POST MARKET REPORT

Indian benchmark indices Sensex and Nifty ended on a strong note, with Nifty at 23,850, led by buying across the sector, especially the financial sector. The market also got a boost from a positive signal over trade deals between the US and Japan. About 2183 shares advanced, 1203 shares declined, and 119 shares remained unchanged.

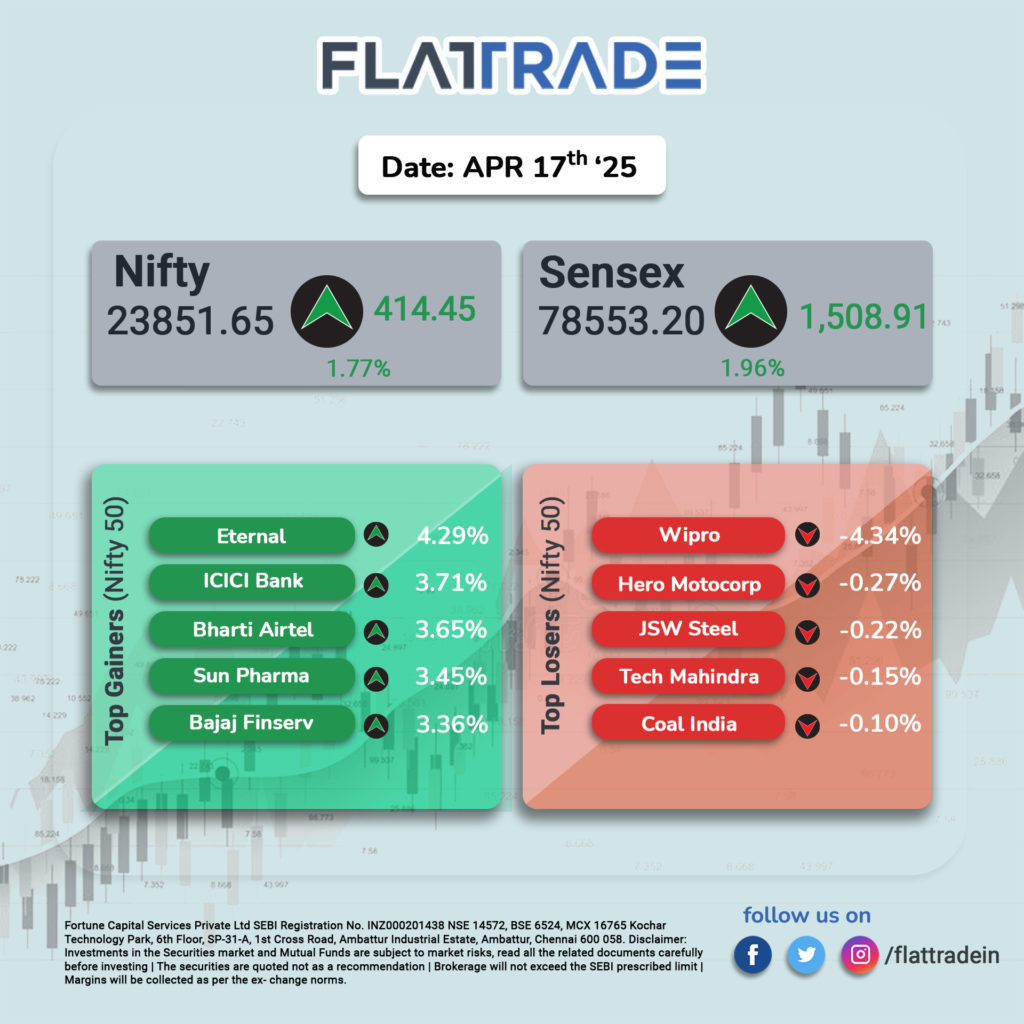

At close, the Sensex was up 1,508.91 points or 1.96 percent at 78,553.20, and the Nifty was up 414.45 points or 1.77 percent at 23,851.65. About 2340 shares advanced, 1468 shares declined, and 149 shares remained unchanged.

Bharti Airtel, ICICI Bank, Bajaj Finance, Sun Pharma, and Eternal were among the major gainers on the Nifty, while losers included Wipro, Hero MotoCorp, Tech Mahindra, Coal India, and JSW Steel.

All the sectoral indices ended in the green with telecom, PSU Bank, Oil & Gas, pharma, auto, energy, and private bank rising 1-2 percent.

Broader indices ended higher with the BSE Midcap and BSE Smallcap indices adding 0.5 percent each.

STOCKS TODAY

One97 Communications

Paytm shares traded flat with around a 2 percent decrease, after its Managing Director and Chief Executive Officer, Vijay Shekhar Sharma, voluntarily surrendered 2.1 crore shares. The shares were granted to Sharma as part of an ESOP (employee stock ownership plan) at the time of the listing of One97 Communications, which owns the Paytm brand.

KFin Tech

Shares of the Financial services company increased 8 percent intraday on Thursday, gaining for a third straight session. This comes after the company announced a strategic acquisition in Singapore’s fund administration space that is expected to be concluded in the next three to four months. The stock delivered over 500 percent returns from its post-IPO low.

Grasim Industries

The shares of the Flagship company of Aditya Birla Group experienced a notable surge, climbing 2.01% to reach Rs 2,758.20. The company’s financial performance, characterized by consistent revenue and fluctuating profitability, will likely remain a key factor influencing its stock trajectory.

KEI Industries

The shares of wire and cable manufacturer were upgraded to ‘buy’ from ‘neutral’ by international brokerage Goldman Sachs, leading the firm’s shares to jump over 2.5 percent on April 17. Out of the 19 analysts covering KEI Industries, 15 have a buy rating, while four others have a neutral recommendation. No analysts tracked have a sell call on the firm.

Suzlon Energy

The global renewable energy solutions provider’s shares gained two percent after bagging an order on April 17. The company has secured a 100.8 MW EPC wind power order from Sunsure Energy, marking their maiden foray into wind energy. Over the past year, Suzlon Energy’s stock has risen around 34 percent, as against an 8 percent gain in the benchmark Nifty 50.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.