POST MARKET REPORT

India’s benchmark indices, Sensex and Nifty, decreased by nearly 0.6 percent, despite the repo rate changes by RBI.

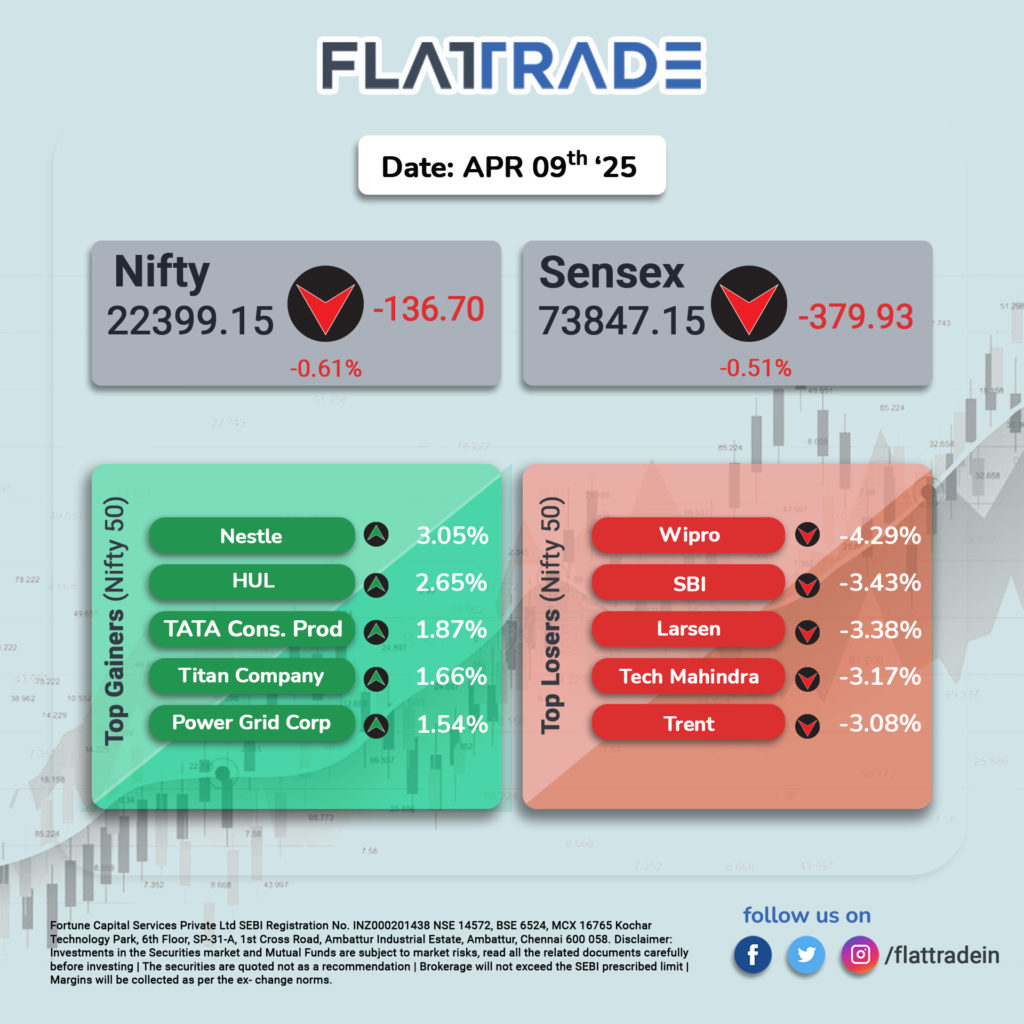

At close, the Sensex was down 379.93 points or 0.51 percent at 73,847.15, and the Nifty was down 136.70 points or 0.61 percent at 22,399.15. About 1500 shares advanced, 2241 shares declined, and 138 shares were unchanged.

Wipro, SBI, Tech Mahindra, L&T, and Trent were among the major losers on the Nifty, while gainers included Nestle, HUL, Tata Consumer, Titan Company, and Power Grid Corp.

Except Consumer Durables (up 0.3 percent) and FMCG (up 1.5 percent), all other sectoral indices ended in the red, with Realty, IT, and PSU Bank down 2 percent each.

Broader indices ended lower, with, BSE Midcap index down 0.8 percent and the Smallcap index down 1 percent.

STOCKS TODAY

Glenmark

The shares of the pharma company have reduced over 6 percent on April 9, after the USFDA regulator announced that 39 drugs manufactured by the company, most of which were made at its Pithampur plant in Madhya Pradesh, have been recalled from the American market owing to GMP concerns. The shares of the company have now extended losses for the fourth consecutive session. The pharma giant has seen a strong downturn in its share price recently, falling over 13 percent in the last five sessions.

Tata Consultancy Services

The country’s largest software services exporter is all set to announce its fourth-quarter results for the financial year ending March 31, 2025. Ahead of the fourth quarter results releasing tomorrow, the share prices fall 1.6 percent.

Asian Paints

The price of crude oil has cooled off to $62 per barrel, extending a decline of over 30 percent in the last year. Due to this, the shares of Asian paints have seen a slight increase of 0.82 percent.

Muthoot Finance

Shares of the company have reduced over 7 percent, but soon recovered a little after the RBI Governor has clarified he didn’t mention tightening of gold loan norms during his April monetary policy speech today in a post-monetary policy press conference in Mumbai.

IDBI Bank

Shares of IDBI Bank increased over 3 percent on April 9. The government’s long-awaited disinvestment of the bank is progressing steadily with several critical steps now underway, DIPAM Secretary Arunish Chawla has said, hoping for a likely closure by the first half of this fiscal.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.