POST-MARKET REPORT

Indian markets snapped an eight-day losing streak on February 17 to end marginally higher in the volatile session on February 17 with Nifty at around 22,950 led by pharma, metal, and financial stocks.

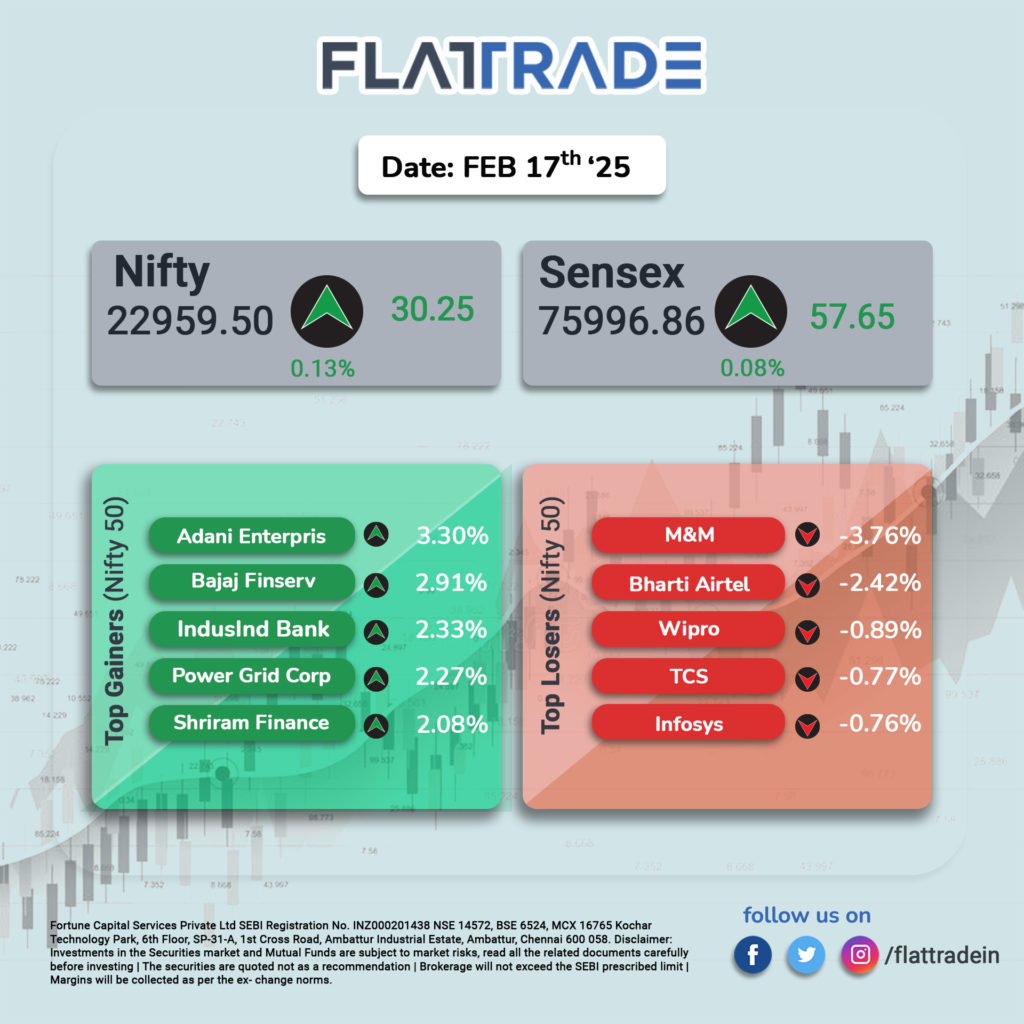

At close, the Sensex was up 57.65 points or 0.08 percent at 75,996.86, and the Nifty was up 30.25 points or 0.13 percent at 22,959.50.

Bajaj Finserv, Adani Enterprises, Power Grid Corp, IndusInd Bank, and Shriram Finance were among the top gainers on the Nifty, while losers were M&M, Bharti Airtel, Wipro, TCS, and Infosys.

Among sectors, Auto, IT, Telecom, and Media shed 0.5-1 percent, while Pharma, PSU Bank, energy, Consumer durables, and Metal indices rose 0.5-1 percent.

Broader indices performance remained mixed as the BSE Midcap index ended 0.5 percent higher, while the smallcap index was down 0.6 percent.

STOCKS TODAY

GSK Pharma: GSK Pharma shares gained 20 percent to hit its upper circuit as the December quarter earnings topped estimates on robust volume growth and continued scale-up in vaccine offtake. Brokerages reaffirmed their bullish ratings on the pharma player.

Godfrey Phillips: Godfrey Phillips shares surged 20 percent, extending a two-day rally, driven by a 49 percent year-on-year increase in Q3FY25 net profit at Rs 316 crore. Between two sessions, the stock has soared 36 percent in trade.

Glenmark Pharmaceuticals: Shares of Glenmark Pharmaceuticals rose 4 percent following strong FY26 guidance and a return to profitability in Q3FY25. It reported a net profit of Rs 348 crore compared to a Rs 351 crore loss in the same quarter last year.

Dilip Buildcon: Dilip Buildcon shares rose 4.4 percent on February 17, 2025, despite mixed Q3 results, showing a 7.4 percent rise year-on-year. Its net profit increased to Rs 115.3 crore, but the revenue fell by 9.98 percent to Rs 2,589.7 crore.

Zen Technologies: Shares of Zen Technologies plunged 20 percent due to a sequential decline in Q3FY25 net profit. The profit nearly halved to Rs 38.62 crore from Rs 65.24 crore in the previous quarter, despite a year-on-year increase.

Samvardhana Motherson: Samvardhana Motherson shares fell over 3 percent after brokerages, including JPMorgan and Jefferies, lowered price targets due to a soft near-term global outlook for the auto component sector, despite Q3FY25 results being in line with estimates.