POST-MARKET REPORT

After witnessing a strong rebound in the previous session (Nov 19), Indian benchmark indices again came under pressure on November 21, erasing all gains from the previous session with Nifty falling below 23,300, intraday.

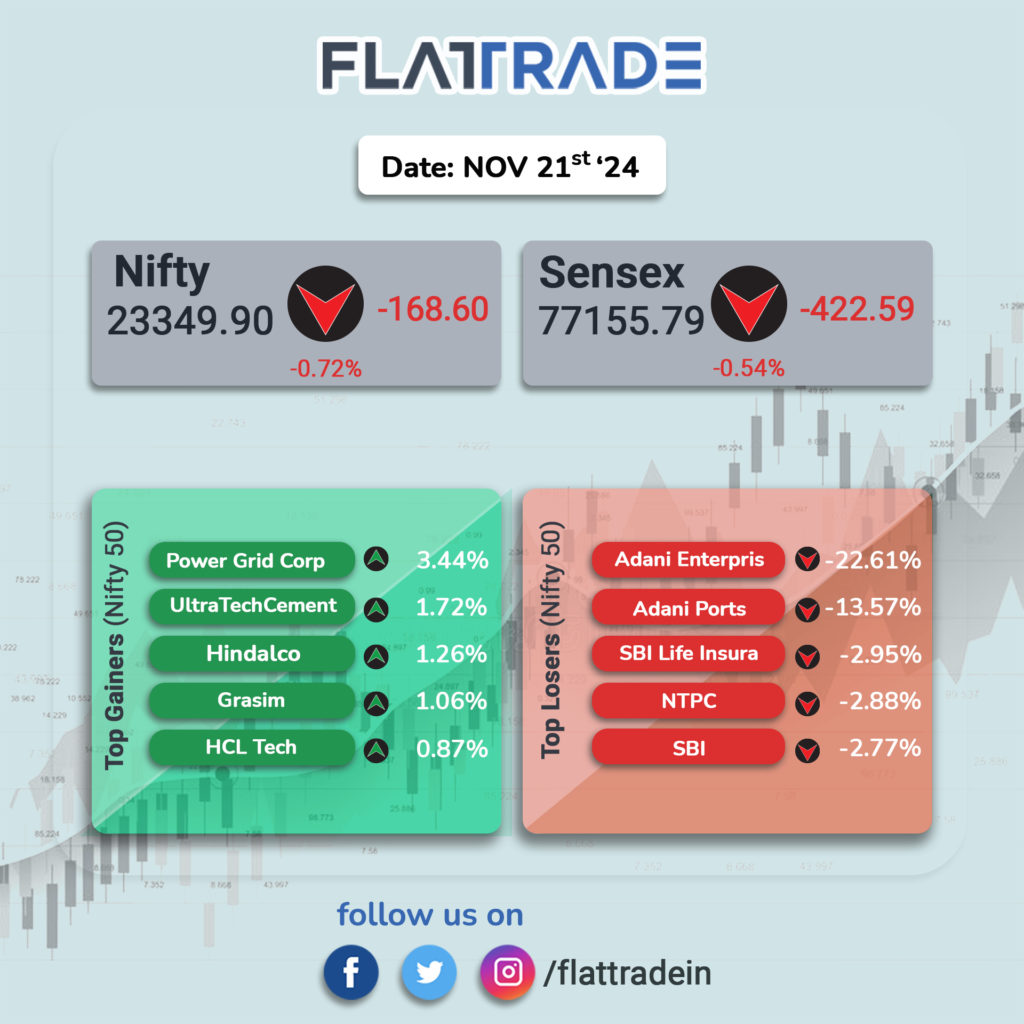

At close, the Sensex was down 422.59 points or 0.54 percent at 77,155.79, while the Nifty fell 168.60 points or 0.72 percent at 23,349.90.

The biggest Nifty losers were Adani Enterprises, Adani Ports, SBI Life Insurance, NTPC, and SBI, while gainers included Power Grid Corp, UltraTech Cement, Hindalco Industries, HCL Tech, and Grasim Industries.

On the sectoral front, Energy, FMCG, Oil & Gas, PSU Bank, Media, Auto, and Metal were down 1-2 percent, while the Realty index gained 1 percent and the Information Technology index rose 0.5 percent.

BSE Midcap index was down 0.3 percent and smallcap index fell 0.6 percent.

STOCKS TODAY

Power Grid Corporation of India: Shares gained over 3 percent after the company was selected as the successful bidder for acquiring Khavda V-A Power Transmission Ltd, a special purpose vehicle (SPV) to establish a transmission system for evacuating power from a renewable energy zone in the Khavda area of Gujarat for Rs 18.95 crore.

One97 Communications: Shares rose nearly 4 percent after international brokerage Bernstein reaffirmed its bullishness on the stock as the narrative for the beleaguered fintech player changes from survival to optimism. Bernstein hiked its target price on Paytm to Rs 1,000 per share from Rs 750 earlier.

Indian Hotels Company: Shares gained over 4 percent following the announcement of its ‘Accelerate 2030’ strategy, which focuses on increasing the revenue share from new and re-imagined businesses to over 25 percent, alongside scaling up management fees to exceed Rs 1,000 crore by FY30. Brokerage firm Jefferies also raised the target price on the stock to Rs 900.

UPL: Shares rose nearly 2 percent after the company announced an investment of $350 million by Alpha Wave Global, a leading global investment firm. The agriculture solutions provider said that it has signed a definitive agreement with the investment firm under which Alpha Wave Global will invest $350 million to acquire approximately 12.5 percent stake in Advanta Enterprises, a subsidiary of UPL and a seed company that delivers innovative farming solutions and technology to farmers around the world.

NLC India: Shares rose 8 percent after the company announced that it will invest up to Rs 3,720 crore in various renewable projects. The company will also acquire stakes in its arm NLC India Renewables by way of subscription for the transfer of renewable assets.

Adani Group Stocks: Several Adani Group shares, including those of the flagship firm Adani Enterprises, suffered massive losses and hit their lower circuits after Gautam Adani was indicted in New York over his role in an alleged multibillion-dollar bribery and fraud scheme. According to US authorities, more than $250 million in bribes were promised to Indian Government officials to secure solar energy contracts.