POST-MARKET REPORT

Indian market extended the losses in the fourth session and ended marginally lower in the highly volatile session on February 19 with Nifty above 22,900.

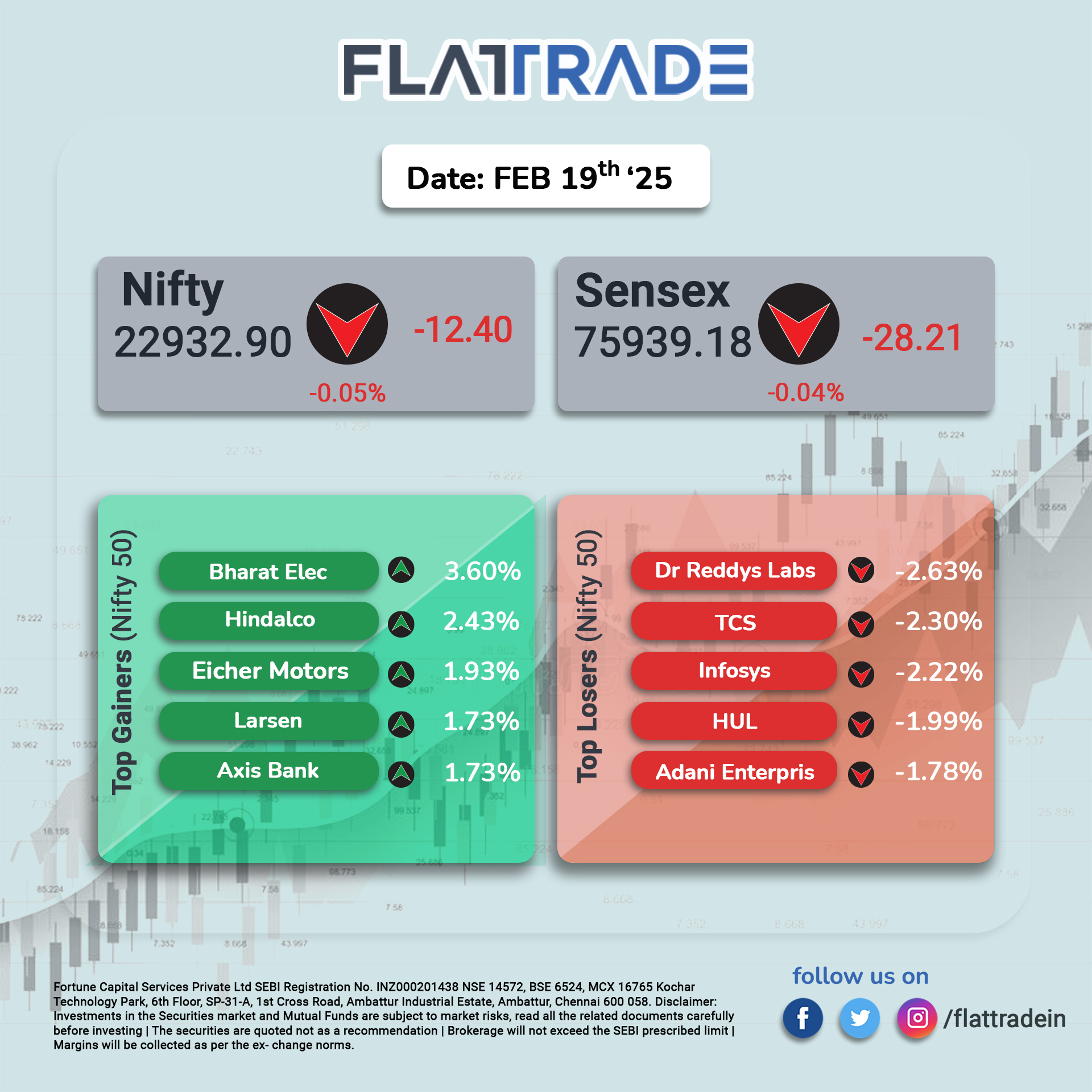

At close, the Sensex was down 28.21 points or 0.04 percent at 75,939.18, and the Nifty was down 12.40 points or 0.05 percent at 22,932.90.

Dr Reddy’s Labs, TCS, HUL, Infosys, and Adani Enterprises were among the major losers on the Nifty, while Bharat Electronics, Hindalco, L&T, Axis Bank, and Eicher Motors were among the gainers.

Among sectors, the IT index shed 1.3 percent and the pharma index was down 0.7 percent, while media, energy, metal, PSU bank, realty, and capital goods rose 1-2 percent.

Broader indices outperformed with the BSE Midcap index rising 1.3 percent and Smallcap index adding 2.4 percent.

STOCKS TODAY

Rail Vikas Nigam Limited (RVNL): shares experienced a significant surge of nearly 11 percent, snapping its three-day losing streak. This jump followed the company’s announcement of securing a Rs 554 crore joint venture project for the Bengaluru Suburban Rail Project (BSRP) in Karnataka.

Hindalco: shares of Hindalco and the national aluminum company jumped up to 4% as European Union envoys agreed on the sixteenth package of sanctions against Russia. Sanctions include a Russian primary aluminum import ban and the listing of 73 new shadow fleet vessels. The sanctions come days ahead of the third anniversary of the Russia-Ukraine conflict.

TVS Motor: The Company shares continued their downward trajectory, slipping over a percent to Rs 2,330 in early trading. This marked the sixth consecutive session of losses for the stock, highlighting a sustained period of negative investor sentiment. The decline occurred despite an “outperform” rating and a target price of Rs 2,904 issued by Macquarie, which suggested a potential 24 percent upside.

Infosys: Export-focused IT companies including LTI Mindtree, Tata Consultancy Services (TCS), and Infosys were among the top losers on the index amid reciprocal tariffs starting in early April. This move is expected to make investors move away from export-oriented stocks, including IT and pharma that earn a significant share of their revenue from the US.

Aurobindo Pharma: Shares of Aurobindo Pharma tumbled 10 percent after the US FDA completed a pre-approval inspection of its subsidiary, Eugia Steriles. The inspection took place from February 10-18, wherein the US regulator concluded with five procedural observations, which the company plans to address within the prescribed time.