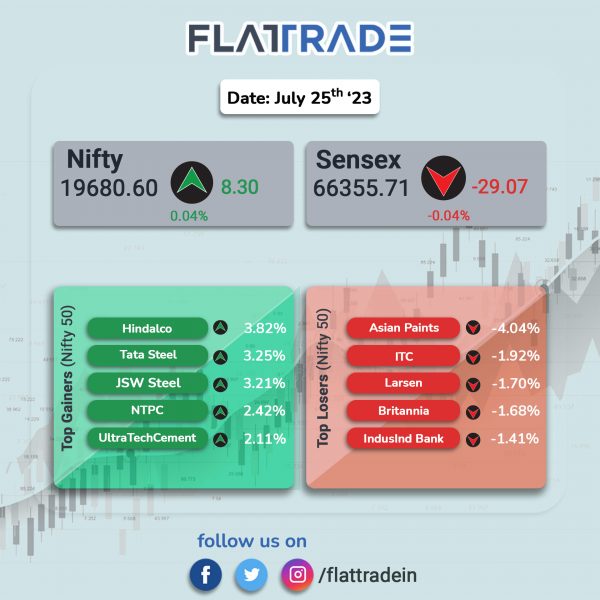

Benchmark equity indices closed flat as investors remained cautious amid high valuations and ahead of the Fed’s monetary policy meeting. The Sensex slipped 0.04% and the Nifty edged up 0.04%.

Broader markets outperformed headline indices. The Nifty Midcap 100 index rose 0.39% and the BSE Smallcap gained 0.31%.

Top gainers among Nifty sectoral indices were Metal [2.94%], Media [1.51%], Auto [0.95%], Consumer Durables [0.79%], and Oil & Gas [0.69%]. Top losers were PSU Bank [-1.46%], FMCG [-0.86%], Realty [-0.4%], IT [-0.28%], and Bank [-0.17%].

Indian rupee fell by 3 paise to 81.87 against the US dollar on Tuesday.

Stock in News Today

Asian Paints: The company has reported a 52% year-on-year rise in consolidated net profit at Rs 1,574.84 crore in the first quarter ended June 2023, as against Rs 1,036.03 crore in the corresponding quarter last year. The company’s consolidated revenue from operations during Q1FY24 rose 6.6% to Rs 9,182.31 crore from Rs 8,606.94 crore in the year-ago period. Ebitda increased 28.1% to Rs 2,121.2 crore from Rs 1.566 crore in the year-ago quarter.

Bajaj Auto: The two-wheeler manufacturer posted a 42% rise in profit after tax (PAT) at Rs 1,665 crore in the quarter ended June 30, 2023, as against Rs 1,173 crore registered in the year-ago period. Its revenue from operations jumped 29% to Rs 10,310 crore in the June quarter, compared with Rs 8,005 crore in the same quarter of last year. Its Ebitda for the quarter under review was up 51% year over year at Rs 1,954 crore, while margins of 19% were up 280 basis points. The rise in net profit was attributed to favourable product mix, healthy volumes and an increase in the average selling price (ASP) of motorcycles.

Suzlon Energy: Shares of the company tumbled 5% after the company’s consolidated net profit tanked 95.85% to Rs 100.90 crore in Q1FY24 compared with Rs 2,433.33 crore posted in Q1FY23. Revenue from operations declined 2.18% YoY to Rs 1,347.52 crore in the quarter ended 30 June 2023. During the quarter, EBITDA stood at Rs 207 crore as against Rs 185 crore posted in corresponding quarter last year. Net debt stood at Rs 1,223 crore as on 30 June 2023 as against Rs 1,180 as of 31 March 2023.

Larsen & Toubro (L&T): The infrastructure company said that its power transmission & distribution business has secured new ‘significant’ orders in India and abroad. As per L&T’s classification, the value of the said contract lies between Rs 1,000 crore and Rs 2,500 crore.

The business has won an order to implement SCADA/DMS and related IT infrastructure for urban area power distribution systems in central Gujarat. Another order has been secured to build a 400kV double circuit transmission line in Jharkhand. It has also received an order for construction of a ±525kV high voltage direct current (HVDC) transmission segment in western Saudi Arabia. In the Sarawak region of Malaysia, the business has also bagged an order, in a consortium, to establish a 275kV substation.

KPIT Technologies: The company’s net profit was up 20% at Rs 133.9 crore in Q1FY24 as against Rs 111.6 crore in the prior quarter. Revenue rose 7.9% to Rs 1,097.6 crore in Q1FY24 as against Rs 1,017.3 crore in Q4Fy23. Ebitda was up 17.4% QoQ at Rs 213.9 crore in Q1FY24 compared with Rs 182.2 crore in the preceding quarter.

SpiceJet: The aviation regulator Directorate General of Civil Aviation (DGCA) has removed the airline from the enhanced surveillance regime, according to media reports. The DGCA had conducted 51 checks in 11 places in India on the airline’s fleet, which includes Boeing 737 and Bombardier DHC Q-400 aeroplanes.

Indoco Remedies: The company’s net profit fell 37.3% to Rs 24.2 crore in Q1FY24 as against Rs 38.6 crore in Q1FY23. Revenue rose 5.5% to Rs 416.8 crore in Q1FY24 as against Rs 395.2 crore in Q1FY23. EBITDA dropped by 12% to Rs 51.4 crore in the reported quarter from Rs 58.4 crore in the year-ago period.

Jyothy Labs: The company said its net profit stood at Rs 96.3 crore in Q1FY24 as against Rs 47 crore in Q1FY23. Its revenue rose 15.1% YoY at Rs 687.1 crore in Q1FY24 as against Rs 597.2 crore in Q1FY23. Ebitda was up 96.3% at Rs 117.4 crore in Q1FY24 as against Rs 59.8 crore in Q1FY23.

IRCON International: The company said that it has bagged a contract worth Rs 80 crore for composite work at Exchange Yard of Bondamunda, South Eastern Railway. The company said that it has been awarded the composite works involving construction of industrial shop with pre-engineered building (PEB), water supply system, drainage system, electrification and illumination works, associated telecom works and supplying & commissioning of specified mechanical machineries (EOT cranes etc.). The entire work shall be completed within 18 months from the date of issue of Letter of Acceptance.

Aurobindo Pharma: The drug maker announced that its wholly owned subsidiary, Eugia Pharma Specialities, has received a final approval from the USFDA to manufacture and market Plerixafor injection. The approved product has an estimated market size of around $210 million for the twelve months ending May 2023, according to IQVIA.

Aurionpro Solutions: The company has reported a total income of Rs 201.58 crore during the period ended June 30, 2023, compared to Rs 146.38 crore during the period ended June 30, 2022. The company has posted a net profit of Rs 31.80 crore for the period ended June 30, 2023, as against a net profit of Rs 23.54 crore for the period ended June 30, 2022. The company reported a diluted EPS of Rs 13.64 for the period ended June 30, 2023, compared to Rs 10.32 for the period ended June 30, 2022.

BCL Industries: The company said in an exchange filing that Food Corporation of India (FCI) has suspended supplies of surplus rice for the purpose of production of ethanol. The company said it awaited a policy from FCI regarding the resumption of supplies. The company continues to produce ENA from broken rice and maize in both Punjab and West Bengal units. The company is also able to produce ethanol in Bathinda from FCI rice that it had bought prior to the suspension but expects a temporary disruption in the production of ethanol.