POST-MARKET REPORT

After a muted start, benchmark indices Nifty and Sensex rallied on November 27 led by energy, auto, metal and, bank stocks. Adani Group stocks also staged a sharp recovery, gaining as much as 12 percent.

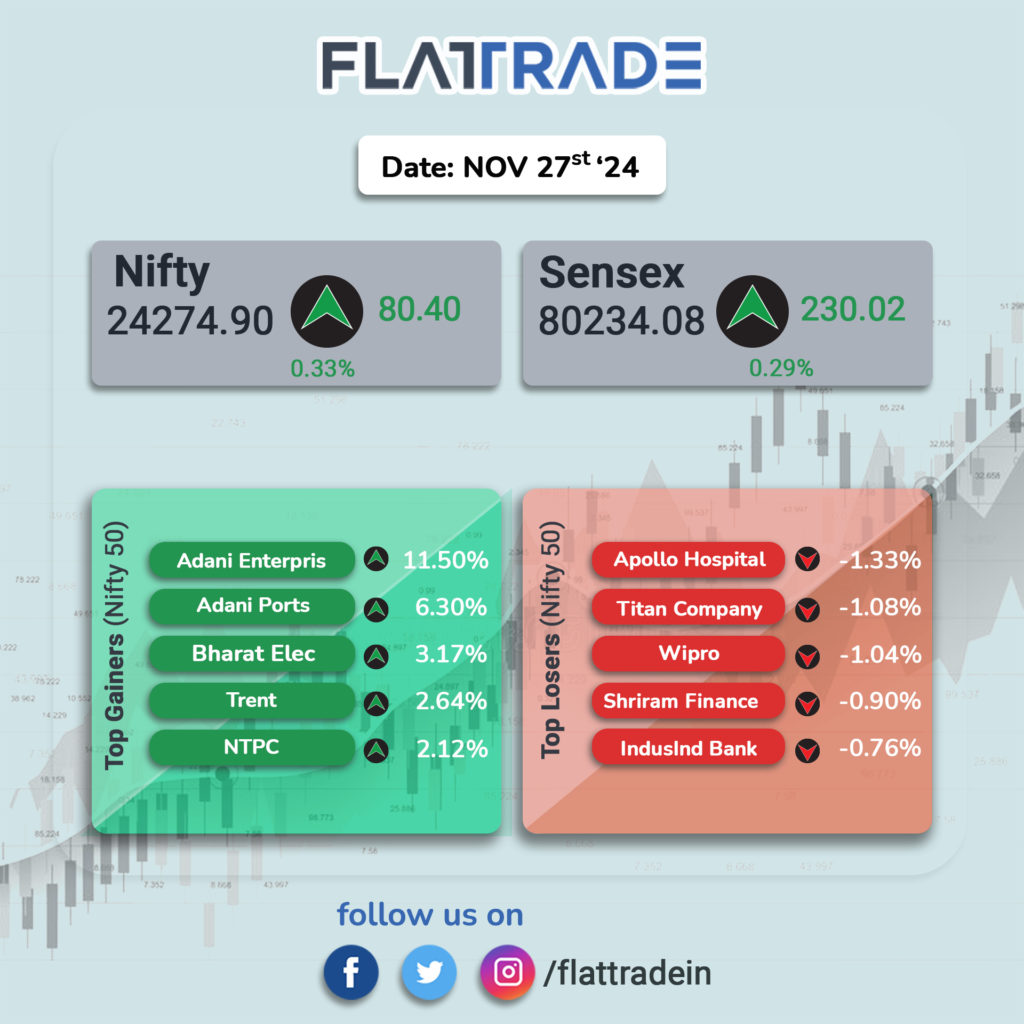

At close, the Sensex was up 230.02 points or 0.29 percent at 80,234.08, and the Nifty was up 82.20 points or 0.34 percent at 24,276.70. About 2470 shares advanced, 1302 shares declined, and 105 shares unchanged.

Among the sectoral indices, Nifty Bank, Auto, and Energy lifted the markets while the Nifty Pharma and Realty sectors were the top losers, each sliding 0.5 percent. Nifty Realty faced profit-taking following a nearly 8 percent surge last week.

Broader market indices have witnessed a sharp rally in the last four sessions, with the Nifty Smallcap 100 advancing nearly 5 percent as foreign institutional investors (FIIs) eased their selling pressure and turned marginal buyers.

On November 27, the Nifty Smallcap 100 touched an intraday high of 18,474.35, up 1.14 percent, while the Nifty climbed over half a percent to reach an intraday high of 24,341.15.

STOCKS TODAY

NTPC Green Energy: The company’s share price hit the upper circuit after a muted listing on the exchanges on November 27. The stock of the company was locked in the highest permissible trade limit for the day to hit Rs 122.65 per share on the NSE. The stock was up 13.56 percent from its IPO price of Rs 108 per share as investors bet on India’s growing clean energy needs as well as the government’s push to increase the usage of renewable energy.

CG Power: CG Power and Industrial Solutions shares rose as much as 3 percent on November 27 after the company’s arm–G.G.Tronics India, bagged an order from Chittaranjan Locomotive Works, West Bengal. The value of the order is in the range of Rs 500-600 crore, with an execution time frame of one year, the company stated in an exchange filing.

Talbros Automotive: Shares of Talbros Automotive Components skyrocketed 15 percent on November 27 after the company announced bagging multi-year orders worth around Rs 475 crore for both domestic and export markets from leading Original Equipment Manufacturers (OEMs). The surge in the stock was also triggered by a spike in trading volumes in the counter. As many as 14 lakh shares already changed hands on the exchanges, far higher than the one-month daily traded average of one lakh shares.

Netweb Technologies: Shares of Netweb Technologies jumped nearly 8 percent to hit an all-time high of Rs 3,059 apiece on November 27 amid heavy volumes. So far, around 0.5 million equity shares exchanged hands at the BSE and NSE, significantly exceeding 0.2 million equity shares on a 1-week average. So far this year, shares of Netweb Tech have surged over two-fold or 143 percent, as against a 10 percent rise in the benchmark Nifty 50 index.

Vodafone Idea: Shares of Vodafone Idea shares rose on November 27, extending their three-day rally to 17.5 percent, amid reports that the Union Cabinet may approve bank guarantee waivers for spectrum purchased before 2022. The telecom operator currently holds bank guarantee obligations of over Rs 24,700 crore, while combined liabilities with Bharti Airtel exceed Rs 30,000 crore.