POST-MARKET REPORT

The domestic benchmark equity indices, Sensex and Nifty 50, ended Thursday’s session in green after struggling through some volatility during the trade.

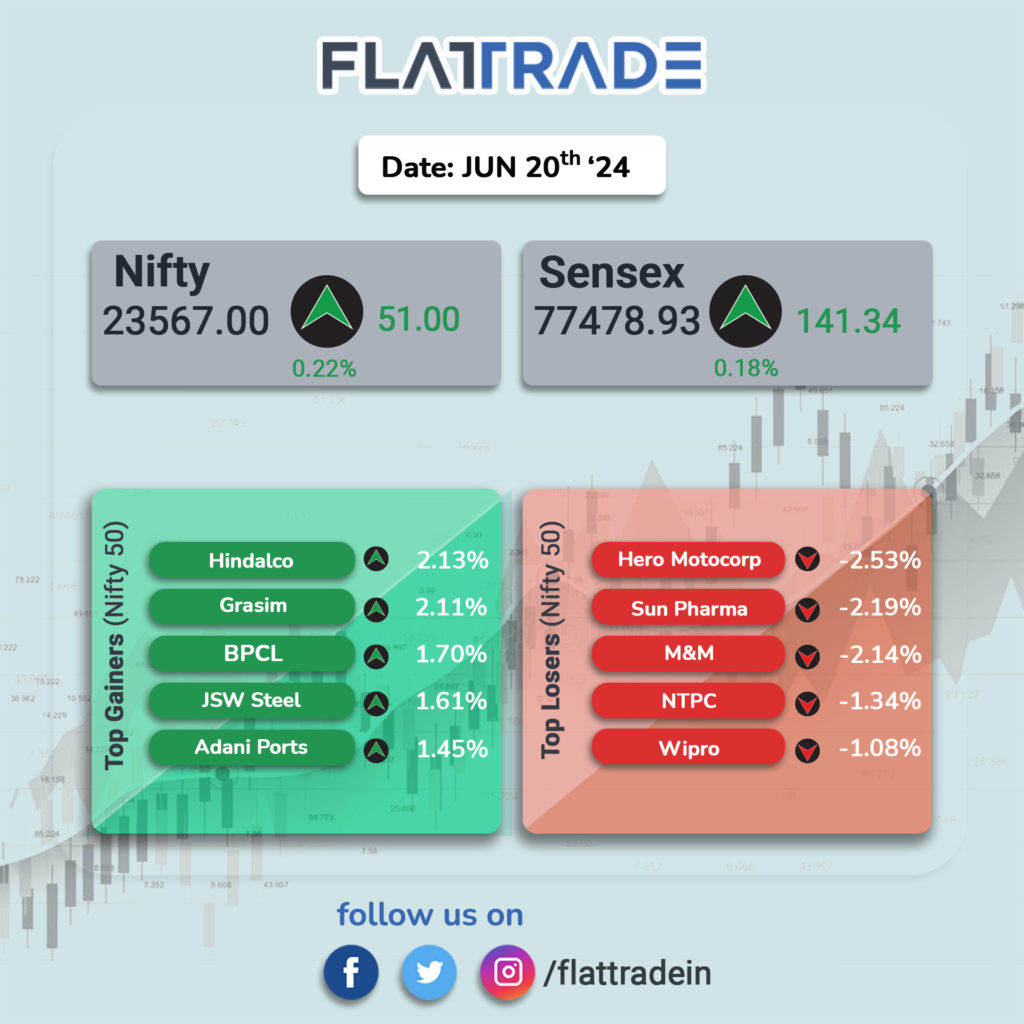

At close, the Sensex ended higher by 141.34 points or 0.18% at 77,478.93 level while the Nifty 50 closed at 23,567.00 level, up 51.00 points or 0.22%.

Gainers and Losers on Nifty today: The top gainers in the Nifty index were Hindalco Industries, Grasim Industries, Bharat Petroleum Corporation, JSW Steel, and Adani Ports & Special Economic Zone. On the other hand, the top losers in the Nifty index were Hero Motocorp, Sun Pharmaceutical Industries, Mahindra & Mahindra, NTPC, and Wipro.

Gainers and Losers on Sensex today: Tata Steel, ICICI Bank, Reliance Industries, Kotak Mahindra Bank, and Axis Bank while the top losers were Sun Pharmaceutical Industries, Mahindra & Mahindra, NTPC, State Bank Of India, and Wipro.

Sectoral indices today: Selling was seen in the auto, pharma, and PSU Banks stocks, while buying was seen in the metal, capital goods, realty, and oil & gas sectors.

Broader market indices today: On the broader market front, the Nifty Midcap 100 closed 0.95% higher, while the Nifty SmallCap 100 ended up 0.61%, both outperforming the benchmark indices. Further, the BSE midcap index rose 0.5 percent while the smallcap index added 1 percent.

STOCKS TODAY

Sun Pharma: The stock of this pharma giant slipped 1.8 percent on June 20 after it received a warning letter from the United States Food and Drug Administration (USFDA) for current Good Manufacturing Practice (cGMP) violations at its Dadra facility.

KEI Industries: KEI Industries ended marginally lower after having slipped 3 percent intraday after the company announced that the plants at Rakholi and Chinchpada were partially affected due to the production stoppage amid a labor strike.

Waree Renewable Tech: Waaree Energies stock fell 2.45 percent even as the company on Thursday said that it has secured an order to supply 280 MW solar modules to Mahindra Susten. The modules will be delivered from December 2024 onwards and are designed to support Mahindra Susten’s ambitious renewable energy projects, a company statement said.

DCB Bank: Shares of the lender rose over 4.6 percent after brokerage Motilal Oswal upgraded the stock to ‘buy’ from the earlier stance of ‘neutral’ with a target price of Rs 175 per share, citing attractive valuations and strong growth prospects.

MapMyIndia: Shares of CE Info Systems Ltd, the owner of MapmyIndia, closed at 20 percent upper circuit after Goldman Sachs initiated coverage on the stock with a ‘buy’ rating with a price target of Rs 2,800, implying a potential upside of 40 percent from the stock’s last closing level.

Fertilizer stocks: Shares of fertilizer firms including state-run National Fertilisers (NFL), Deepak Fertilizers, Madras Fertilizers, Chambal Fertilisers, RCF, and others zoomed up to 20 percent, extending the previous session’s gains, boosted by reports of a proposal to remove Goods and Services Tax (GST) on the fertilizers.