POST-MARKET REPORT

Indian indices ended on a positive note and broke a two-day losing streak on August 14, mostly led by buying seen in the Information Technology stocks, while selling in other sectors trimmed the intraday gains.

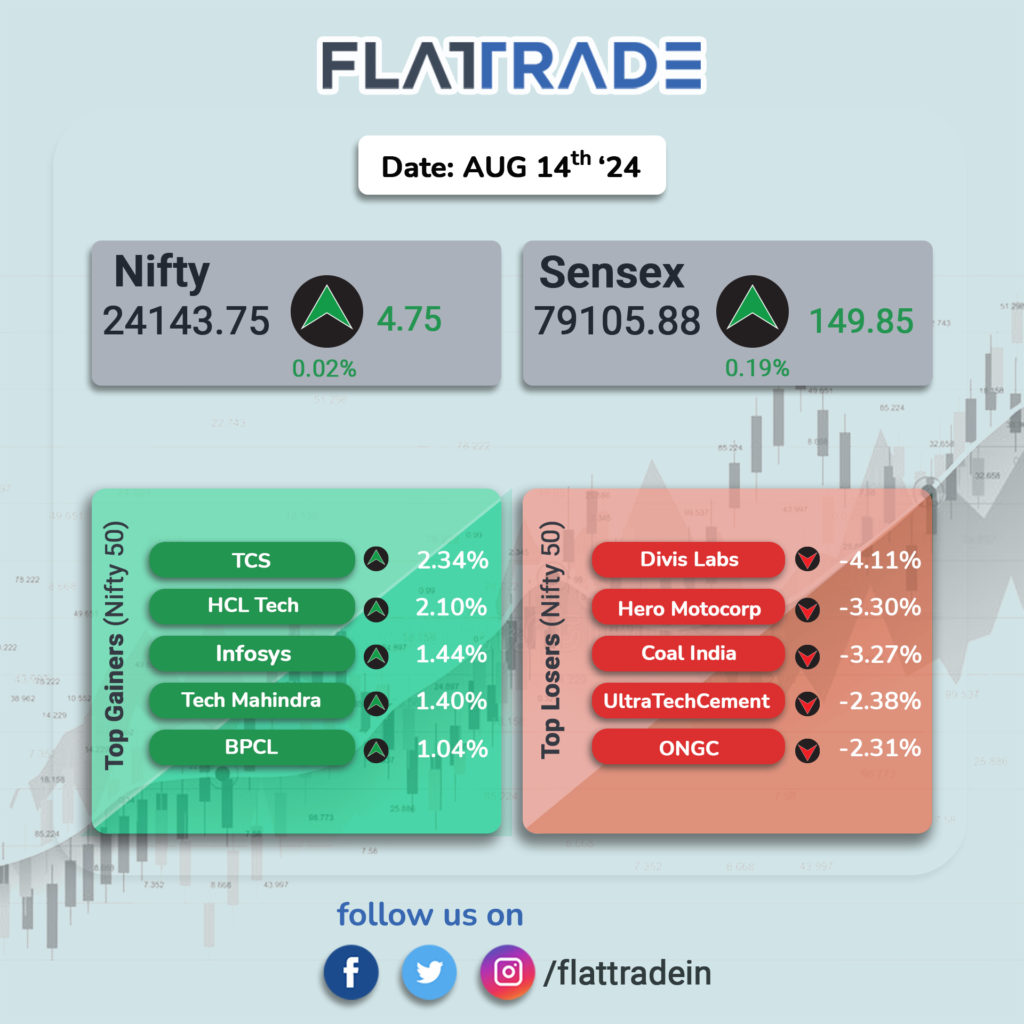

At close, the Sensex was up 149.85 points or 0.19 percent at 79,105.88, and the Nifty was up 4.75 points or 0.02 percent at 24,143.75.

Top Nifty gainers included TCS, HCL Technologies, Infosys, Tech Mahindra, and BPCL, while losers were Divis Labs, Hero MotoCorp, Coal India, ONGC, and UltraTech Cement.

Among sectors, except IT (up 1.5 percent), all other sectoral indices ended in the red. Capital goods, healthcare, oil & gas, metal, realty, pharma, and media were down 0.5-1 percent.

Considering Broader market indices, the BSE midcap and smallcap indices are down 0.5 percent each.

Markets will remain shut tomorrow on account of Independence Day.

STOCKS TODAY

Essel Propack Limited: Shares of EPL, a prominent global specialty packaging company, surged 12% in the morning trade, reaching a 35-month high of ₹243 per share. The company reported an 11% year-on-year increase in consolidated revenue, reaching ₹1,007 crore. The EBITDA margin improved by 90 basis points year-on-year to 18.4%, driven by stronger margins in the Americas and Europe.

Apollo Tyres: The June quarter proved challenging for the company due to commodity headwinds and a loss in market share in the truck segment. the recent sell-off has caused the stock to decline by nearly 13% this month, marking its worst monthly performance since June 2022. Elara Capital downgraded the stock from ‘Neutral’ to ‘Sell’ and lowered its target price from ₹506 to ₹442 per share.

Gravita India: Gravita India shares have surged over 70% year-to-date (YTD), and the stock has given multi-bagger returns of more than 150% in one year and over 905% in three years. The company is incurring significant capex of over ₹600 crore on the existing gross block of ₹480 crore to more than double the capacity over the next three years, to 686K MTPA by FY27 from 303K in FY24.

Piramal Enterprises: Piramal Enterprises shares dropped following a 64% decline in Q1 net profit to ₹181 crore due to a high base effect. This significant drop was primarily due to a high base effect from a one-off item in the previous year. Its core net interest income increased by 18% to ₹807 crore, supported by a 10% rise in total assets under management (AUM) to ₹70,576 crore.

Hindustan Aeronautics: The PSU defence company’s revenue from operations in Q1FY25 increased 11% to ₹4,347.5 crore from ₹3,915.3 crores, year-on-year (YoY). Other income jumped to ₹736.5 crore from ₹409.9 crore, YoY. The EBITDA margin improved marginally to 22.8% from 22.4%, YoY.