POST-MARKET REPORT

The Indian market extended the winning streak for the third consecutive session on July 16 with benchmarks hitting fresh record highs amid buying seen in the IT, realty, and FMCG stocks.

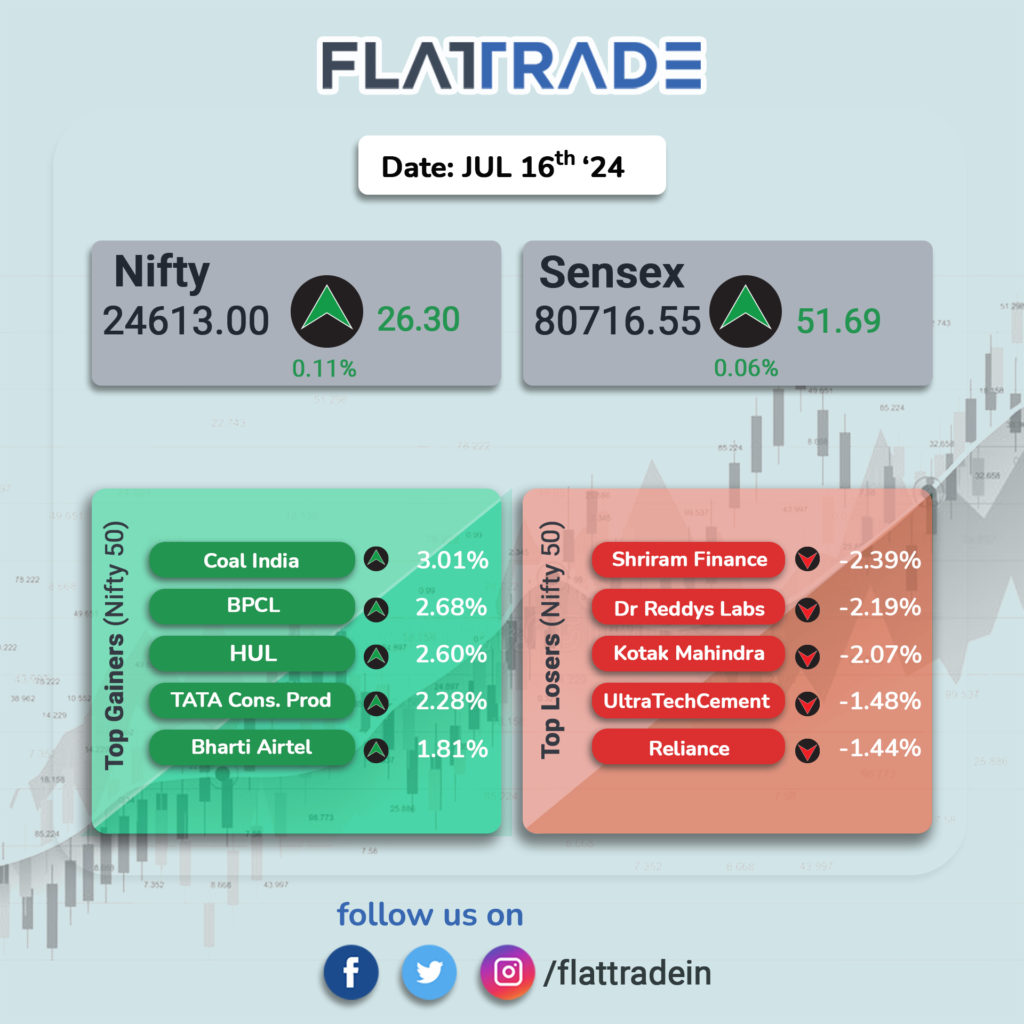

At close, the Sensex was up 51.69 points or 0.06 percent at 80,716.55, and the Nifty was up 26.30 points or 0.11 percent at 24,613.

Top Nifty gainers were Coal India, BPCL, HUL, Tata Consumer Products, and Bharti Airtel, while losers were Shriram Finance, Dr. Reddy’s Labs, Kotak Mahindra Bank, UltraTech Cement and Reliance Industries.

Among sectors, the Realty index surged 1.6 percent and FMCG, IT, Metal, and Telecom up 0.3-0.9 percent. On the other hand, the Media index shed 1 percent, and Power and Capital Goods indices were down 0.5 percent each.

The BSE midcap index was down 0.3 percent while the smallcap index was up 0.3 percent.

STOCKS TODAY

Bajaj Auto: Bajaj Auto Ltd on July 16 posted an 18 percent on-year rise in its Q1 FY25 consolidated net profit to Rs 1,941.79 crore. The Pune-based automaker’s revenue during the April-June quarter jumped 16 percent on-year to Rs 11,932 crore, aided by robust vehicle sales and record spares revenue, leading to a higher average selling price (ASP).

Bharti Hexacom: Shares of Bharti Hexacom surged as much as 9.5 percent on July 16 after global brokerage JPMorgan initiated coverage on the stock with an ‘overweight’ tag. The brokerage assigned a price target of Rs 1,280 for the stock, foreseeing a 20 percent upside potential from the previous closing level.

Angel One: Shares of Angel One surged by 2 percent to Rs 2,325 per share on July 16 after net profit jumped by 36 percent year-on-year (YoY) to Rs 297 crore in the April-June quarter (Q1FY25). So far this year, the stock of the broking firm languished by 34 percent, underperforming the benchmark Nifty 50 index that rose by 11 percent during the same period.

SpiceJet: SpiceJet shares surged six percent in the morning session after the debt-laden airline flew back into the black in the fourth quarter ended March 2024. The debt-laden airline reported its Q3 and Q4 results for the financial year 2023-34 on July 15. The carrier reported a six-fold jump in fourth-quarter profit after reporting a loss in the third quarter of 2023-24.

Hatsun Agro: Shares of Hatsun Agro Products soared 18 percent to hit their highest level in 52 weeks on July 16, a day after the dairy company posted quarterly numbers that were strong on all key parameters. The strong quarterly numbers also triggered a spike in volumes in the counter as three lakh shares changed hands on the exchanges, manifold the one-month daily traded average of 45,000 shares.

Century Textiles: Shares of Century Textiles and Industries soared over 8 percent on July 16, a day after its wholly-owned subsidiary- Birla Estates acquired a 5-acre land parcel in Gurugram.The land parcel offers a development potential of around 10 lakh square feet and is expected to generate revenue of over Rs 1,400 crore, the company stated.