POST-MARKET REPORT

Benchmarks hitting fresh all-time high led by banking stocks post robust earnings reported over the weekend.

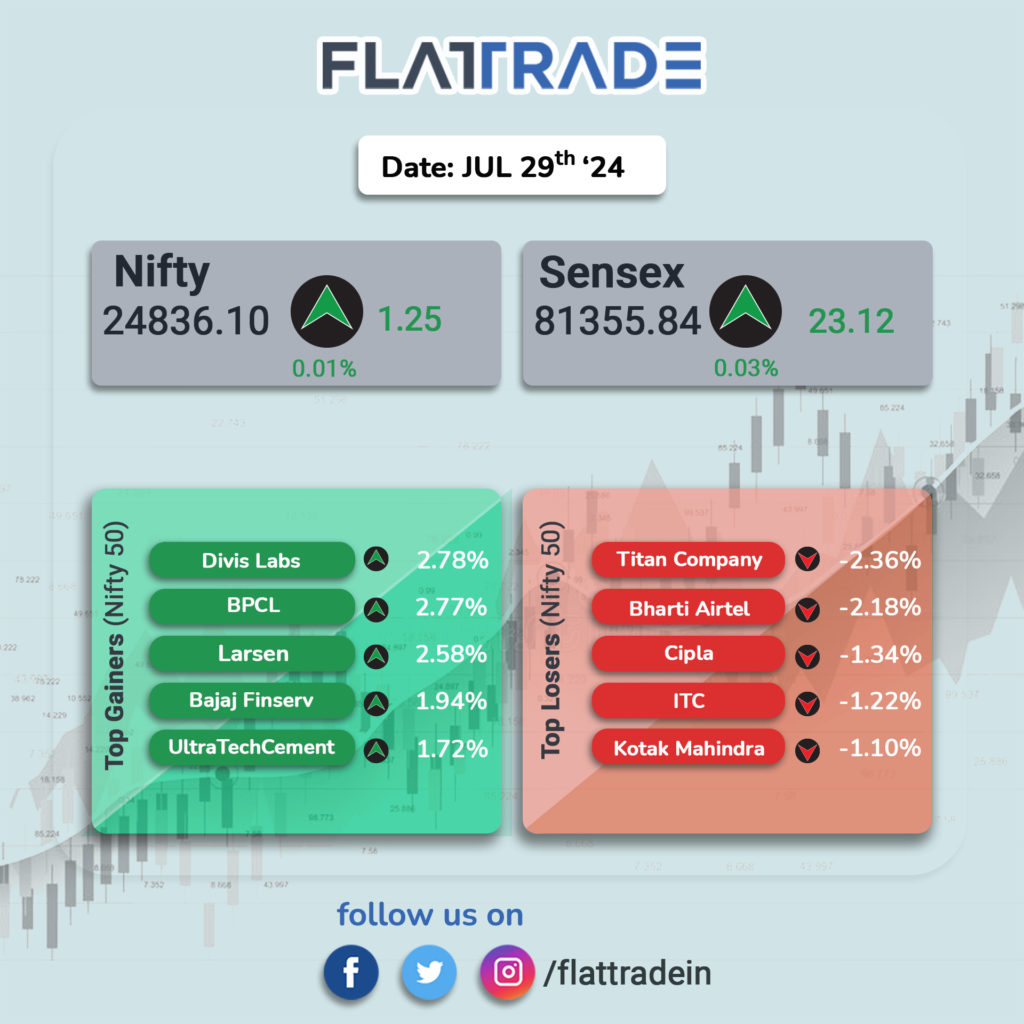

At close, the Sensex was up 23.12 points or 0.03 percent at 81,355.84, and the Nifty was up 0.01 points or 1.25 percent at 24,836.10.

On July 29, the Nifty50 and BSE Sensex touched fresh record highs of 24,999.75 and 81,908.43, respectively.

Top Nifty gainers were Divis Labs, L&T, BPCL, Bajaj Finserv, and M&M, while losers were Titan Company, Bharti Airtel, Cipla, ITC, and Tata Consumer Products.

On the sectoral front, IT, FMCG, and telecom were down 0.4 percent each, while auto, bank, media, capital goods, oil & gas, power, and realty rose 0.5-2.5 percent.

The BSE midcap index rose nearly 1 percent while smallcap index added 1.2 percent.

STOCKS TODAY

Mphasis: The company Mphasis shares declined over four percent on July 29 after brokerages expressed concerns over the stock’s high valuations. While there are positive indicators, such as a robust deal pipeline and stable margins, the slower growth and delayed BFSI recovery have led ICICI Securities to maintain a cautious outlook with a ‘Sell’ rating.

Adani Total Gas: The company has reported a 14.4% rise in its net profit at Rs 171.8 crore on a year-on-year basis, compared to Rs 150 crore in the same period last year. The company’s revenue saw an 8.5% increase, reaching Rs 1,145.4 crore, up from Rs 1,056 crore in the previous year’s corresponding quarter. EBITDA witnessed a significant growth of 19.6%, amounting to Rs 296.3 crore as opposed to Rs 247.7 crore in the previous year.

BEL: The company reported a 46.1 percent increase in net profit, reaching Rs 776 crore in Q1FY25 compared to Rs 531 crore in the same period last year. The company’s revenue also saw a rise of 19.6 percent, amounting to Rs 4,199 crore, up from Rs 3,511 crore in the year-ago quarter. EBITDA experienced growth of 41 percent, totaling Rs 937 crore, compared to Rs 665 crore in the previous year.

Indian Bank: Indian Bank on July 29 reported a 40.6 percent on-year rise in net profit at Rs 2,403.42 crore in the first quarter of the current financial year. In absolute terms, the gross NPA of the lender stood at Rs 20,302.16 crore as of June 30, as compared to Rs 21,106.31 crore in a quarter-ago period, and Rs 26,226.92 crore in a year-ago period.

RITES: The railway-linked state-run company informed the exchanges that it will hold a board meeting on July 31 to consider a bonus issue of shares. Along with the bonus issue proposal, the board will also consider its June quarter earnings and a first interim dividend for FY25.

Realty stocks: Realty stocks, which came under heavy selling pressure last week after the removal of indexation benefit for the asset class, partially recovered on July 29. The recovery is due to a large section of experts believing that the changes would not have such a drastic impact as estimated earlier, especially for those who again re-invest the gains in the real estate segment.