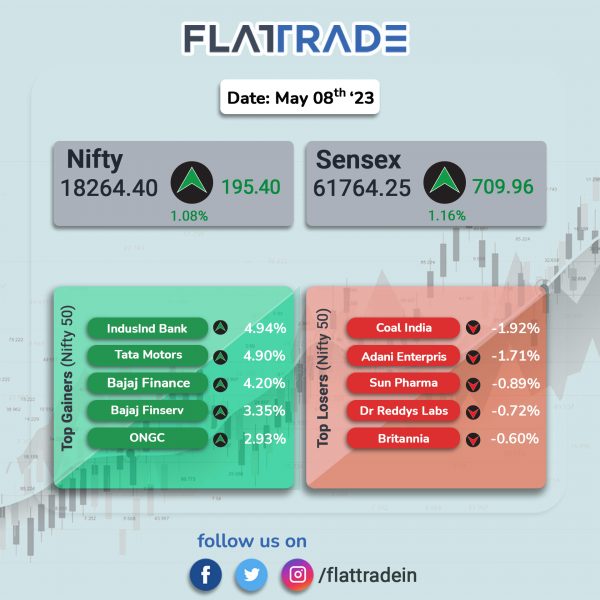

Benchmark equity indices closed higher, aided by foreign inflows and gains in private bank and auto stocks. The Sensex jumped 1.16% and the Nifty rose 1.08%.

In broader markets, the Nifty Midcap 100 index advanced 1.02% and the BSE Smallcap was up 0.56%.

Top gainers among nifty sectoral indices were Auto [1.79%], Private Bank [1.7%], Realty [1.64%], Financial Services [1.47%], and Bank [1.46%]. Top losers were PSU Bank [-0.93%] and Media [-0.6%].

Indian rupee closed at 81.7950 against the US dollar on Monday.

Stock in News Today

UPL: The company reported a 42.57% decline in net profit at Rs 792 crore in Q4FY23 as against Rs 1,379 crore in Q4FY22. Revenue from operations rose 4.46% YoY to Rs 16,569 crore in the quarter ended March 2023, despite rapid decline in product prices and delays in planting season that resulted in headwinds for product placements. Ebitda dropped 16% to Rs 3,033 crore in Q4FY23 as against Rs 3,591 crore reported in Q4FY22. For FY23, the company’s consolidated net profit rose marginally to Rs 3,570 crore from Rs 3,626 crore registered in FY22. Revenue jumped 15.87% YoY to Rs 53,576 crore in FY23.

Computer Age Management Services (CAMS): The company reported a marginal increase in net profit at Rs 74.61 crore in Q4FY23 from Rs 73.84 crore recorded in Q4FY22. Revenue from operations rose 2.5% to Rs 249.24 crore in Q4FY23 as against Rs 243.18 crore reported in the same period last year. Average assets under management (AAUM) stood at Rs 28 lakh crore in Q4FY23, up 5.1% YoY. On a full year basis, the company’s consolidated net profit fell marginally to Rs 285.25 crore in FY23 from Rs 286.95 crore recorded in FY22. Revenue grew by 6.8% YoY to Rs 971.83 crore during the financial year ended March 2023.

JSW Energy: The company’s wholly owned step-down subsidiary, JSW Renew Energy Three, signed power purchase agreement (PPA) with Solar Energy Corporation of India (SECI) for 300 megawatt (MW) ISTS connected wind power project. Under the agreement, the company will supply power for a period of 25 years with a tariff of Rs 2.94/Kilowatt hour (KWh). The project is located in Maharashtra and is expected to be commissioned in next 24 months. In addition, the company has forayed into energy storage space and has currently locked in 3.4 GWh of energy storage capacity by means of battery energy storage system and hydro pumped storage project.

Happiest Minds: The company’s revenue was up 3.1 % QoQ to Rs 377.98 crore in Q4FY23. Ebit was flat at Rs 79.23 crore in the reported quarter as against Rs 79.54 crore in the preceding quarter. Its net profit was up marginally by 0.13% QoQ to Rs 57.66 crore in the quarter under review. The company has declared a dividend of Rs 3.4 per share.

Indian Bank: The lender’s standalone net profit jumped 47% YoY to Rs 1,447.3 crore in Q4FY23. It net interest income rose 29.4% YoY to Rs 5,508.3 crore and total income rose 24.84% YoY to Rs 14,238.29 crore in the reported quarter. Net NPA stood at 0.90% in the quarter under review as against 1% in the preceding quarter. Deposits stood at Rs 1179219 crore, up 8.5% YoY and advances stood at Rs 862782 crore, up 16.4% YoY. CASA ratio stood at 33.5% in Q4FY23 as against 35.9% Q4FY22.

Exide: The battery manufacturer recorded a net income of Rs 3712.88 crore, up by 4.84% YoY from Rs 3541.44 crore during Q4FY22. Its net profit for the quarter ended March 2023 was Rs 180.12 crore, down by 95.45% YoY from Rs 3959.24 Cr in the quarter ended March 2022. The board has recommended a final dividend of Rs. 2.00 per equity share of face value of Re. 1/- each fully paid up for the financial year 2023, subject to the approval of the shareholders.

Aether Industries: The specialty chemicals manufacturer reported 44.4% surge in consolidated net profit to Rs 37.56 crore and 24.6% increase in revenue from operations to Rs 183.78 crore in Q4FY23 over Q4FY22. Ebitda jumped 42.3% YoY to Rs 60.2 crore in the quarter ended March 2023. On full year basis, the company’s consolidated net profit rose 19.7% to Rs 130.42 crore on 10.3% increase in net sales to Rs 651.07 crore in FY23 over FY22. Exports outside of India accounted for 41% of the total revenue from operations for FY23.

Meanwhile, the company’s board has approved raising of funds up to Rs 750 crore through issuance of equity shares or any other equity linked instruments or securities including convertible preference shares, and / or bonds including foreign currency convertible bonds / debentures / non-convertible debt instruments along with warrants / convertible debentures / securities and / or any other equity based instruments.

Pennar Industries: The company said the Group has secured orders worth Rs 682 crore across its various business verticals. The Pennar Group consists of Pennar Industries, Saven Technologies and Pennar Engineered Building Systems. The orders are expected to be executed within the next two quarters, the company stated.

Capacite Infraprojects: The civil construction company received order from Raymond (Realty division) worth Rs 224 crore for residential project – TenX Era at Thane. Meanwhile, on Saturday 6 May 2023, the company announced that it received an order worth Rs 474.08 crore from Godrej Group (Godrej Group Residency) for construction of residential towers at Mahalaxmi, Mumbai.

Ajanta Pharma: The company’s net profit slumped 19.15% YoY to Rs 122.25 crore in Q4FY23 as compared with Rs 151.21 crore in Q4FY22. Revenue from operations increased marginally to Rs 881.84 crore in Q4FY23 as against Rs 870.29 crore recorded in same quarter last year. Ebitda stood at Rs 149 crore in Q4 FY23, down 17% as against Rs 207 crore posted in corresponding quarter last year. On the fiscal 2023, the company’s net profit declined 17.5% to Rs 587.98 crore despite of 12% jump in revenue from operations to Rs 3,742.64 crore in FY23 over FY22.

Zen Technologies: Shares jumped over 13% in intraday trade after the aerospace company reported a net profit of Rs 20.20 crore in Q4FY23 from Rs 3.31 crore in Q4FY22. Revenue from operations rose multi-fold to Rs 95.88 crore in the quarter ended March 2023 as against Rs 27.78 crore in the same quarter last year. As on 31 March 2023, the company’s total order book stood at Rs 472.82 crore.

Astra Microwave: The company raised Rs 275 crore through a qualified institutional placement issue and the indicative price of the QIP issue was Rs 270 per share. The company allotted 83.33 lakh shares of face value of Rs 2 each to the eligible qualified institutional buyers. After concluding the QIP, the paid-up equity share capital of the company stands increased to Rs 18.98 crore from Rs 17.32 crore.

APAR Industries: The company reported a consolidated net profit of Rs 242.73 crore in Q4FY23, up 193.83% from Rs 82.61 crore recorded in Q4FY22. Revenue from operations increased 35.72% YoY to Rs 4,088.58 crore in the quarter ended March 2023. Ebidta during the quarter stood at Rs 445 crore, 146% YoY jump. Its order book at the end of Q4FY23 stood at Rs 5,124 crore. For the full financial year 2023, its consolidated net profit surged 148.4% to Rs 637.72 crore on 54.05% jump in revenue from operations to Rs 14,352.15 crore over FY22.