POST-MARKET REPORT

The Indian equity indices failed to hold on to early gains and ended 1.5 percent lower in the volatile session on November 28, with Nifty closing below 24,000 amid November F&O expiry and geopolitical tensions.

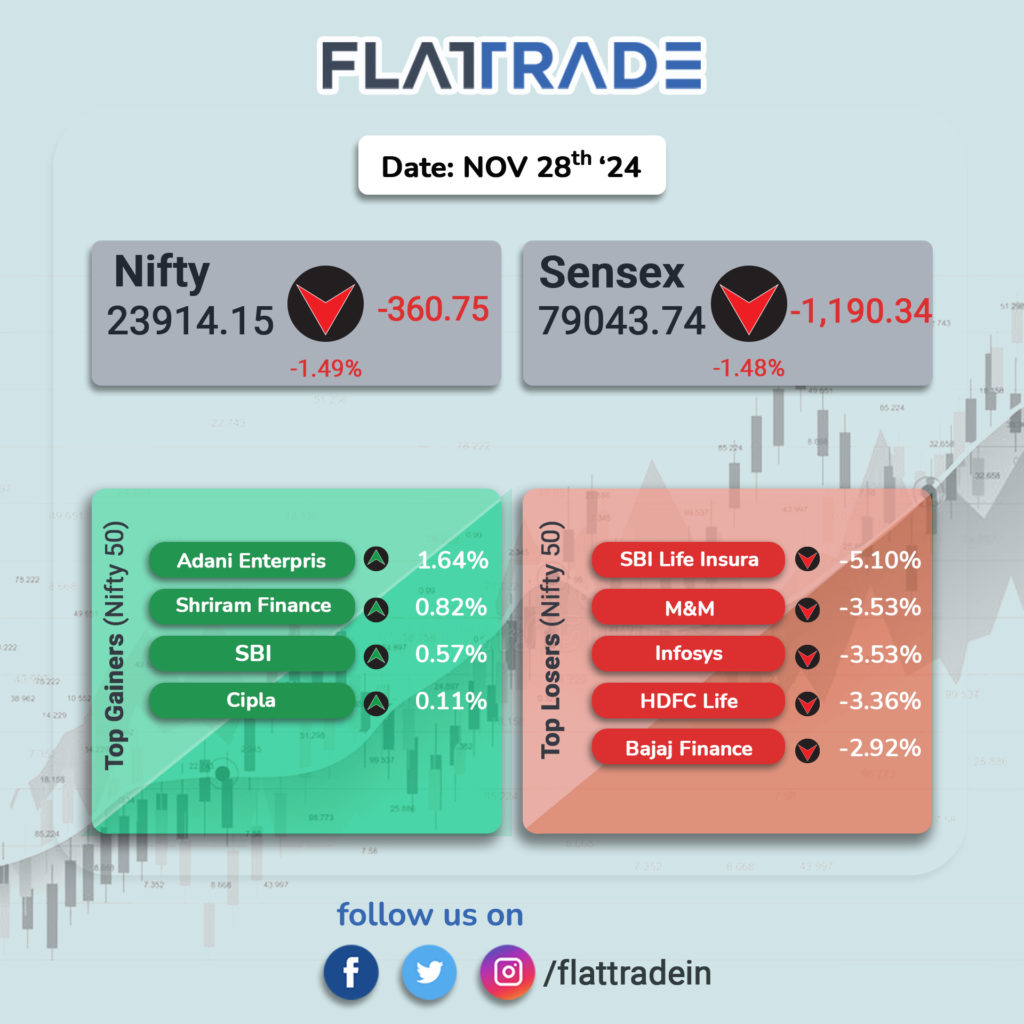

At close, the Sensex was down 1,190.34 points or 1.48 percent at 79,043.74, and the Nifty was down 360.70 points or 1.49 percent at 23,914.20.

In today’s fall, investors’ wealth eroded by around Rs 92,801 crore, as the market capitalization of BSE-listed companies slipped to Rs 443.55 lakh crore, from Rs 444.48 lakh crore in the previous session.

SBI Life Insurance, HDFC Life, Infosys, M&M, and Bajaj Finance were among the top losers on the Nifty, while gainers included Adani Enterprises, Shriram Finance, SBI, and Cipla.

On the sectoral front, auto, bank, IT, FMCG, metal pharma, and energy shed 0.3-2 percent, while the PSU bank index gained 1 percent and the media index went up 0.3 percent.

The BSE midcap index ended flat and Smallcap index was up 0.4 percent.

STOCKS TODAY

NBCC India: The stock surged 5 percent as investors cheered for the company’s recent order wins, worth a cumulative Rs 919 crore. HUDCO awarded the first order, worth Rs 600 crore, for the development of a 10-acre institutional plot at Noida. The Government of Odisha gave the second order to upgrade various primary school hostels across the state.

Ola Electric: The stock revved up 6 percent, extending its upsurge to the fifth straight session. This upward run in the stock comes after the company unveiled its most affordable electric scooters yet — the S1 Z and Gig range — with prices starting at Rs 39,000, drawing positive outlook from brokerages.

Paytm: The stock gained 2 percent UBS, a New York-based financial services firm, raised its target price for the stock to Rs 1,000 from Rs 490, citing that significant improvements have already been factored into the valuation. The brokerage projects Paytm’s FY26 revenue to align with FY24 levels, with adjusted EBITDA expected to break even by Q4FY25.

Honasa Consumer: The stock skyrocketed 10 percent as heavy trading volumes lifted the counter to its upper circuit. A total of 31 lakh equity shares changed hands so far on the BSE and NSE combined. This is higher than the one-month traded average of 18 lakh shares.

NTPC Green Energy: The stock rallied and extended its gains, following its debut on the bourses in the previous session. The firm announced that it successfully commissioned the first part of the 105 MW Shajapur Solar Project, with a capacity of 55 MW. NTPC Green Energy has joined the Rs 1 lakh crore market cap club, and its IPO was the third-largest after Hyundai Motor India and Life Insurance Corporation.

Amber Enterprises: The stock fell over 6 percent on November 28 after Goldman Sachs downgraded the stock to ‘Neutral’ from ‘Buy’ following a recent surge in its stock price. At the same time, the brokerage has raised its target price on Amber to Rs 6,300 from Rs 4,550.