POST-MARKET REPORT

Indian markets fell nearly 0.5 percent on September 11, tracking global declines ahead of a key United States inflation report and concerns that the Federal Reserve may have delayed easing the monetary policy.

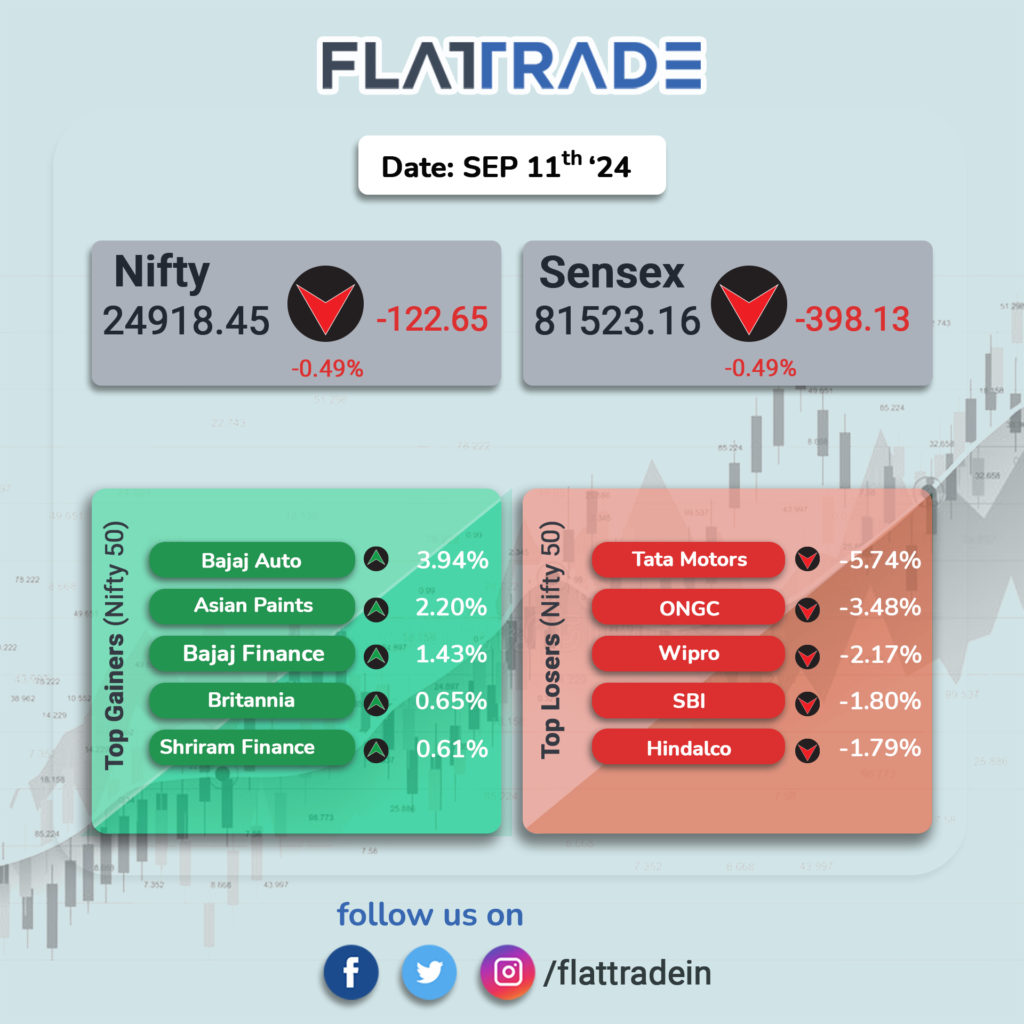

The benchmark Sensex fell 398 points (0.49 percent) at 81,523.16, and the Nifty slipped 122.65 points (0.49 percent) to 24,918.45.

Asian Paints, Bajaj Finance, and Sun Pharma led the gains, while Tata Motors, NTPC, and Adani Ports & SEZ were the top losers. There were 1,619 advancing stocks, 2,345 declining, and 106 unchanged.

Among sectors, the Nifty Oil & Gas Index was the biggest loser, down 2 percent, followed by Nifty PSU Bank and Nifty Metal, which fell 1.8 percent and 1.5 percent, respectively. Nifty Auto and Realty also declined by 1.2 percent each. On the upside, Nifty FMCG was the top gainer, rising 0.3 percent.

STOCKS TODAY

Prism Johnson: The stock surged over 9 percent on September 11 to hit a fresh record high of Rs 246 on the National Stock Exchange (NSE) due to a spurt in volume. A total of 10 crore shares of the company changed hands on BSE and NSE combined, compared to the one-month trading volume of 37 lakh shares.

Century Textiles and Industries: The stock surged over 7 percent to hit a fresh record high of Rs 2,689 on the National Stock Exchange. It ended up 4 percent higher. The surge came after the Aditya Birla Group-owned company acquired the ownership rights of an approximately 10-acre leasehold land parcel in Worli, Mumbai from Wadia Group chairman Nusli Wadia for Rs 1,100 crore.

Suzlon Energy: The stock extended gains, rising 5 percent to hit the upper circuit. The stock is gaining traction after Morgan Stanley reaffirmed its ‘overweight’ rating, following the company’s win of India’s largest wind energy order from NTPC Green Energy Ltd, a subsidiary of NTPC Ltd.

Goa Carbon: Shares rose over 3 percent after the company informed the exchanges that it has officially resumed operations in its Goa unit following a temporary shutdown for maintenance work. The plant, located in St. Jose de Areal, Salcete-Goa, had been non-operational since July 29.

Infibeam Avenues: The stock fell as much as 8 percent as the stock traded ex-date for the spin-off of its digital marketing arm Odigma Consultancy Solutions. The stock ended 3.5 percent lower. September 11 is also the record date to determine the eligibility of shareholders of Infibeam Avenues for the issue and allotment of equity shares of Odigma Consultancy Solutions.

SAMIL: Samvardhana Motherson International shares fell almost 3 percent following a downward revision of BMW Group’s 2024 guidance. As BMW contributes around five percent to Samvardhana Motherson’s topline, the market reacted to the news negatively. BMW Group said its earnings before tax will decrease significantly in 2024.