POST-MARKET REPORT

Indian equities ignored positive global markets after the US Federal Reserve cut its benchmark lending rate by a quarter percentage point. The benchmark indices ended lower for the second consecutive session on November 8 with Nifty below 24,150.

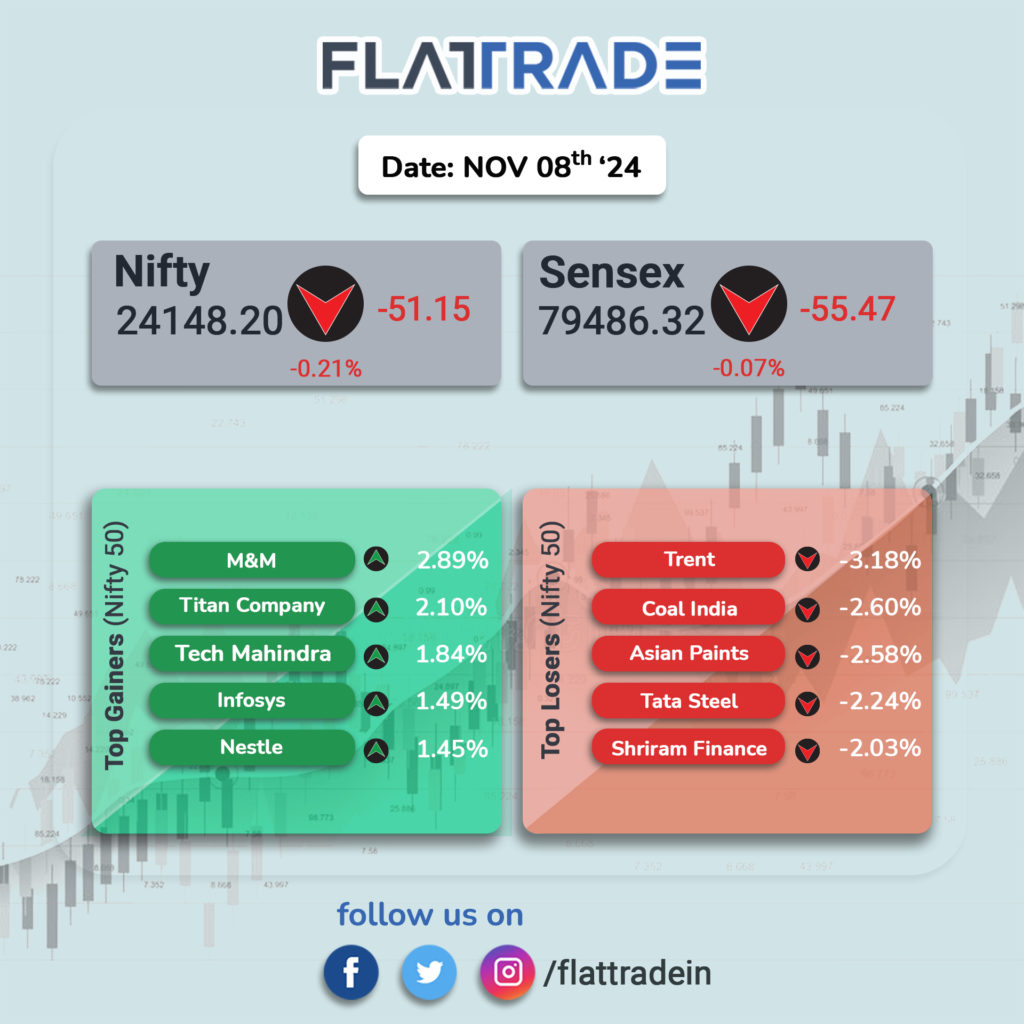

At close, the Sensex was down 55.47 points or 0.07 percent at 79,486.32, and the Nifty was down 51.15 points or 0.21 percent at 24,148.20.

For the week, the BSE Sensex was down 0.3 percent and the Nifty50 index fell 0.6 percent. M&M, Titan Company, Tech Mahindra, Infosys, and Nestle were among the major gainers on the Nifty, while losers were Coal India, Tata Steel, Trent, Asian Paints, and Shriram Finance.

Among sectors, the IT index was up 0.7 percent, while media, PSU Bank, metal, oil & gas, power, and realty declined 1-2 percent.

The BSE midcap index shed 1 percent and smallcap index was down 1.6 percent.

STOCKS TODAY

Bajaj Electricals: Shares fell 4.5 percent after the company reported a muted performance for Q2FY25, with a sharp decline in net profit despite modest revenue growth. The company’s net profit for Q2FY25 fell over 52 percent on year to Rs 12.9 crore.

GMM Pfaudler: Shares declined 7 percent following a year-on-year dip in consolidated net profit and revenue for the September quarter. In Q2FY25, the company’s net profit plunged 75 percent year-on-year to Rs 17.3 crore and revenue dropped 14 percent on-year to Rs 805.4 crore.

Cochin Shipyard: Shares dropped 5 percent after the higher costs dented the company’s Q2 margins. The stock has dropped over 50 percent from its peak. The earnings before interest, tax, depreciation, and amortization (EBITDA) margin stood at 17.3 percent in the quarter under review for the current fiscal. Previously, it reported 18.9 percent of the corresponding quarter of the previous fiscal.

Trent: Retail player and Zudio operator Trent reported its earnings show for the second quarter ended September on November 7, which came in under expectations. This caused the Street to sell off shares of the Tata group firm prompting a 3.5 percent fall. Trent reported a standalone net profit of Rs 423.44 crore, a 46 percent jump from Rs 289.67 crore reported during the same quarter last financial year. Its revenue from operations came in at Rs 4,035.56 crore, higher by 39.9 percent on-year.

Waaree Energies: Shares dropped over 10 percent in the last two trading sessions amid fears of a decline in renewable energy exports to the United States during the presidency of Donald Trump. The impact could be severe on companies that are heavily reliant on the US for exports. Waaree Energies stock declined nearly 5 percent on November 8 to quote at Rs 3,186 per share on the NSE. After two days of decline, the company’s total market capitalization has declined to Rs 93,213.34 crore from an earlier over Rs 1 lakh crore.

Rail Vikas Nigam: Shares of the state-owned company fell over 6 percent after the company reported disappointing results for the quarter ended September 30, 2024. RVNL’s net profit dropped 27 percent on-year, falling to Rs 287 crore in Q2FY25. Meanwhile, the company’s revenue registered a marginal decline, reaching Rs 4,855 crore. Analysts anticipated a decline in revenue and profit due to lower project executions and slower growth in the company’s core segments