POST-MARKET REPORT

Benchmark indices, the Sensex and the Nifty 50 ended with losses on Friday, June 21, mirroring weak global sentiment and bogged down by public sector banks and FMCG stocks.

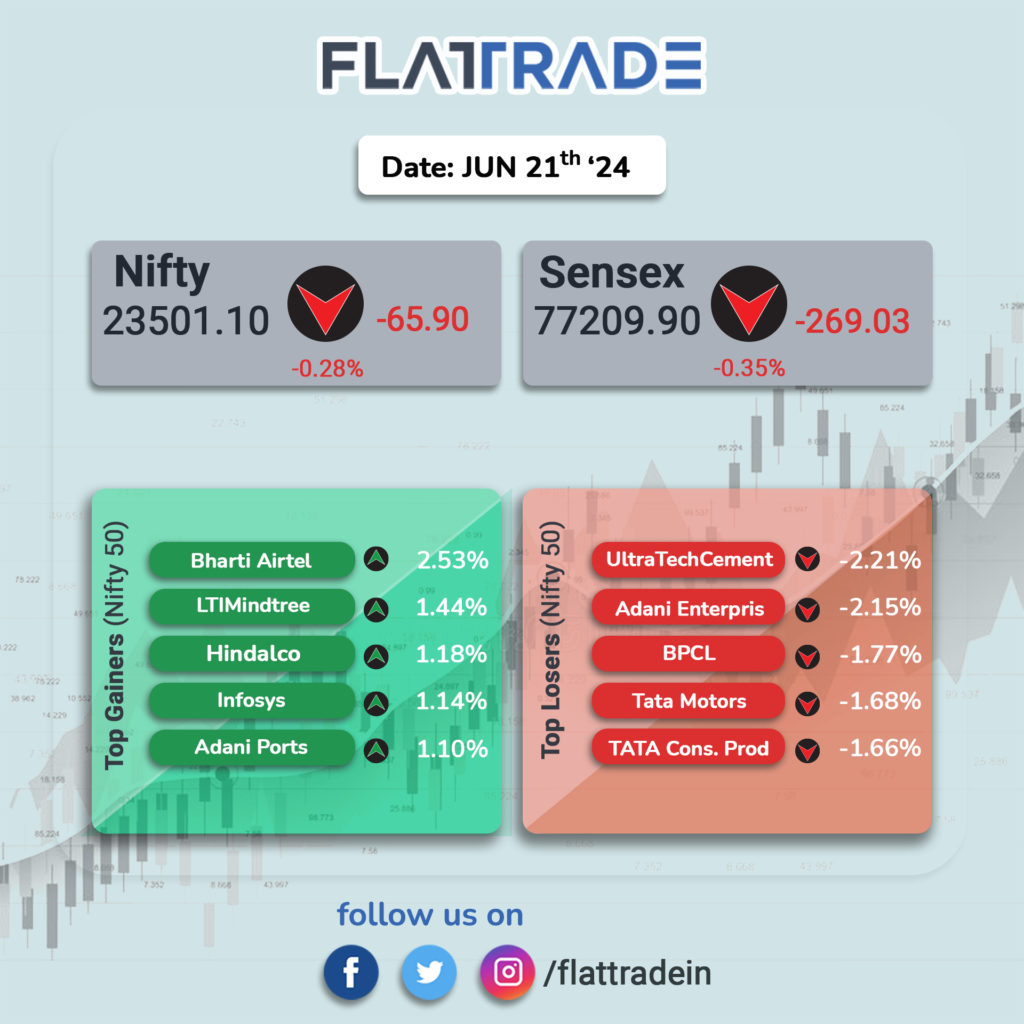

At close, Sensex was down by 269 points, or 0.35 percent, lower at 77,209.90, while the Nifty 50 closed with a loss of 66 points, or 0.28 percent, at 23,501.10.

Airtel, LTIMindtree, Hindalco, Infosys, and Adani Ports were the top gainers on Nifty. UltraTech Cement, Adani Ports, BPCL, Tata Motors, and Tata Consumer Products were the laggards.

Among the sectoral indices, Nifty Media, IT, Consumer Durables and ended in the green. while the losers were Nifty FMCG, PSU Bank, and Oil & Gas lost big. Further, the Nifty Bank index fell 0.24 percent, while the Private Bank index ended 0.15 percent lower.

Considering the broader market indices, the BSE Midcap index fell 0.26 percent, following the trend of the large caps. However, the Smallcap index ended with a nominal gain of 0.06 percent.

STOCKS TODAY

JM Financial: Shares tumbled up to 5.7 percent, a day after it was directed by the Securities and Exchange Board of India (SEBI) to refrain from accepting new mandates as a lead manager in public issues of debt securities until March 31, 2025, or until further notice from SEBI.

Welspun Specialty Solutions: Shares fell nearly 2 percent after the firm said that Gujarat Pollution Control Board (GPCB) has directed it to cease operations of its plant located at GIDC Jhagadia, Bharuch.

V-Marc India: Shares rose nearly 4 percent after the company received a letter of intent (LoI) amounting to Rs 13.72 crores from Purvanchal Vidyut Vitran Nigam Ltd (PuVVNL).

Time Technoplast: Shares rose nearly 13 percent and hit a 52-week high of Rs 335 apiece after the company received final approval for manufacturing Type-IV hydrogen composite cylinders.

Bikaji Foods International: Shares advanced 4 percent to hit a fresh 52-week high after Nuvama Institutional Equities initiated coverage with a ‘buy’ rating as it forecasts healthy long-term growth.

GE Power India: Shares surged over 6 percent after the company secured a letter of intent (LoI) for a contract valued at Rs 243.46 crore from NTPC GE Power Services Pvt Ltd (NGSL).

Sugar stocks: Shares of sugar companies drew attention with a sudden intraday increase, though they quickly retreated from their day’s highs. Expectations of positive decisions post-elections like a hike in MSP (minimal selling prices), lifting of restrictions on ethanol production, and ethanol price hikes (B-heavy and sugarcane juice ethanol) led to optimism in the sector.