POST- MARKET REPORT

Indian benchmark indices Sensex and Nifty hit fresh lifetime highs of 80,481 and 24,461 and it retreated later in the day due to broad-based selloff.

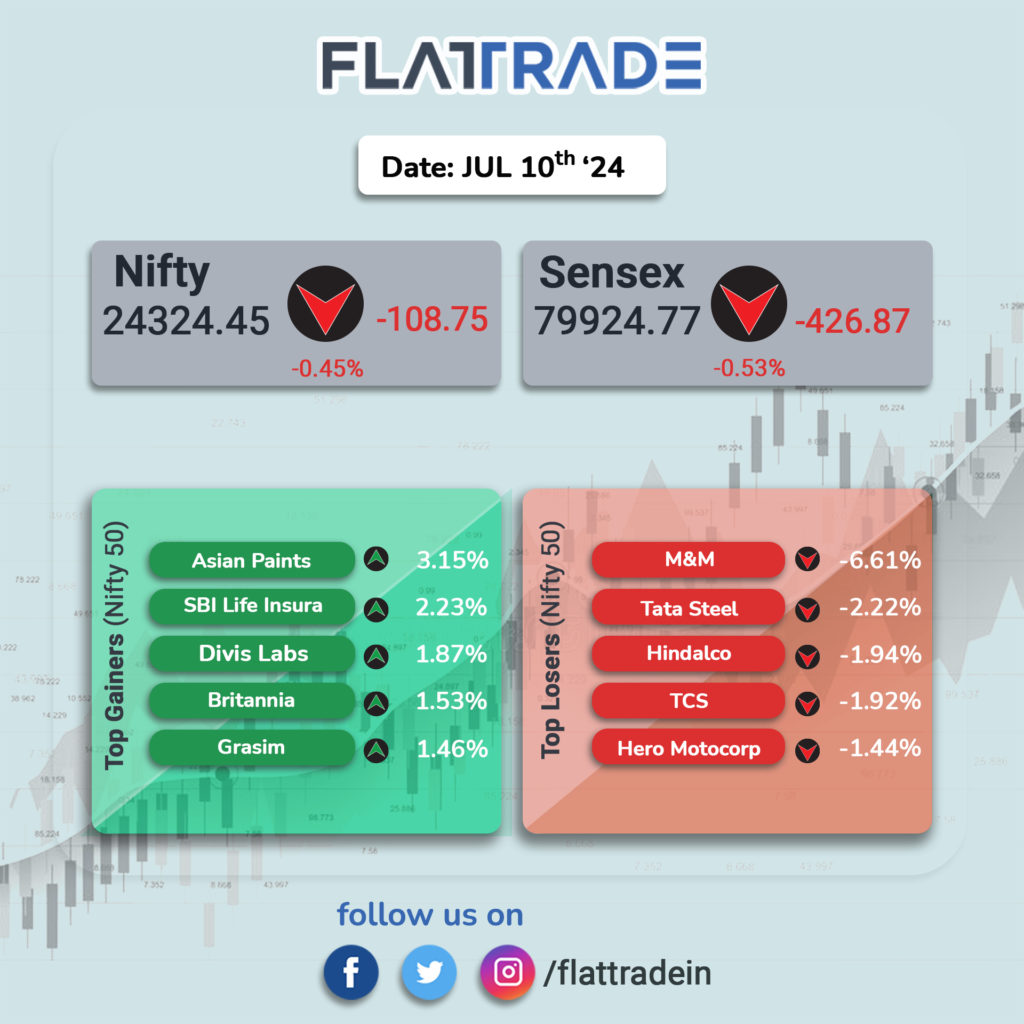

At close, the Sensex was down 426 points or 0.5 percent at 79,924 and the Nifty was down 120 points at 24,313. About 1,115 shares advanced, 2,305 shares declined, and 66 shares were unchanged.

Asian Paints (up 3.27 percent), SBI Life Insurance Company (up 2.05 percent), and Divi’s Laboratories (up 1.63 percent) stood as the top gainers of Nifty, while Shares of Mahindra and Mahindra (down 6.69 percent), Hindalco (down 2.11 percent) and Tata Steel (down 2.10 percent) closed as the top losers in the Nifty 50 index.

Among sectoral indices, the Nifty Auto index led losses, falling 2 percent, followed by the Nifty Metal and PSU Bank indices, which declined by 1.6 percent and 1.4 percent, respectively. The Nifty IT index was down 1 percent, while the Nifty Bank index slipped by 0.7 percent.

Mirroring the trends in the benchmark indices, the midcap and smallcap indices also ended in the red. The BSE Midcap index slipped 0.19 percent, while the BSE Smallcap index dropped 0.69 percent.

STOCKS TODAY

Delhivery: As much as 3.17 percent stake or 2.34 crore shares of logistics company Delhivery were sold in a block deal, with Canada Pension Plan Investment Board being the likely seller. Shares of the company were up 3 percent following the block deal.

Adani Ports: Shares gained nearly 1 percent, a day after the company informed that it has been awarded the Letter of Intent (LoI) for the development, operation, and maintenance of Berth No. 13 at Deendayal Port. The LoI is for a 30-year concession period through a competitive bidding process.

ONGC: Shares gained almost 1 percent after the firm announced it will invest around Rs 2 lakh crore to establish renewable energy sites and green hydrogen plants in an attempt to achieve its net-zero carbon emission goal by 2038.

Delta Corp: Shares fell by more than 4 percent intraday to Rs 136 per share after the company reported disappointing results for the quarter ending in June (Q1FY25), due to higher GST rates, general elections, and seasonal factors.

Supreme Industries: Shares surged over 4 percent to Rs 6,264 per share after global brokerage firm Jefferies shared a ‘Buy’ call and raised the target price to Rs 6,700 apiece, indicating an upside of 7 percent from current levels.

GE Power India: Bagged an order worth Rs 7.67 crore from Mangalore Refinery and Petrochemicals, leading its share price to jump over 11 percent.