POST-MARKET REPORT

Indian benchmark indices pulled back from their intraday highs in the closing hours of the trading session on Tuesday as globally muted cues weighed on market sentiment.

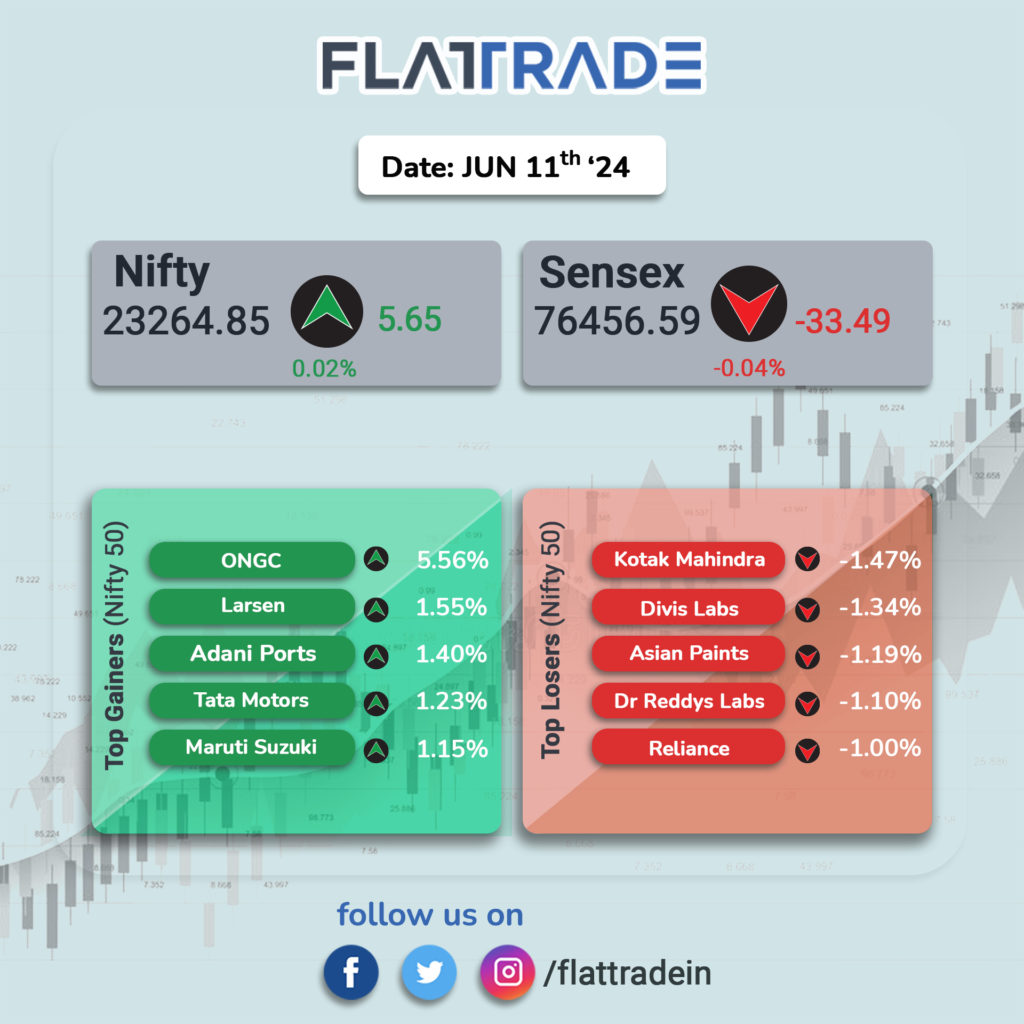

At close, Sensex was at 76,456.59, down 33.49 points, or 0.04% while the Nifty closed at 23,264.85, up 5.65 points, or 0.02%.

Gainers and Losers on Nifty: 20 of the 50 stocks on the Nifty 50 were trading in the red. Kotak Mahindra Bank, Divi’s Laboratories, Dr Reddy’s, Reliance Industries, and ITC were the top losers, while ONGC, Tata Motors, Larsen & Toubro, Adani Ports & SEZ, and Mahindra & Mahindra, were the top gainers.

Gainers and Losers on Sensex: 12 of the 30 stocks on the BSE Sensex were trading in the red. Kotak Mahindra Bank, Asian Paints, Reliance Industries, Sun Pharma, and ITC were the top drags, while Larsen & Toubro, Maruti Suzuki India, Tata Motors, Mahindra & Mahindra, and UltraTech Cement were the top gainers.

Sectoral Indices today: Many heavyweigh sectoral indices like bank, financial services, pharma, healthcare, FMCG and IT were trading in the red, while others like oil & gas, media, realty, auto, and consumer durables were leading the gains.

Broader market indices today: The broader market was outperforming the benchmark indices, with the BSE SmallCap index gaining 1.08% and the BSE MidCap climbing 0.81%.

STOCKS TODAY

Hindustan Construction Company: Domestic brokerage Elara Securities initiated coverage on HCC with a buy rating, believing the company is poised to reclaim its earlier glory. Elara issued a target price of Rs 63 per share on HCC, seeing a 58 percent upside from current levels. Shares settled 19.1 percent higher.

Honasa Consumer: Shares slipped 4.5 percent after a 2 percent stake in the company changed hands in a Rs 291 crore block deal that took place on the exchanges. According to reports, two investors-Fireside Ventures and Sofina Ventures were looking to offload around a 2 percent stake in the Mamaearth parent.

InterGlobe Aviation: Shares fell 4.2 percent after a Rs 3,689 crore block deal involving a 2.2 percent stake in the company took place on the exchanges. As per reports, promoter Rahul Bhatia’s family’s holding company InterGlobe Enterprises was the seller in the transaction.

IRB Infrastructure Developers: Shares fell 5.3 percent following block deals worth Rs 2,656 crore, involving a 6.8 percent stake in the company that took place on the exchanges. As per reports, Cintra, an affiliate of Dutch infrastructure major Ferrovial was eyeing to offload around a 5 percent stake in the company for $228 million.

Transformers and Rectifiers (India): Shares of Transformers and Rectifiers (India) were firmly locked in the upper circuit of five percent as the firm launched a qualified institutional placement (QIP). The firm set a floor price of Rs 699.95 apiece for the issue, which comes at a discount of 4.5 percent to the closing price on June 10.

PTC Industries: The stock surged over 5 percent to reach an all-time high of Rs 11,753 each on June 11. This rise follows the company’s participation in a special purpose vehicle (SPV) under the government’s ‘Make in India’ initiative aimed at boosting the defence and aerospace sectors.