POST-MARKET REPORT

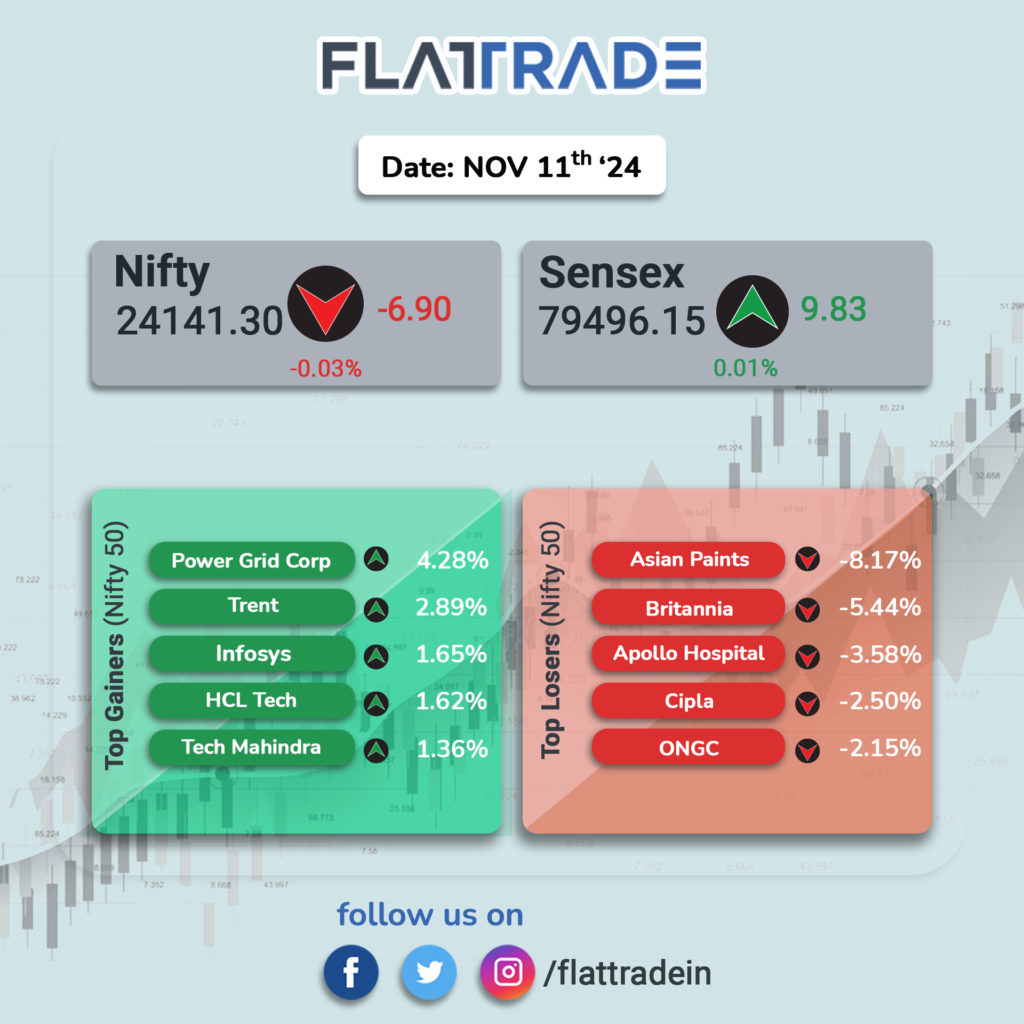

In a highly volatile session, the Indian equity indices ended with little change on November 11. At close, the Sensex was up 9.83 points or 0.01 percent at 79,496.15, and the Nifty was down 6.90 points or 0.03 percent at 24,141.30.

The Indian indices opened marginally lower but erased all the gains in the initial hour and extended the gain as the day progressed. But profit booking at higher levels removed all the intraday gains to close on a flat note.

Power Grid Corp, Trent, Infosys, HCL Tech, and Tech Mahindra were among the major gainers on the Nifty, while losers were Asian Paints, Britannia, Apollo Hospitals, Cipla and ONGC.

Among sectors, the bank index was up 0.6 percent and IT index was up 1 percent, while auto, FMCG, healthcare, metal, oil & gas, and media fell 0.5-1 percent.

BSE Midcap index was down 0.8 percent and smallcap index shed 1 percent.

STOCKS TODAY

HFCL: The company’s shares rose over 6 percent intraday after the company, along with partners Rail Vikas Nigam Ltd (RVNL) and Aerial Telecom Solutions, emerged as the lowest bidder for BharatNet Phase III project bids totaling Rs 8,100 crore. HFCL and its consortium won the Uttar Pradesh East and West bids valued at Rs 6,925 crore, to build a middle-mile broadband network under the government-backed initiative to expand rural connectivity. The stock ended 0.8 percent higher.

Biocon: Shares jumped 8 percent after the US Food and Drug Administration granted a “Voluntary Action Indicated” (VAI) status to its biologics unit in Bengaluru. The US FDA’s VAI classification is a regulatory designation given after an inspection of a facility. VAI is generally a favorable outcome for companies, as it means they can continue business operations without additional regulatory hurdles.

Trent: Breaking a five-day losing streak, Trent shares staged a rebound, rising 2.6 percent after international brokerage Goldman Sachs initiated coverage on the player with a bullish call, as the growth story for the retail player is led by its rising market share. The brokerage initiated coverage on Trent with a ‘buy’ call and a price target of Rs 8,000 per share.

United Spirits: United Spirits gained nearly two percent, after foreign brokering firm Goldman Sachs kicked off coverage with a bullish outlook on India’s spirit market. According to the brokerage, India’s spirit markets are seeing an overarching trend of premiumization, which, United Spirits is well-positioned to capture. Goldman Sachs initiated coverage with a buy call and a target price of Rs 1,650 apiece.

Jupiter Wagon: Shares dropped nearly 5 percent as profit booking in the counter continued despite the company’s decent Q2 earnings performance. Sharp profit booking has taken over railway names over the last few months after two years of bull run, triggering a 14 percent correction in the stock in the past three months. Despite that though, the stock is still up 50 percent for the year so far.

Aarti Industries: Shares tanked over 7.4 percent bogged down by the company’s dismal earnings performance for the July-September quarter which marked a steep fall in its net profit along with a sharp margin contraction. The fall was also triggered by a sharp spike in trading volumes in the counter as two crore shares changed hands on the exchanges in just the first hour of trade, sharply higher than the one-month daily traded average of 17 lakh shares.