POST-MARKET REPORT

Indian benchmark indices slipped into negative territory in today’s session, January 24, as profit booking during the second half of the trading session erased earlier gains, causing the indices to end their 2-day recovery rally.

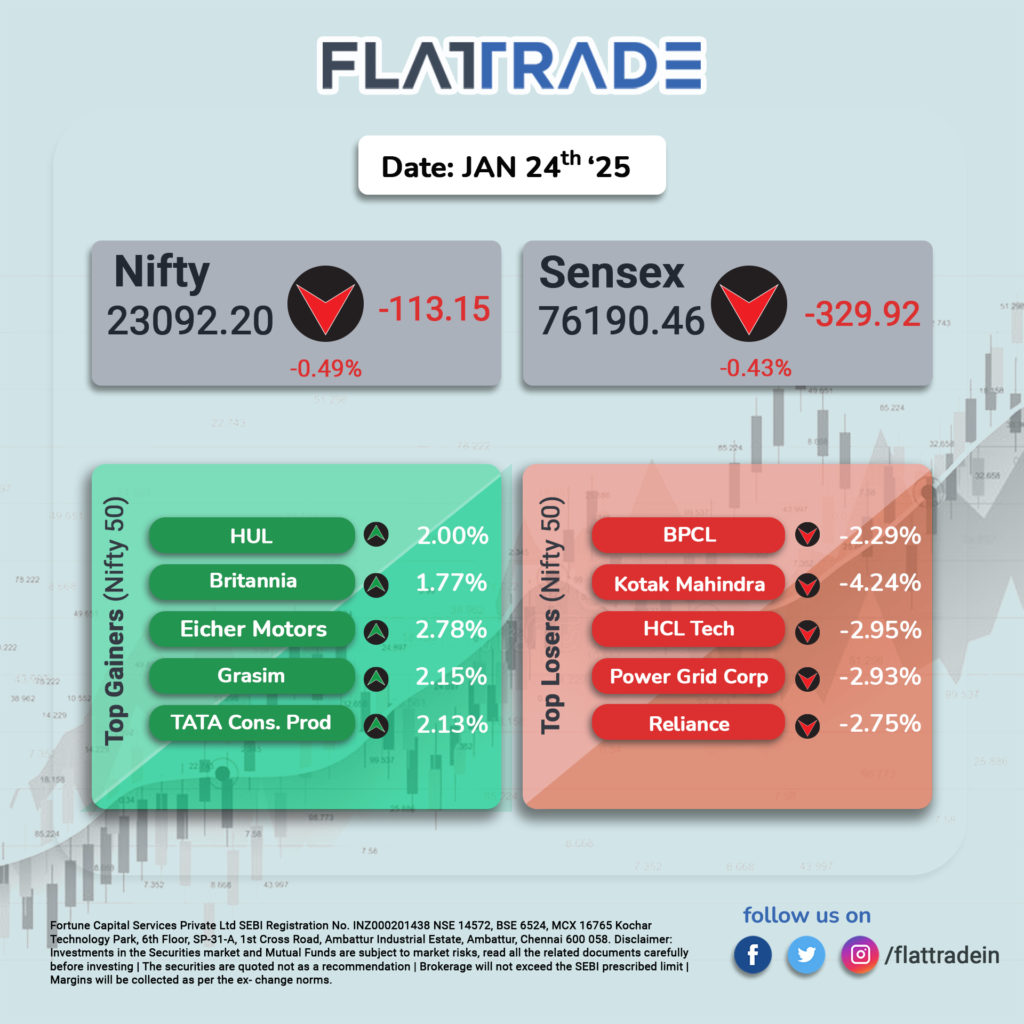

The Nifty 50 tumbled 255 points from the day’s high to end the session 0.49% lower at 23,092, concluding the week with a drop of 0.48%. Likewise, Sensex wrapped up the session with a drop of 0.43%, plummeting 795 points to end at 76,190.

The biggest gainer was Hindustan Unilever (HUL), with a price increase of 2 percent, while Dr Reddy’s Labs was the biggest loser, with a price decline of 5.04 percent.

Multiple sectoral indices slumped sharply including Auto, media, pharma, PSU Bank, realty, healthcare, oil, and gas.

The Nifty FMCG sector emerged as the best performer, closing at 56069.3 with a positive change of 0.52 percent. In contrast, the Nifty Pharma sector was the worst performer, closing at 21,872.40 with a negative change of 2.11 percent.

The Nifty Midcap 100 index concluded the session with a decline of 1.55%, while the Nifty Smallcap 100 index witnessed even more selling pressure, tumbling by 2.35%. Both indices finished the week with a drop of up to 4%.

Indian markets are witnessing volatility amid uncertainty over US President Donald Trump’s policies. Investors anticipate potential disruptions to global trade during Trump’s presidency.

STOCKS TODAY

Mphasis: The company shares gained over 4 percent on January 24 after the mid-tier IT firm reported its December quarter results. Mphasis’ Q3FY25 revenue stood at Rs 3,561 crore, which is 6.69 percent higher than last year. The company’s consolidated net profit grew nearly 15 percent to Rs 428 crore ($49.54 million) for the quarter and a percent higher on a YoY basis.

Shriram Finance: The company shares traded flat on Friday ahead of the company’s third-quarter results announcement later in the day. The stock of the flagship company of diversified conglomerate Shriram Group opened with a gap-up gain of 2.56 percent and touched an intraday high of Rs 541.80 on the NSE, registering a 4.46 percent rise.

Mankind Pharma: Shares of the company plunged nearly 6 percent on January 24, weighed down by a fall in the company’s October-December net profit. The company’s bottom line dropped over 16 percent on year in Q3 to Rs 385 crore, dented by a sharp rise in expenses.

Cyient: Shares of the company took a strong beating on January 24, plummeting over 19 percent amid a slew of negative triggers for the company. The IT company’s weak Q3 numbers dented sentiment, slashing its FY25 revenue growth guidance to -2.7 percent against the previous expectation of flattish growth.

Paytm: The company share price recovered partially after dropping more than 8 percent in the January 24 trade on the buzz of the ED probe in the crypto scam. The company, however, clarified in a stock exchange filing that it did not receive any such query from ED.

Thyrocare Technologies: Shares of the company jumped over 6 percent in early trade on January 24 to hit an intraday high of Rs 867.95 apiece. This comes after the diagnostics company reported a 24 percent year-on-year rise in net profit to Rs 19.11 crore in the October-December quarter of FY25.