POST-MARKET REPORT

Indian benchmark indices failed to hold intraday gains and ended marginally lower in a volatile session on October 9.

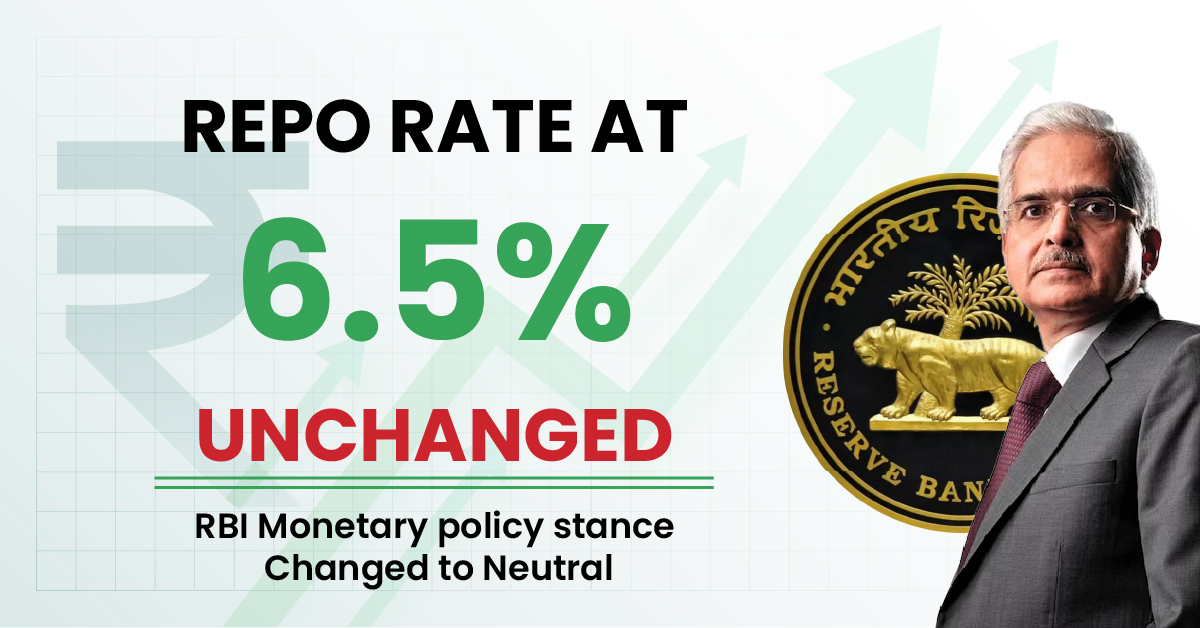

The Reserve Bank of India (RBI) has made no change in its key policy rates amid geopolitical and inflation concerns while shifting its stance to ‘neutral’ from ‘withdrawal of accommodation’.

The Monetary Policy Committee has kept the repo rate unchanged at 6.5 percent for the 10th time and also maintained MSF & SDF rates unchanged at 6.75 percent & 6.25 percent, respectively.

At close, the Sensex was down 167.71 points or 0.21 percent at 81,467.10, and the Nifty was down 31.20 points or 0.12 percent at 24,982.

BSE Sensex and Nifty 50 indices erased 852 points and 252 points from their day’s high.

Top Nifty losers were ITC, Nestle, Reliance Industries, ONGC, and HUL, while gainers included Trent, Cipla, Tata Motors, SBI, and Maruti Suzuki.

Among sectors, except FMCG (down 1.3 percent) and oil & gas (down 0.6 percent), all other indices ended in the green with pharma, power, and realty up 1-2 percent.

BSE Midcap and Smallcap indices are up more than 1 percent each.

STOCKS TODAY

Torrent Power: Shares surged over 6 percent a day after the company announced that it had secured a significant contract from Maharashtra State Electricity Distribution Company Ltd (MSEDCL). The energy player received a letter of award for the long-term supply of 2,000 MW energy storage capacity from its upcoming InSTS Connected Pumped Hydro Storage Plant.

Divi’s Labs: Shares of the pharma major jumped 8 percent after brokerage firm Citi initiated its coverage with a ‘buy’ rating and set a price target of Rs 6,400 for the stock, the highest on the Street. This suggests over a 15 percent upside from the previous closing price. With this, Citi also became the first brokerage to see Divi’s Labs stock surpassing the Rs 6,000 mark.

Premier Energies: Shares of the recently listed company rallied 6 percent after it announced a significant step forward in its renewable energy efforts. The company’s subsidiary, Premier Energies International, finalized a solar module supply agreement with BN Hybrid Power-1, a special-purpose vehicle under BrightNight India. The first shipment of these modules is set to begin in July 2025.

Ajmera Realty: The real estate major saw its share price rise around 4 percent after the company posted robust growth in its collections for the September quarter. The company’s collections grew by 20% to Rs 133 crore compared to Rs 111 crore in the previous year. Sequentially, however, Ajmera Realty’s collections fell by 20% from Rs 165 crore in the first quarter of this fiscal.

Sobha: Shares plunged over 3 percent, extending losses for a second session in a row after the company reported q muted business update for the September quarter. The realty major posted new area sales of 0.93 million square feet during Q2, generating sales worth Rs 1,179 crore at an average price realization of 12,674 per square foot.

JK Cement: Shares slipped 2 percent on the back of a spike in short positions in the counter. Open interest in the stock was up over 4 percent, suggesting a rise in short bets from investors. JK Cement shares have showcased a weak trend off late, slipping 10 percent in the past month.