POST-MARKET REPORT

Indian markets declined on November 4 due to sustained foreign investor selling and weaker-than-expected September quarter earnings.

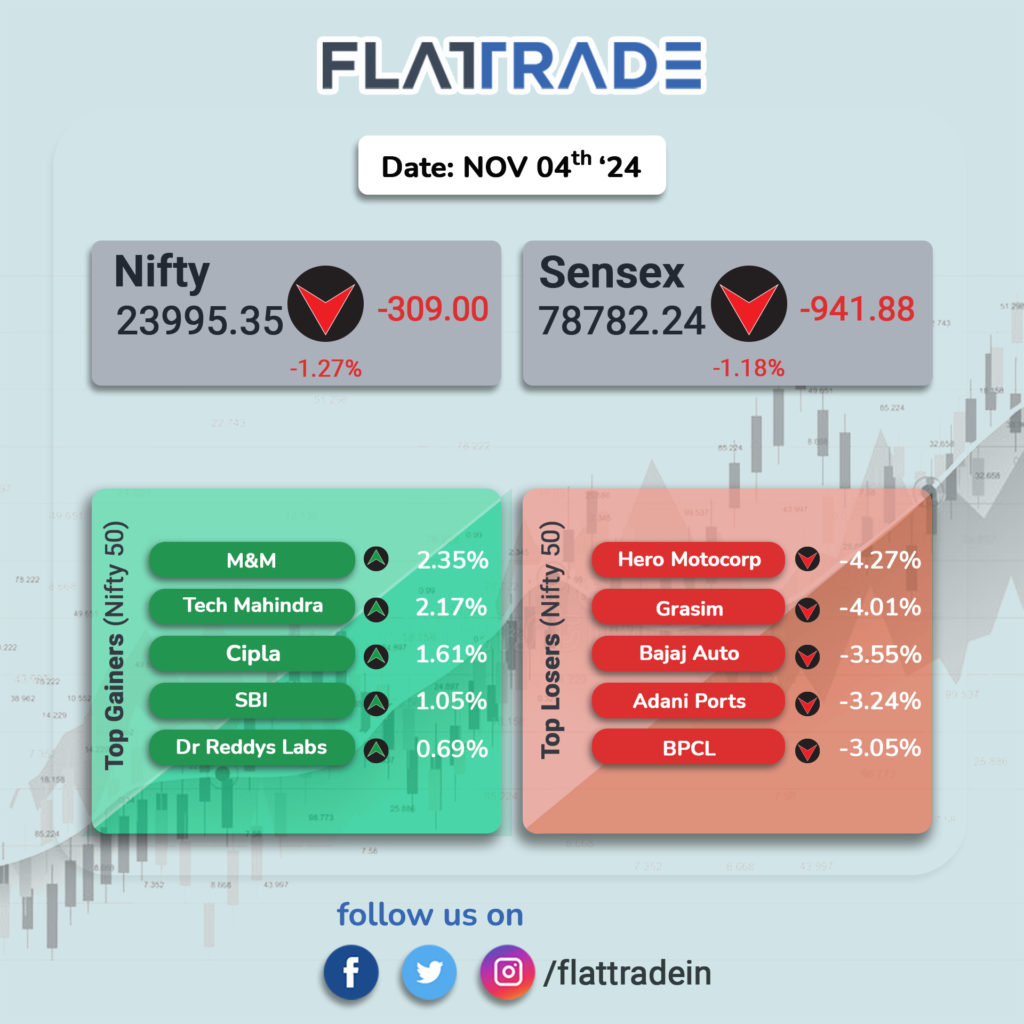

At the close, the Sensex fell by 1.2 percent or 942 points to 78782.24, while the Nifty dropped 1.27 percent or 309 points to 23995.35.

In the Nifty 50 index, as many as 42 stocks ended with losses, with shares of Hero MotoCorp, Grasim, Bajaj Auto, Adani Ports, Special Economic Zone, and BPCL as the top losers, falling 3-4 percent. While, Mahindra and Mahindra, Tech Mahindra, Cipla, and SBI ended as the top gainers in the index, rising 1-2 percent.

Among the sectoral indices, Nifty Realty, Oil & Gas, and Media fell over 2 percent. Nifty Bank, Auto, Financial Services, FMCG, Metal, Private Bank, and Consumer Durables fell 1 percent.

The BSE Midcap and Smallcap indices fell 1.31 percent and 1.65 percent, respectively.

STOCKS TODAY

Gensol Engineering: Shares gained 3.5 percent after the company bagged a solar PV project worth Rs 780 crore from a leading public utility in Maharashtra. It is a large turnkey engineering, procurement, and construction (EPC) order that involves the development of a 150 MWac ground-mounted solar PV power plant. The order is to be executed over 15 months.

Tata Power Company: Shares fell nearly 4 percent after CLSA said that the stock has run ahead of its fundamentals, backed by the strength of retail shareholders, who have lapped up power-linked stocks. The brokerage has maintained its “underperform” recommendation on the stock as it has surged over 80 percent so far in 2024, without any significant change in profitability, thereby making its current valuations “expensive.”

Sun Pharmaceutical Industries: Shares slumped 3 percent after a recent ruling by the US District Court of New Jersey granted a preliminary injunction in a patent dispute case against the drugmaker’s hair loss drug, Leqselvi.

Bajaj Auto: Shares fell 3.5 percent as investors reacted to the company’s weak October sales data. The two-wheeler manufacturer’s monthly domestic sales dropped 8 percent on year to 3.03 lakh units in October, down from 3.29 lakh units sold in the same month last year.

Hero MotoCorp: Shares fell over 4 percent after the world’s largest motorcycle and scooter manufacturer reported its October sales numbers at 6.79 lakh units, up by 18 percent YoY.