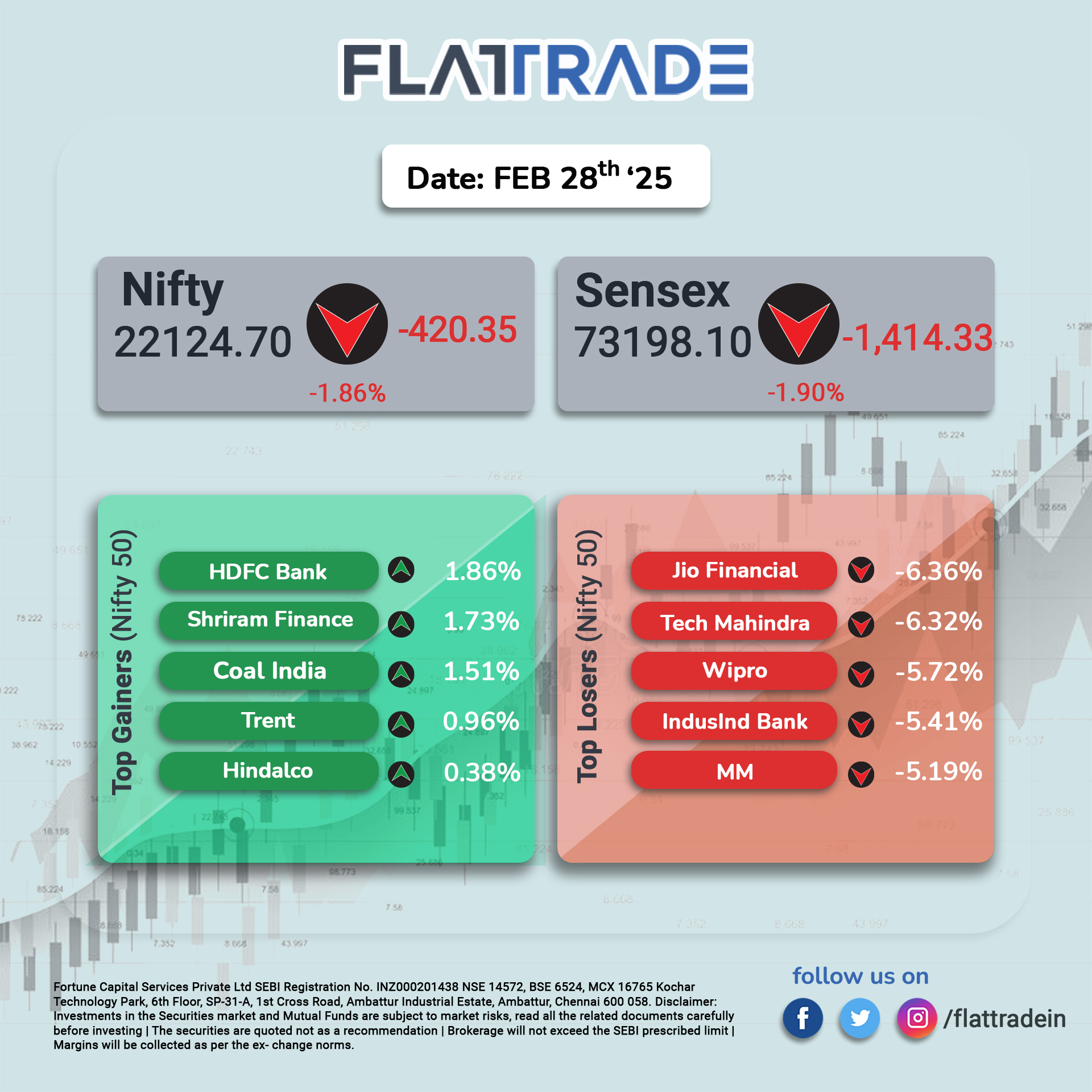

The Sensex and Nifty plunged nearly 2 percent on February 28, dragged down by a broad-based sell-off as fears of a full-blown global trade war and a slowing U.S. economy unsettled investors.

All 13 major sectoral indices sank deep into the red, with the BSE Smallcap and BSE Midcap indices taking a heavy hit, slipping over 2 percent each. IT and financial stocks, where foreign investors have a significant presence, contributed to half of the Nifty 50’s losses.

Other sectors weren’t spared either. Nifty Auto, FMCG, PSU Bank, Healthcare, Oil & Gas, and Media indices slumped between 2-4 percent, adding to the market’s turmoil.

Considering the Broader market indices, the mid-small cap index tanked the most, falling 2.5 and 3 percent, respectively.

STOCKS TODAY

Coal India: Shares of Coal India advanced about 2 percent, supported by a fresh announcement from the company. Northern Coalfields Ltd (NCL), a key subsidiary, introduced a Rs 300 per tonne levy across all its mines, effective May 1, 2025. The levy is expected to generate additional revenue of approximately Rs 3,877.5 crore, strengthening Coal India’s financial outlook, which fueled buying interest in the stock.

Hindalco Industries: Shares of Hindalco Industries, part of the Aditya Birla Group, continued their upward momentum, rising about 0.5 percent during the session. The gains followed Kotak Institutional Equities’ decision to upgrade the stock to ‘Buy’ from ‘Reduce’, while raising its price target to Rs 725 from Rs 640, implying a 17 percent upside. The brokerage highlighted favorable demand outlook and improving aluminum pricing dynamics as key factors supporting the upgrade.

HDFC Bank: HDFC Bank gained about 2 percent today, continuing to enjoy gains with the RBI’s latest move to lower risk weights. Analysts at Nuvama Institutional Equities believe that this policy reversal will have a positive impact on bank loan growth and enhance system liquidity in the coming months.

Granules India: The shares plunged over 8 percent, making it one of the biggest losers of the day. The sharp decline followed news that the company received a warning letter from the US FDA regarding its Gagillapur facility in Hyderabad after an August 2024 inspection. Although Granules India claims to have addressed most issues and is progressing on the remaining corrective actions, regulatory overhang weighed heavily on the stock.

IREDA: The shares slumped over 7 percent to Rs 154 as the stock officially entered the Futures & Options (F&O) segment with the start of the March series. The sharp drop followed a strong run, where the stock had logged gains in four of the last five sessions, leading to profit booking. Additionally, IREDA is now down almost 50 percent from its post-listing peak of Rs 310 (July 2023) and has shed over 20 percent in February alone, making this its worst monthly performance since its listing in December 2023.