POST MARKET REPORT

Indian benchmark indices Nifty and Sensex ended on a strong note with Nifty50 index comfortably closed above 24,300, hitting a 4-month high, while BSE Sensex closed above 80,000 for the first time since December 2024.

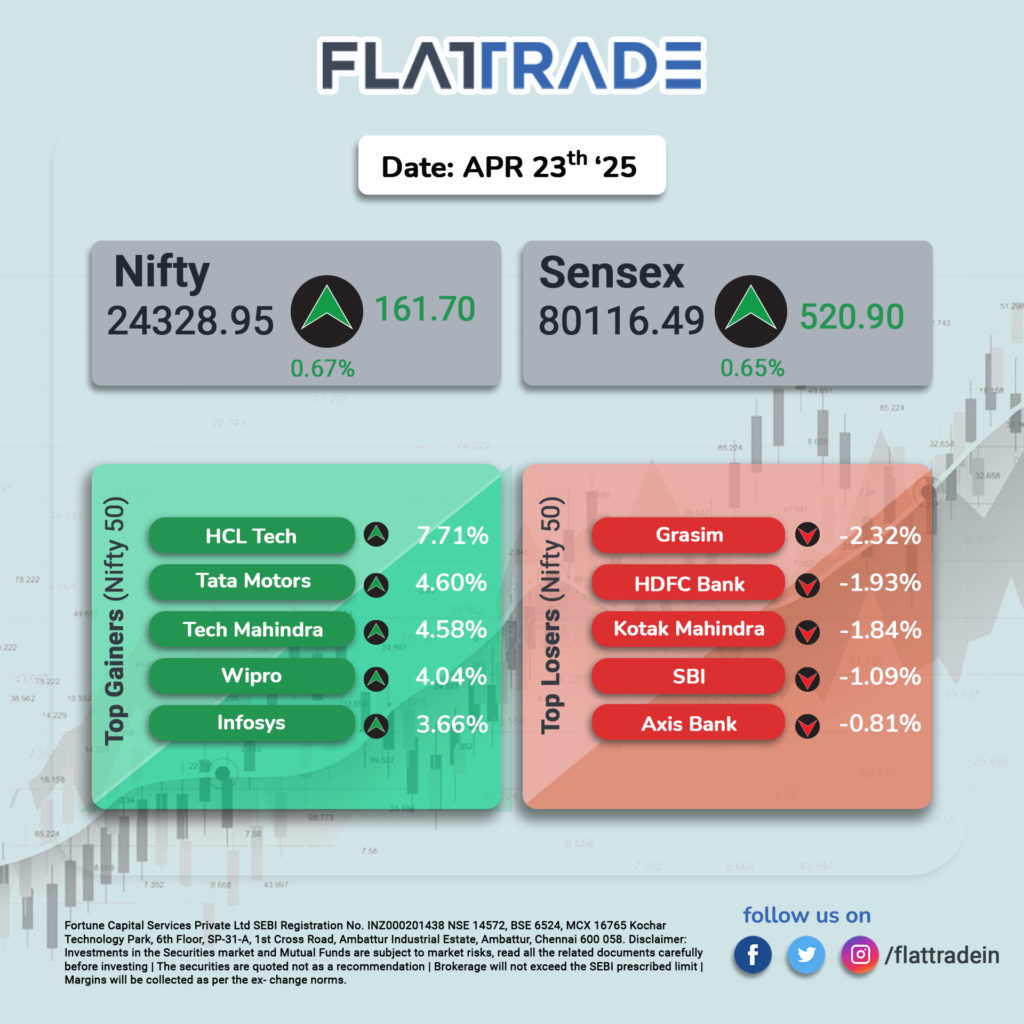

At close, the Sensex was up 520.90 points or 0.65 percent at 80,116.49, and the Nifty was up 161.70 points or 0.67 percent at 24,328.95. About 1989 shares advanced, 1832 shares declined, and 141 shares remained unchanged.

HCL Technologies, Tech Mahindra, Tata Motors, Wipro, Infosys were among the biggest gainers on the Nifty, while losers were HDFC Bank, Kotak Mahindra Bank, Axis Bank, SBI, Grasim Industries.

On the sectoral front, the IT index jumped 4 percent, the auto index added more than 2 percent, while PSU Bank, consumer durables were down 0.5-1 percent.

The broader markets performed well, with the BSE Midcap index rising 1 percent and the Smallcap index increasing a mere 0.2 percent.

STOCKS TODAY

Au Small Finance Bank

The bank’s shares were higher by 5 percent in early trade on April 23, reacting to its fourth-quarter earnings, which showcased a 41 percent year on year increase in net profit to Rs 528 crore and FY27 guidance, even as the analysts have a cautious outlook around credit cost and asset quality concerns remain mixed.

Vardhman Special Steels

Shares of Punjab-based special and alloy steels producer are locked at 20 percent upper circuit on April 23 after the company announced significant capital expenditure plans, even though it reported a drop in the top and bottom line during its March quarterly results.

Ashoka Buildcon

A leading highway developer and a Fortune 500 company’s share price extended the gains on the fourth consecutive session, rising 4 percent, following the company receiving a Letter of Acceptance (LoA) from Central Railway for a project worth Rs 568.86 crore.

Eicher Motors

Eicher Motors’ share price dropped up to 3 percent on April 23 as the government plans to cut import duties on Harley-Davidson and other high-end bikes, especially cutting duties on high-end motorcycles in the 705 cc and above category to zero. The entry of high-end Harley-Davidson bikes may compete with the Bullet motorcycles of Royal Enfield. Eicher is the parent company of Royal Enfield. The stock has been losing for the last two days.

Lupin Limited

Shares of the pharmaceutical company edged 2.5 percent higher after the company announced the launch of Tolvaptan tablets in the US market, marking a key milestone in its US generics portfolio. The drug is a therapeutic equivalent of Jynarque, developed by Otsuka, and is used to treat autosomal dominant polycystic kidney disease (ADPKD), which is a chronic condition with limited treatment options.

Source – Money Control

Disclaimer: Investments in the Securities market and Mutual Funds are subject to market risks. Read all the related documents carefully before investing | The securities are quoted as an example and not as a recommendation | Brokerage will not exceed the SEBI-prescribed limit | Margins will be collected as per the exchange norms.