POST-MARKET REPORT

The final hour selling pressure erased all the intraday gains to end on a negative note in the volatile session on October 23 despite broader indices outperformance.

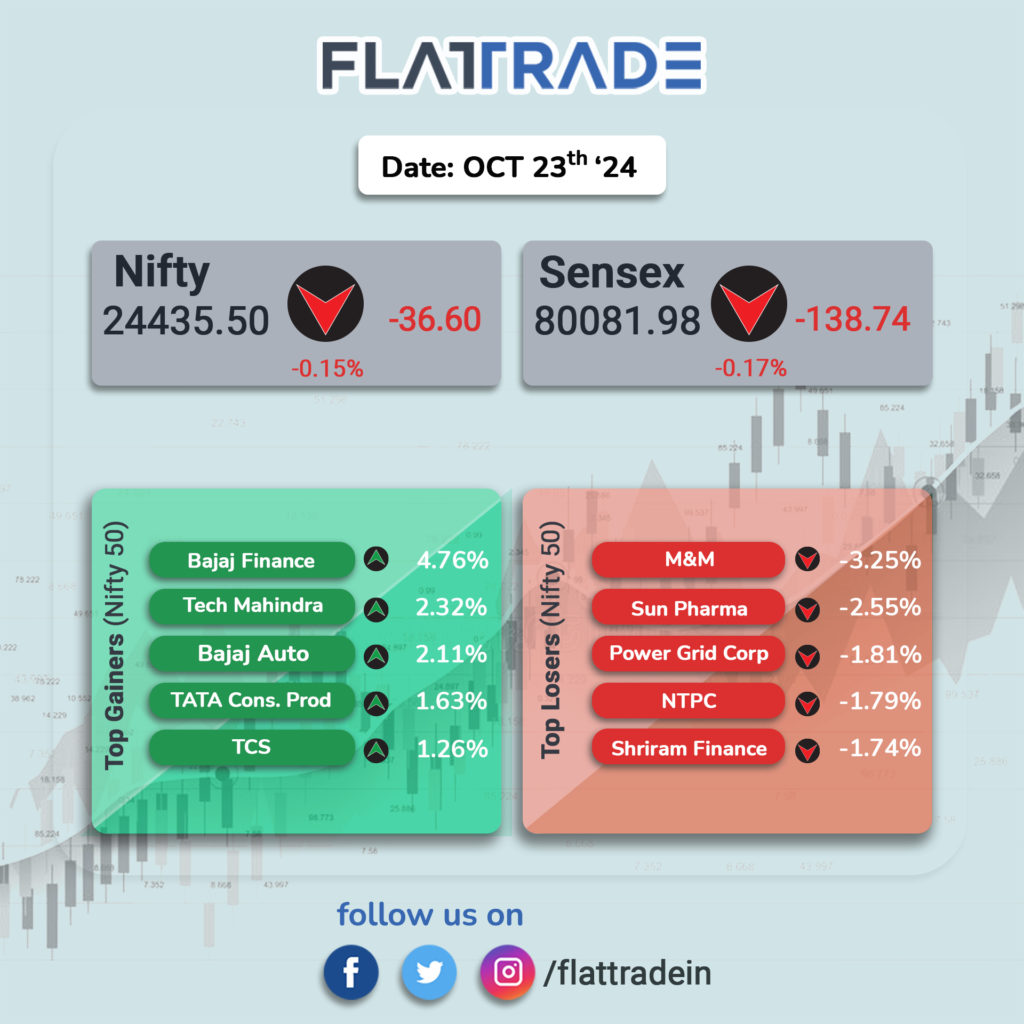

At close, the Sensex was down 138.74 points or 0.17 percent at 80,081.98, and the Nifty was down 36.60 points or 0.15 percent at 24,435.50.

Bajaj Finance, Bajaj Auto, Tech Mahindra, HCL Tech, and Tata Consumer were among the top gainers on the Nifty, while losers included M&M, Sun Pharma, NTPC, Power Grid Corp and Shriram Finance.

Among the sectors, the IT index is up more than 2 percent, while capital goods, power, and pharma are down 1 percent each.

The BSE Midcap index is up 0.5 percent and Smallcap indices are up 1 percent.

STOCKS TODAY

Amber Enterprises: Shares of the company zoomed 11 percent. The buying in the stock came after the company’s board approved a scheme of amalgamation between AmberPR Technoplast India and Amber Enterprises, apart from reporting robust numbers in its Q2FY25 results.

Persistent Systems: Shares of the mid-tier IT services firm jumped as much as 11 percent after it reported a 23.4 percent YoY increase in net profit at Rs 325 crore for Q2FY25. The IT firm’s revenue from operations surged 20.1 percent YoY to Rs 2,897 crore. The strong financial performance has caught the attention of several brokerages, leading to optimistic forecasts and buy recommendations.

Coforge: Shares of the company 11 percent after the IT solutions provider reported that its net profit rose 35.6 percent YoY to Rs 255.2 crore, while the revenue jumped 33 percent YoY to Rs 3,062.3 crore in the quarter ended on September 2024, which bolstered investor sentiment. The company’s order intake for the quarter stood at $516 million, marking the eleventh consecutive quarter of more than $300 million order intake.

Hyundai Motor India: Shares rose 4 percent to Rs 1,929, following its muted market debut on Tuesday. Despite mounting concerns about the automobile sector’s demand slowdown, a host of analysts are bullish on Hyundai. Motilal Oswal has set a target of Rs 2,345 for the stock, emphasizing its diverse product range across the mid-segment, SUV, and premium categories.

PNC Infratech: Shares of the company fell over 2 percent, extending their losses for the third session after the Ministry of Road Transport & Highways disqualified the company and its two subsidiaries from participating in any of the ministry’s tenders. In an exchange filing, PNC Infratech stated that it has been barred from tender processes for one year, effective October 18, 2024.

M&M Finance: Shares of Mahindra & Mahindra Financial Services (M&M Finance) shares fell 5.2 percent after the company reported weak Q2FY25 results. For the second quarter, the company reported a net profit of Rs 369 crore as compared to Rs 235 crore a year ago, implying a rise of 57 percent YoY. Its total income rose by 19 percent YoY to Rs 1,991 crore.