POST-MARKET REPORT

The headline benchmark indices Sensex and Nifty resumed the rally in Thursday’s trade and ended higher after hitting record highs on positive global cues following the United States Federal Reserve’s 50 basis point cut.

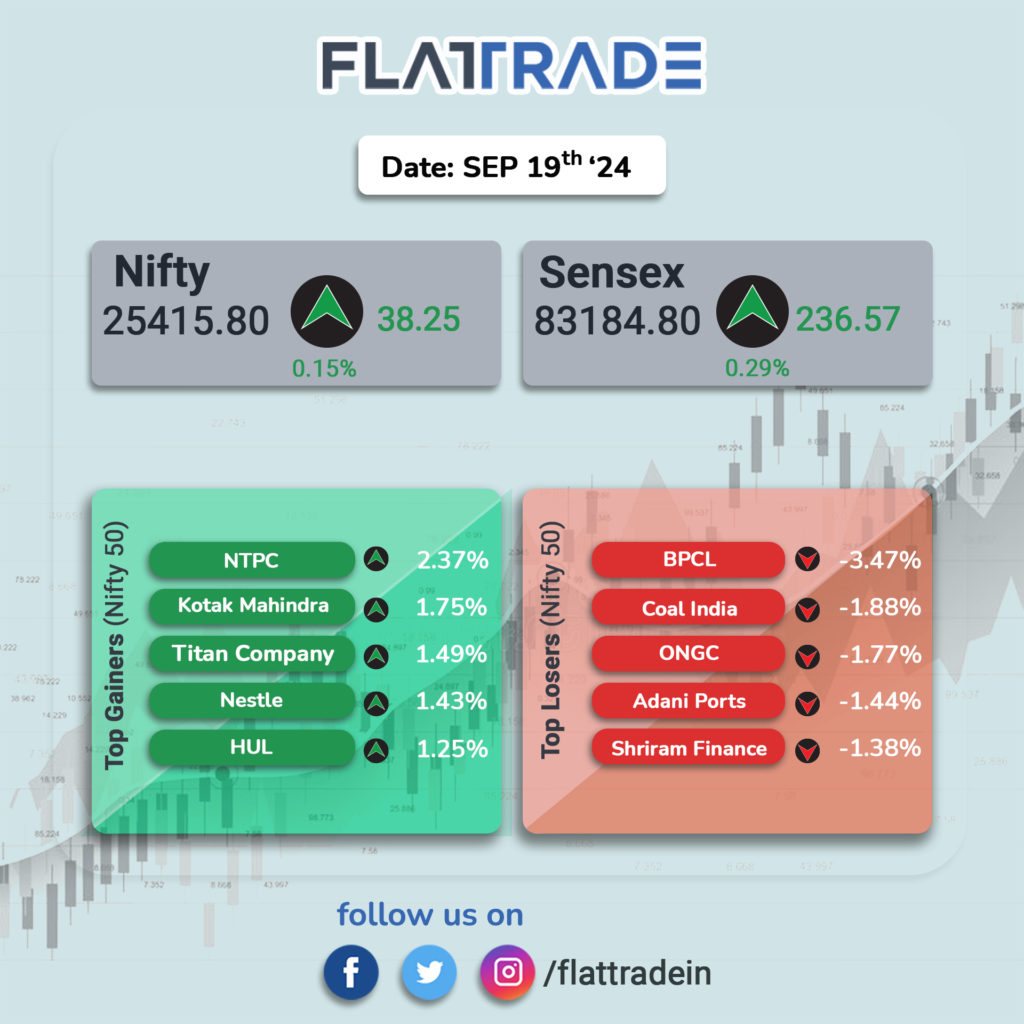

At close, the Sensex climbed 236.57 points to settle at a lifetime high of 83,184.80, while the broader Nifty went up 38.25 points to 25,415.80.

NTPC, Kotak Bank, Titan, Nestle India, Hindustan Unilever, and HDFC Bank were among the top gainers in the Sensex pack while Adani Ports, L&T, and TCS were among the laggards.

Among the sectors, Nifty Media, Oil and Gas, Metal, and PSU Bank were the worst hit falling up to 2.45 percent. Domestic heavyweight sectors such as banking and FMCG witnessed buying, spurred by foreign investments and expectations of monetary easing by the RBI in October.

The broader Indian markets fell on September 19, with Nifty Midcap and Smallcap indices giving up morning gains and slipping deep into the red.

STOCKS TODAY

Neogen Chemicals: The stock rallied 14 percent amid a volume spurt. Around 1.8 million shares were exchanged on BSE and NSE in intra-day deals, exceeding the 1-week average of 0.1 million equity shares. With today’s rise, the stock has extended its rally to 41 percent in the past five days, outperforming benchmark Nifty 50’s 0.5 percent rise.

Info Edge: Shares surged 1.7 percent during the session after Bank of America (BofA) upgraded the stock to ‘buy’ from ‘underperform’ translating to a double upgrade amid robust growth prospects. The brokerage firm suggests that Info Edge has a 70 percent market share, a dominant position, and there are no disruption risks.

IREDA: Indian Renewable Energy Development Agency shares jumped 1.24 percent after DIPAM gave its thumbs up for IREDA to raise to Rs 4,500 crore in a fresh equity share issue through a Qualified Institutional Placement (QIP).

DCX Systems: Shares gained 1.7 percent after the company announced it has received an export order from Israel’s Elta System worth Rs 154.80 crore. In a regulatory filing to the exchanges, DCX Systems said that the order is related to the supply of RF Electronic Modules and is expected to be completed within 12 months.

Exide Industries: Shares fell 2 percent after Citi Research cut the company’s target price to Rs 560 from Rs 610 while maintaining its ‘Buy’ rating. The adjustment was driven by sluggish auto (original equipment manufacturer) OEM volumes, which could moderately impact the company’s revenue growth.

ONGC: Shares fell 1.3 percent after HSBC downgraded the stock to a ‘Reduce’ due to falling oil prices and its impact on the company’s future project viability. The brokerage set a target price of Rs 235 for ONGC which implies a downside of nearly 18 percent from the stock’s current market price.