POST-MARKET REPORT

The Indian equity indices closed with little change on December 26, with the Nifty at 23,750 led by auto, pharma, and energy stocks.

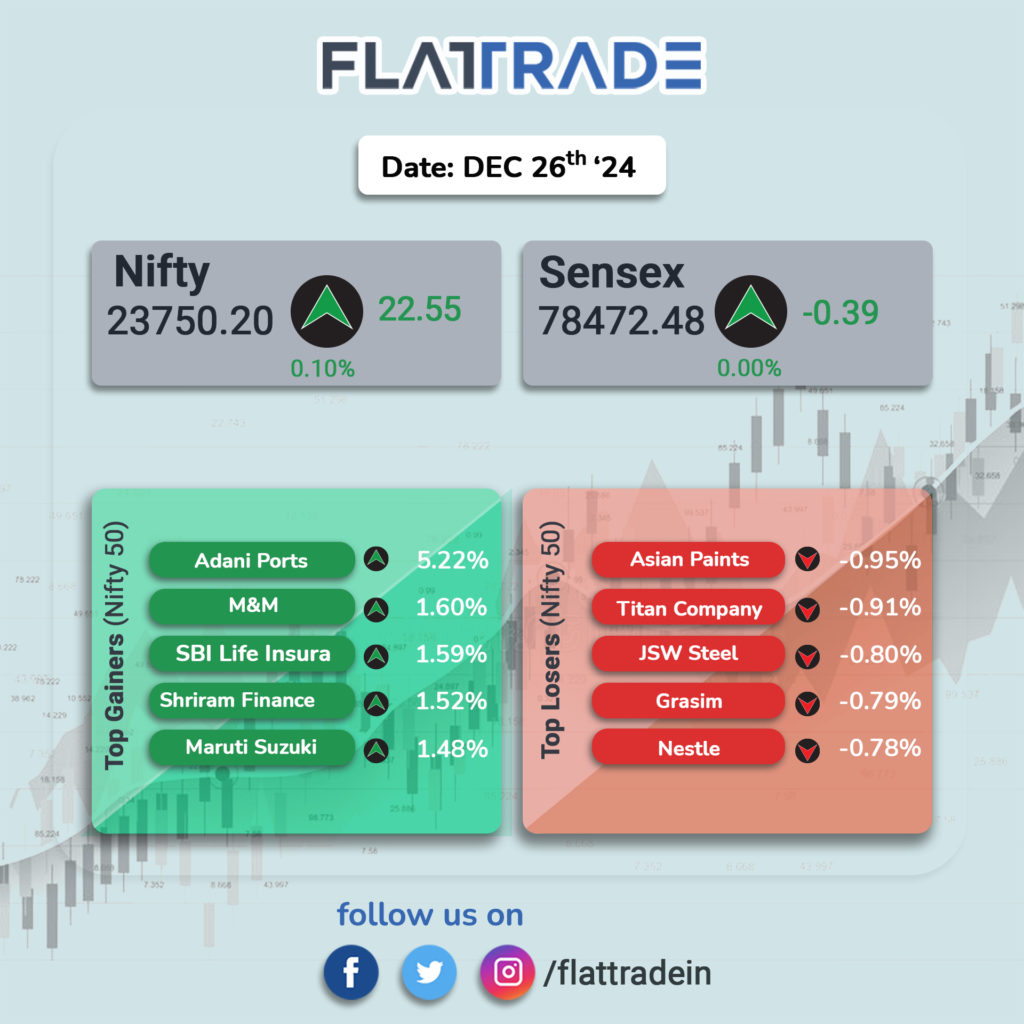

At close, the Sensex was down 0.39 points at 78,472.48, and the Nifty was up 22.55 points or 0.10 percent at 23,750.20.

Adani Ports, Shriram Finance, M&M, Maruti Suzuki, and SBI Life Insurance were among the major gainers on the Nifty, while losers were Titan Company, Asian Paints, Nestle, JSW Steel, Grasim Industries.

Considering Broader market indices, BSE midcap and smallcap indices ended flat.

On the sectoral front, buying was seen in the auto, energy, pharma, realty, and PSU Bank, while selling was seen in the metal, FMCG, and media.

STOCKS TODAY

Ceigall India: Shares of Ceigall India, a recently listed infrastructure player, surged as high as 7 percent after the company announced that its subsidiary, Ludhiana Bathinda Greenfield Highway, had signed a Concession Agreement with the National Highways Authority of India (NHAI). The project, valued at Rs 981 crore, is slated for completion within 24 months and will also be operated by the company upon its completion.

EPACK Durable: EPACK Durable stock gained 5 percent, following a clarification on a media report on plans for a Chinese television manufacturer to invest in EPACK Durable’s wholly owned subsidiary. In an exchange filing on December 24, the company said that the discussions are currently in a preliminary stage and that an update will be provided to the exchanges, as and when required.

One MobiKwik Systems: Shares of recently listed One MobiKwik Systems surged over seven percent in the morning session on December 26, as a block deal worth Rs 118 crore took place on the exchanges. Around 18.6 lakh shares or 2.4 percent of equity in the firm were exchanged in a block deal window, at an average price of Rs 635 per share.

Sagility India: Sagility India’s share price hit a fresh high, rallying for the 8th straight session. The stock hit the 5 percent upper circuit in the morning trade and has risen 29 percent in the period. Last week, global International brokerage Jefferies initiated coverage on Sagility India with a ‘Buy’ rating and a target price of Rs 52 per share.

NTPC Green Energy: Shares of NTPC Green Energy tumbled over 4 percent, as the one-month lock-in period for anchor investors expired today. Following the lock-in expiry, as many as 1.83 crore shares of NTPC Green Energy, or a 2 percent stake in the company, became eligible to trade, opening the doors for anchor investors to go ahead and offload 50 percent of their holdings in the stock if they wished to do so.

Hindustan Copper: Hindustan Copper’s stock fell over six percent in trade, underperforming its sector and the broader market. The stock is trading below all key moving averages. Over the past month, the stock has declined by six percent, compared to the fall in the Nifty 50 index, which is lower by 1.9 percent for the month.