POST-MARKET REPORT

The Sensex and the Nifty 50 ended mixed, while the midcap and smallcap segments continued their record-setting march, aggravating concerns over their unsustainable valuations.

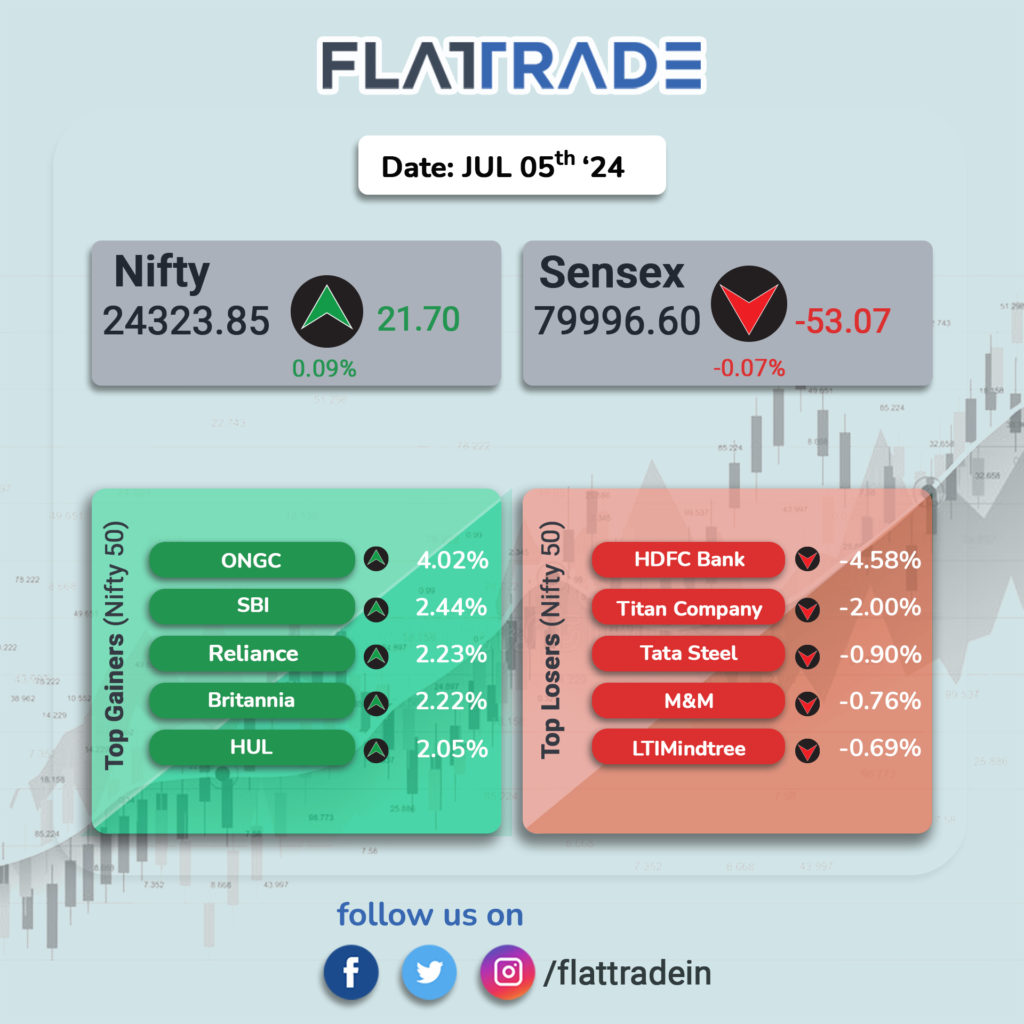

At close, the Sensex was down 72.47 points or 0.09 percent at 79,977.20, and the Nifty was up 12.00 points or 0.05 percent at 24,314.20. About 1820 shares advanced, 1588 shares declined, and 74 shares unchanged.

Among sectoral gainers on the Nifty, Nifty Oil & Gas led the way with a gain of 1.9 percent, followed by Nifty Pharma and PSU Bank, both up by 1.3 percent each. Nifty FMCG also showed strength with a gain of one percent. On the other hand, among sectoral losers, Nifty Bank was the top decliner, down by 0.8 percent, followed by Nifty Consumer Durables, which was down 0.2 percent

The BSE Midcap index hit its fresh all-time high of 47,484.71 during the session. It closed 0.75 percent higher at 47,437.85. The BSE Smallcap index hit a fresh record high of 54,258.65 before ending 0.70 percent higher at 54,153.96.

STOCKS TODAY

HDFC Bank: The stock of India’s largest private lender declined over 4 percent on July 5 after it reported a soft April-June quarter (Q1FY25) business update. In its Q1FY25 update, HDFC Bank reported a robust 52.6 percent year-on-year (YoY) growth in gross advances to Rs 24.87 lakh crore. However, this figure was down 0.8 percent quarter-on-quarter (QoQ) from Rs 25.07 lakh crore in Q4FY24, driven by a decline in corporate and wholesale loans.

Kalyan Jewellers: The stock rose 0.9 percent on July 5 buoyed by the company’s upbeat business update for the April-June quarter of FY25. The quarter gone by saw a strong operating performance for the company across India and the Middle East markets despite volatility in Gold prices and an unfavourable base.

Gabriel India: Brokerage Elara Capital has initiated coverage on Gabriel India with a buy rating and set a target price of Rs 624 a share, up 30 percent from the current market price. Gabriel India holds a dominant 31 percent market share in India’s 2W suspension segment, contributing to 61 percent of its total sales as of FY24.

RBL Bank: Shares of RBL Bank dropped by over 1 percent on July 5 after the lender reported a sequential decline in its total deposits and current account savings account (CASA) in the April-June quarter (Q1FY25) business update.

Angel One: Angel One’s shares finally saw some respite from a four-day losing streak – due to revised market intermediary charges – rising by 3 percent as the company registered a rise in client base and the number of orders in June. Angel One’s client base was up 3.7 percent on month to 2.47 crore in June. Yearly, the client base increased by 64.2 percent.

Defence stocks: Shares of defence companies were buzzing in trade, surging up to 13 percent on July 5 after the defence minister announced that the country’s defence production recorded the highest-ever growth in 2023-24.