POST-MARKET REPORT

The Indian stock market’s benchmark index, the Nifty 50, closed almost a percent lower on Monday, December 30, on losses led by banking heavyweights, including HDFC Bank and ICICI Bank amid weak global cues.

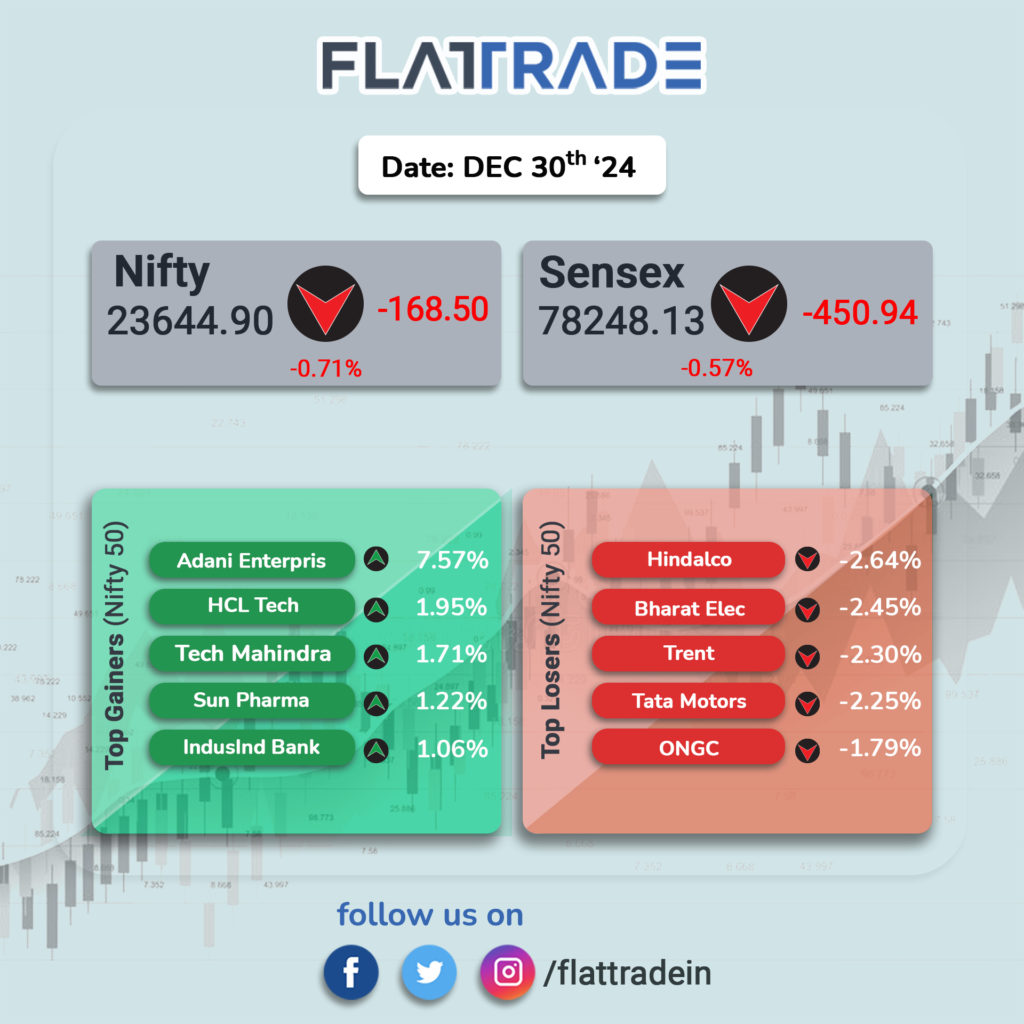

The Nifty 50 closed with a loss of 169 points, or 0.71 percent, at 23,644.90, while the Sensex settled at 78,248.13, down 451 points, or 0.57 percent.

Among the sectoral indices, Nifty Media (down 1.87 percent), Realty (down 1.54 percent), Auto (down 1.43 percent), and Metal (down 1.27 percent) lost up to 2 percent.

All banking and financial indices suffered. Nifty Bank index dropped 0.70 percent, while the PSU Bank and Private Bank indices fell 1.18 percent and 0.63 percent, respectively. The Nifty Financial Services index fell by almost a percent. On the other hand, Nifty Healthcare and Pharma indices rose by over a percent.

The BSE Midcap index climbed 0.13 percent, but the Smallcap index fell 0.47 percent.

STOCKS TODAY

Vodafone Idea: Shares of Vodafone Idea rose over 5 percent as the government waived bank guarantees for past spectrum auctions. The telecom firm has been exempted from providing bank guarantees worth Rs 24,800 crore for spectrum auctions held before 2021 (2012, 2014, 2015, 2016). In a December 28 filing, the company termed the government reform as a “big relief for telecom companies”.

Utkarsh Small Finance Bank: Utkarsh Small Finance Bank surged as much as 3 percent after it revealed plans to sell off Rs 355 crore worth of non-performing microfinance loans to asset reconstruction companies. The bank set a reserve price of Rs 52 crore for the assets it is putting up for sale, which would translate into a recovery of 14.64 percent.

JSW Energy: JSW Energy surged over 7 percent after its arm, JSW Neo, signed a definitive agreement with O2 Power to acquire 4,696 MW of renewable energy platform in a $1.47 billion deal. The transaction is expected to boost JSW Energy’s locked-in generation capacity to 24,708 MW.

Adani Enterprises: Adani Enterprises shares were on fire, surging 7 percent to emerge as the top gainer on the list of Nifty 50 stocks. The sentiment for the stock bolstered after brokerage firm Ventura Securities assigned a price target of Rs 3,801 for the stock within a two-year time frame. The target price translates into an upside potential of nearly 58 percent from Friday’s closing.

Suzlon Energy: Suzlon Energy stock prices tumbled, despite an announcement of an income tax refund that is worth Rs 173 crore. As of 2024, Suzlon Energy’s shares have gained over 60 percent despite a recent correction from its peak of Rs 86. Suzlon Energy has successfully overturned a Rs 172.76 crore penalty imposed by the National Faceless Penalty Centre of the Income Tax Department.

Cigniti Technologies: Shares of Cigniti Technologies were trading over 6% lower, days after the company announced the merger swap ratio of 1 share of Coforge for every 5 shares of Cigniti Tech. Share swap transactions will lead to a 4% dilution in Coforge equity shares. The merged entity will create 3 new scaled-up verticals- Retail, Technology, and Healthcare.