POST-MARKET REPORT

Indian stocks fell for the eighth session amid escalating trade tensions escalated further after U.S. President Donald Trump directed his economic team on Thursday to formulate plans for reciprocal tariffs on every country that imposes taxes on U.S. imports.

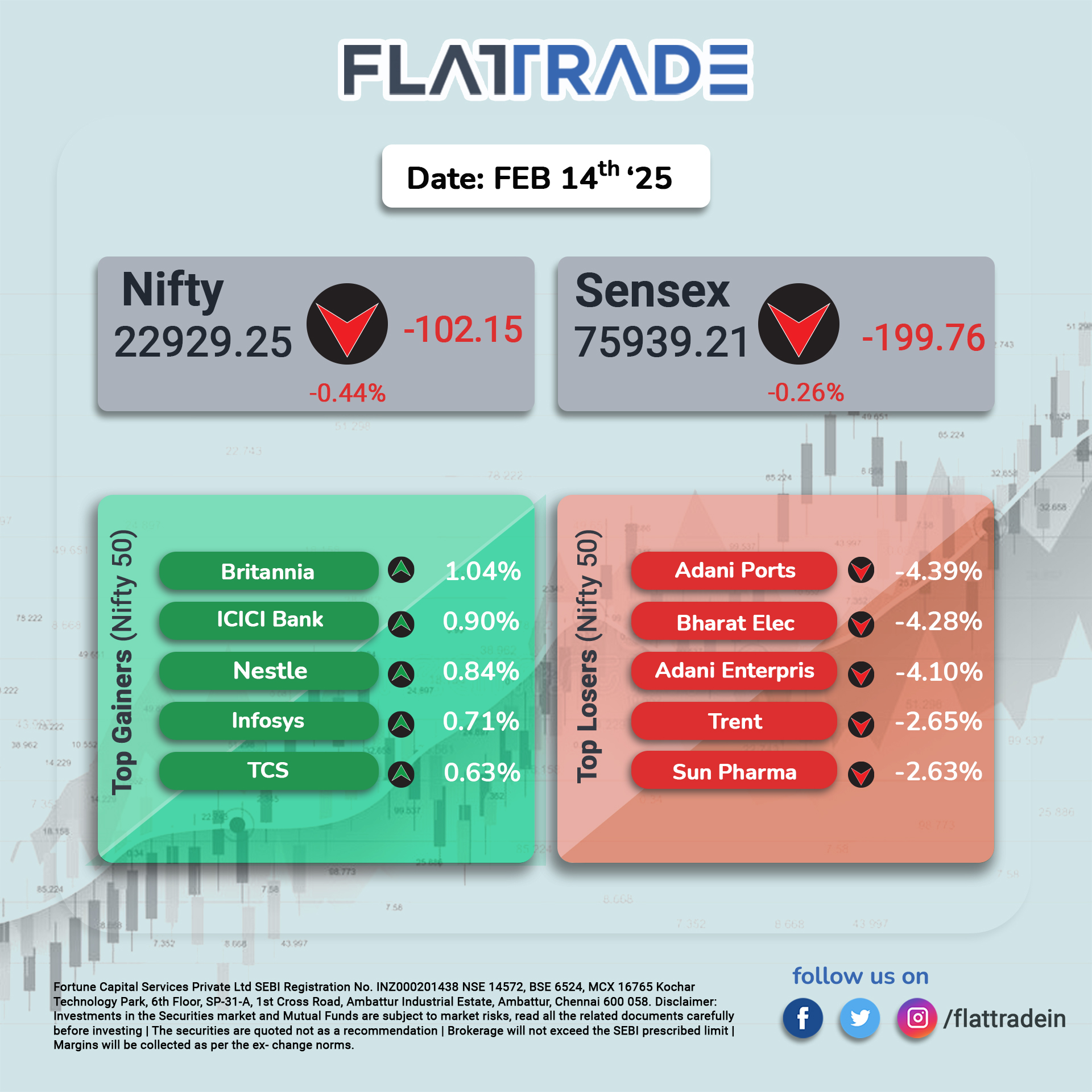

The Nifty 50 ended today’s session down 0.44% at 22,929, marking its eighth consecutive decline and the longest losing streak in two years. The Sensex closed 0.70% lower at 75,939 points. Both indices dropped 2.6% this week, marking the biggest weekly decline of 2025.

All 13 major sectoral indices ended Friday’s session lower, with the Nifty Pharma index emerging as the biggest loser, dropping 2.77%. This was followed by Nifty Energy, Nifty Auto, Nifty Metal, and Nifty Realty, all closing in the red with losses of up to 2%.

For the week, Nifty Realty declined by 9.31%, while Nifty Media, Nifty Energy, Nifty Oil & Gas, and Nifty Pharma all dropped between 5% and 9%, respectively.

The broader markets witnessed even sharper losses, with the Nifty Midcap 100 tumbling 2.41% today, bringing its weekly losses to 7.4%. Meanwhile, the Nifty Smallcap 100 crashed 3.55% in today’s session, pushing its weekly decline to nearly 10%.

STOCKS TODAY

Concord Biotech: The shares dropped 20 percent to an intraday low of Rs 1,689.4 per share on the NSE. The stock opened with a loss of 5.29 percent. The company reported that its consolidated net profit declined 2.19 percent to Rs 75.9 crore in the December 2024 quarter, The company had reported a Rs 77.6 crore profit in the same period a year ago, according to an exchange filing by the company.

Hindustan Construction Company: Shares of HCC plummeted 10 percent to a fresh 52-week low after the company posted dismal third-quarter (Q3FY25) results. HCC reported a net loss of Rs 216 crore in Q3FY25, a stark contrast to the Rs 68.5 crore profit it posted a year ago. Revenue nosedived 19.5 percent year-on-year to Rs 1,002.1 crore.

ITI: State-owned ITI Ltd. shares slipped five percent in trade on February 14, after reporting a net loss for the quarter ended December (Q3) of the current financial year (FY25). ITI narrowed its net loss to Rs 48.9 crore for the three months ended December, from Rs 101.3 crore in the same quarter last year. Revenue from operations surged 299.7 percent year-over-year to Rs 1,034.5 crore, up from Rs 258.8 crore, driven by strong operational performance despite higher raw material costs.

Samvardhana Motherson: The shares of Samvardhana Motherson International dropped over 3 percent on February 14 after the company reported a net profit of Rs 879 crore in the quarter which ended on December 31, 2024. The company’s revenue from operations meanwhile rose nearly 8 percent year-on-year to Rs 27,666 crore in Q3 FY25. Its revenue from operations stood at Rs 25,644 crore in Q3 of FY24.

Fertilisers and Chemicals Travancore: Shares slid over 8 percent on February 14, as investors dumped the stock after the company’s net profit tanked in Q3. The fertilizer company’s net profit dived nearly one-fourth on year to just Rs 8 crore during the December quarter, marking a sharp downturn from the Rs 30.30 crore that it reported in the year-ago period.