POST-MARKET REPORT

Benchmark index Nifty went almost below the crucial 24,000 level amid selling seen in the IT, Pharma, and Banking names. However, buying in media and oil & gas stocks limited the extent of the losses.

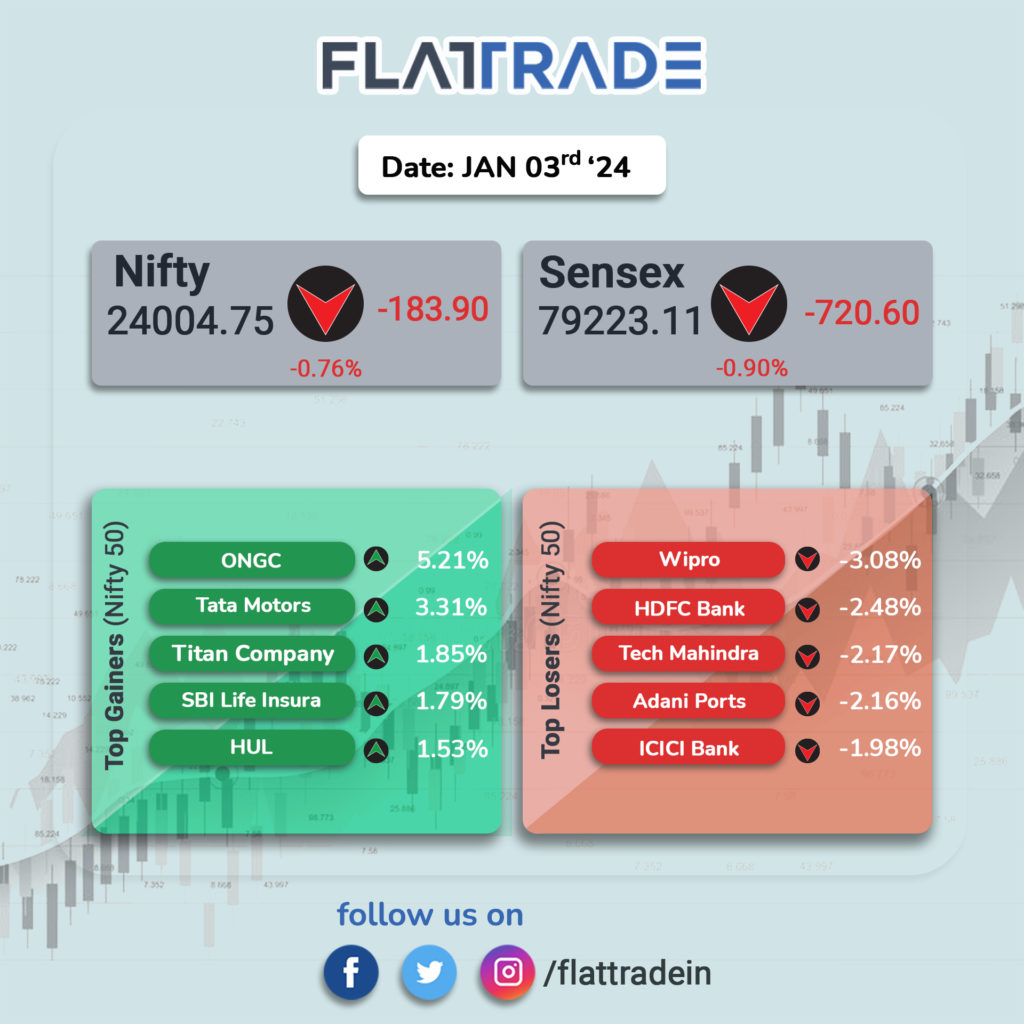

At close, the Sensex was down 720.60 points or 0.90 percent at 79,223.11, and the Nifty was down 183.90 points or 0.76 percent at 24,004.75.

For the week, the BSE Sensex added 0.66 percent and the Nifty50 index rose 0.8 percent.

Among sectors, banks, capital goods, IT, and pharma shed 1 percent apiece, while oil & gas, and media rose 1 percent each. Wipro, ICICI Bank, HDFC Bank, Tech Mahindra, and Adani Ports were among the major losers on the Nifty, while gainers included ONGC, Tata Motors, SBI Life Insurance, Titan Company, and HUL.

BSE Midcap index was down 0.33 percent, while the smallcap index ended flat.

STOCKS TODAY

Hero MotoCorp: Shares of Hero MotoCorp declined over 3 percent to Rs 4,159 apiece on January 3 after the automaker reported weak December sales figures. In December 2024, the company’s sales declined by 18 percent YoY to 3.24 lakh units from 3.93 units in the same month a year ago. Domestic sales too plunged 22 percent YoY to 2.94 units from 3.77 units, while exports jumped 91 percent YoY to 30,754 units.

Afcons Infra: The company has received a Letter of Intent from the Govt of India, Ministry of Defence, Defence Research and Development Organisation (DRDO) for the execution of work related to the augmentation of MTC, creation of SAF, and workshop equipment for the ship lift facility (AMCSWF) at Visakhapatnam.

Avenue Supermarts: The company reported a standalone revenue from operations at Rs 15,565.23 crore, higher by 17.5 percent on-year compared to Rs 13,247 crore in the same period a year ago. The total number of stores as of December 31, 2024 stood at 387.

ITI: Shares of ITI Ltd. witnessed a significant surge today to post the biggest single-day gain in 9 months at Rs 456.5 apiece, driven by high trading volumes that neared 9 crore shares. The shares have risen a whopping 70% since April 2024. On January 3, the stock soared by a substantial 20 percent i.e. adding Rs 76.20 to its value from its opening on Friday. This strong performance has pushed the company’s market capitalization to Rs 43,936.56 crore.

RITES: The company bagged a work order worth Rs 69.78 crore from SAIL- Bhilai Steel Plant for R3Y/ R6Y Repair of WDS6 Locomotives (43 Nos.) for 3 years. In another development, the company’s subsidiary REMC signed a Memorandum of Understanding (MoU) with Indian Railway Finance Corporation (IRFC) to explore options for financing power projects for supply to the railways.