POST-MARKET REPORT

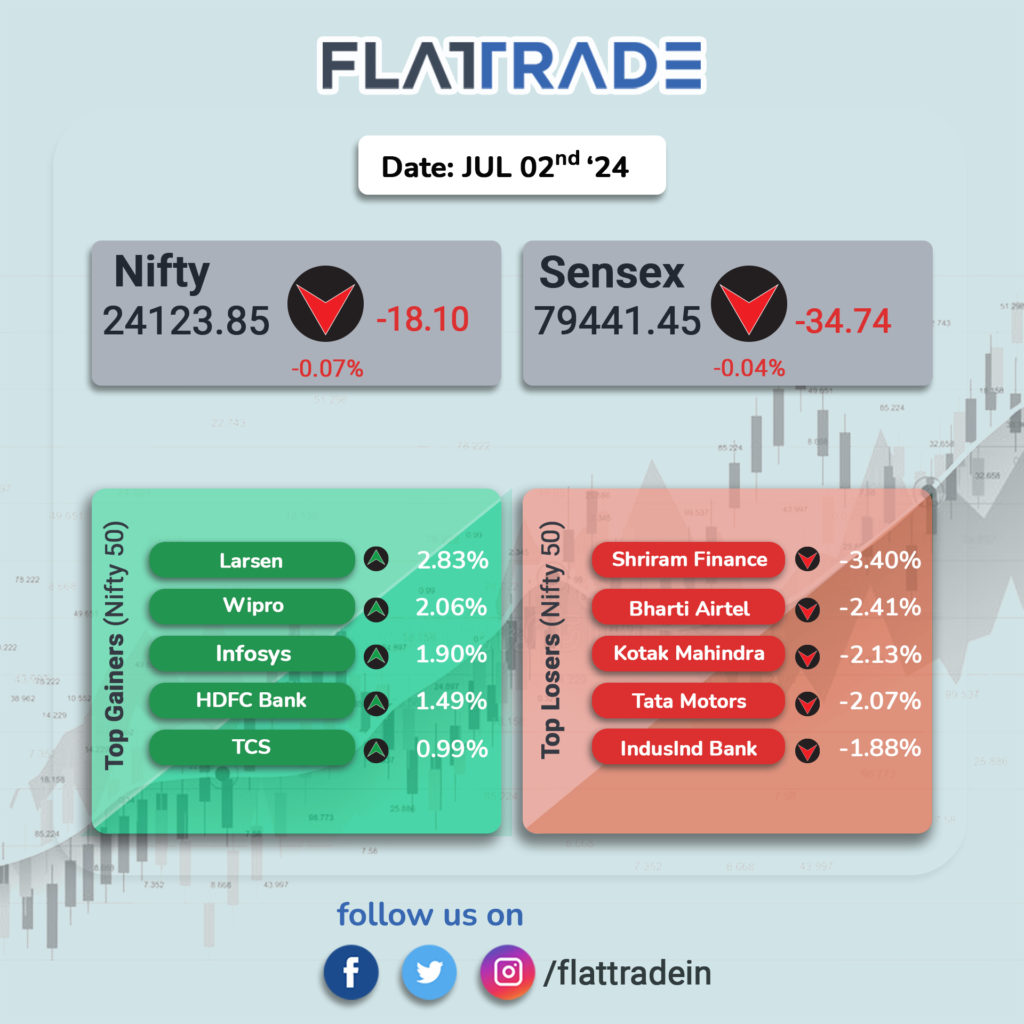

The market traded rangebound throughout the session on July 2 with Nifty crossing 24,200 for the first time. At close, the Sensex was down 34.74 points or 0.04 percent at 79,441.45, and the Nifty was down 18.2 points or 0.08 percent at 24,123.80.

BSE Sensex and Nifty50 touched record highs of 79,855.87 and 24,236.35, respectively.

Nifty Midcap 100 index touched a fresh high of 56,504.5 during the day but ended 0.8 percent lower at 55,854.7.

Top Nifty gainers were L&T, Wipro, Infosys, HDFC Bank and TCS, while losers were Shriram Finance, Bharti Airtel, Kotak Mahindra Bank, Tata Motors and IndusInd Bank.

On the sectoral front, capital goods, Information Technology, realty, and oil & gas rose 0.3-1 percent, while bank, auto, FMCG, power down 0.3-0.9 percent.

Broader indices also hit a fresh high but the BSE midcap index shed 0.5 percent, while smallcap index ended flat.

STOCKS TODAY

CSB Bank: Shares jumped around 2 percent after the lender shared a business update that showed strong growth in total deposits and gross advances for the June-ended quarter (Q1FY25). Total deposits marked a 0.6 percent increase quarter-on-quarter (QoQ) to Rs 29,920 crore, while it was up 22.2 percent year-on-year (YoY) from Rs 24,476 crore. The bank’s gross advances grew by 17.7 percent YoY to Rs 25,099 crore in Q1FY25 and 2.15 percent QoQ.

DCX Systems: Shares ended nearly 13 percent higher after hitting a 52-week high of Rs 440 intraday. This comes after the company received an order worth Rs 1,250 crore from L&T. Larsen & Toubro has awarded a contract to manufacture and supply electronic modules within 3 years.

Info Edge: Shares fell 3 percent after the company released the JobsSpeak Index for June which reflected muted hiring activity. Hiring trends were down 8 percent on month as well as on year, slipping to a six-month low. IT and software hiring was also down 5 percent on year in June.

NMDC: Shares slipped 3 percent after the iron ore company slashed lump ore prices by Rs 500 to Rs 5,950 per tonne, from Rs 6,450 per tonne, and prices of fines by Rs 500 to Rs 5,110, from Rs 5,610 per tonne. Further, the total production of iron ore fell by 3.16 percent on year to 3.37 MT and sales declined by 9 percent to 3.73 MT in June 2024.

Welspun Specialty Solutions: Shares gained over 5 percent after the company received a contract worth Rs 117.17 crore for the supply of seamless stainless steel boiler tubes for NTPC’s Talcher 2 x 660 MW supercritical thermal power project. The contract is expected to be executed by December 2024.

TD Power Systems: Shares surged around 3 percent after the company bagged an order worth $9 million from a US-based Original Equipment Manufacturer for gas turbine generators.