Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.07% higher at 17,771, signalling that Dalal Street was headed for a flat-to-positive start on Tuesday.

Asian shares were mixed as investors gauged corporate earnings estimates and economic growth outlook. The Nikkei 225 index rose 0.39% and the Topix was up 0.56%. The Hang Seng fell 1.68% and the CSI 300 index dropped 0.81%.

Indian rupee rose 18 paise to 81.90 against the US dollar on Monday.

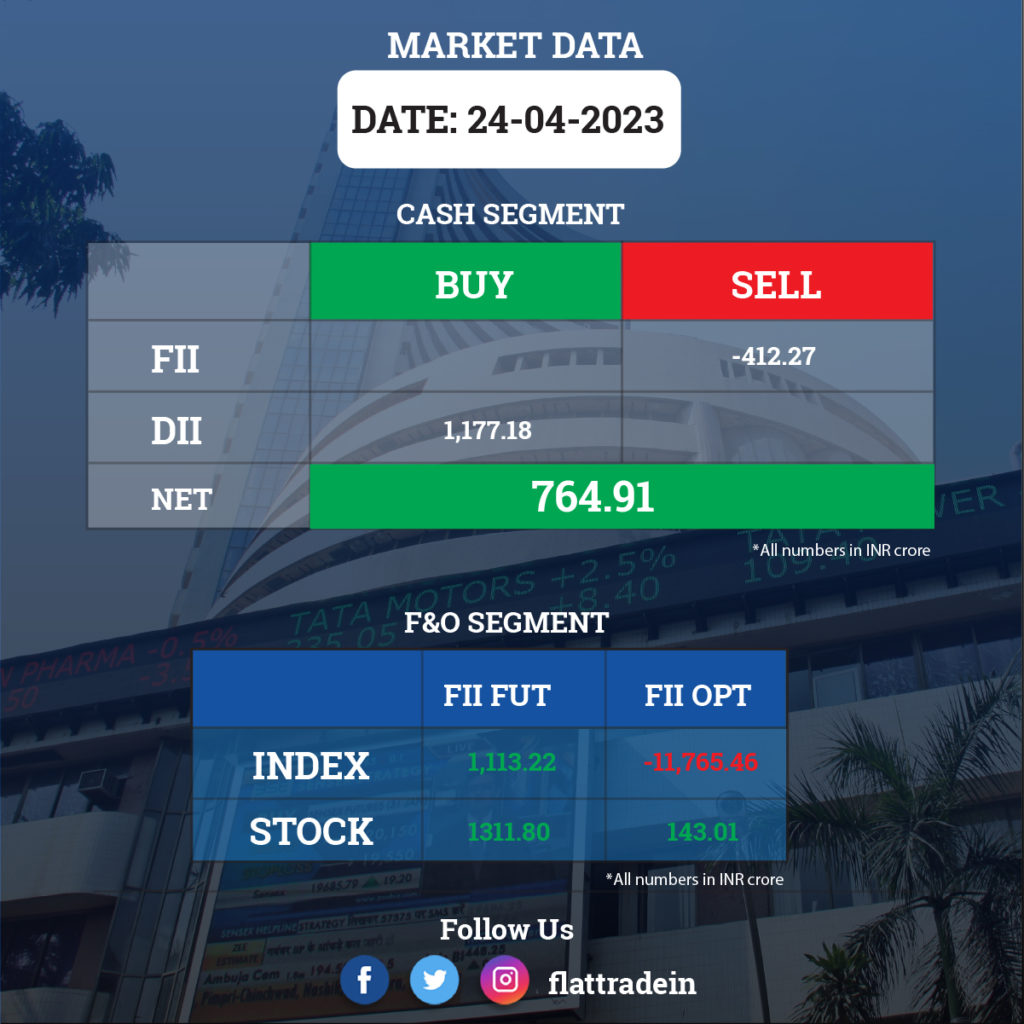

FII/DII Trading Data

Upcoming Results

Bajaj Auto, Nestle India, Tata Consumer Products, AU Small Finance Bank, Tata Steel Long Products, Mahindra CIE Automotive, Mahindra Holidays & Resorts India, Nippon Life India Asset Management, Dalmia Bharat, HDFC Asset Management Company, Mahindra Lifespace Developers, Anant Raj, Axita Cotton, Dhampur Bio Organics, Elecon Engineering, Huhtamaki India, Lloyds Metals and Energy, Meghmani Finechem, Rallis India, VST Industries will report quarterly earnings today.

Stocks in News Today

Ipca Laboratories: The pharmaceutical company is going to acquire a 33.38% stake in Unichem Laboratories, from one of its promoter shareholders at a price of Rs 440 per equity share, amounting to Rs 1,034.06 crore. This proposed acquisition is subject to the approval of the Competition Commission of India. The company has also received board approval for making an open offer to the public shareholders of Unichem Laboratories to acquire up to 26% stake at the same price, amounting to Rs 805.44 crore.

Infosys: The IT services company has signed a Memorandum of Understanding (MoU) with energy and chemicals company Aramco, to collaborate on accelerating their human resource (HR) technology. Infosys aims to leverage AI to further bolster Aramco’s employee learning and development experiences and reduce skill gaps.

HDFC Bank: Monetary Authority of Singapore (MAS) has granted approval for the acquisition of shares in Griha Pte. by HDFC Bank due to the proposed amalgamation. As a result, HDFC Bank will acquire a 20 percent or more stake in Griha Pte. The proposed amalgamation is subject to receipt of final approvals from SEBI in respect of the change in control of certain subsidiaries of HDFC.

Nelco: Consolidated revenue was up 14.35% YoY at Rs 81.98 crore in Q4FY23. Consolidated net profit up 86.8% at Rs 5.66 crore in Q4FY23. Ebitda rose 25.48% to Rs 26.84 crore in Q4FY23. Ebitda margin stood at 32.74% in Q4FY23 as against 29.84% in the eyar-ago period. The board recommended a dividend of Rs 2 per share for the financial year 2023.

IIFL Securities: Consolidated revenue rose 15.9% YoY to Rs 401.9 crore in Q4FY23. Consolidated net profit was up 9.36% YoY at Rs 86.34 crore in Q4FY23. Ebitda rose 21.13% to Rs 151.77 crore in the reprotd quarter. Ebitda margin stood at 37.76% in the reported quarter as against 36.13% in the year-ago period. The board approved raising up to Rs 500 crore via non-convertible debentures on private placement basis. The board also approved appointment of Shanker Ramrakhiani as Chief Information Security Officer, effective May 1, 2023.

Mahindra Lifespace Developers: Mahindra Group-owned real estate and infrastructure development subsidiary has bagged another society redevelopment project in Mumbai. The project will offer Mahindra Lifespaces a revenue potential of around Rs 850 crore.

Crompton Greaves Consumer Electricals: The company has appointed and elevated Shantanu Khosla as the Executive Vice Chairman for one year from May 1, 2023, and thereafter he will be Non-Executive Vice-Chairman till December 31, 2025. Mathew Job has resigned as CEO and Executive Director of the company to pursue other career interests. The board has appointed Promeet Ghosh as the company’s new MD & CEO effective May 1, 2023.

IndusInd Bank: The private sector lender said the Board of Directors has decided to seek approval of shareholders for the re-appointment of Sumant Kathpalia as a Managing Director and Chief Executive Officer (MD & CEO) of the bank for two years with effect from March 24.

Welspun India: The textile company said its board will meet on April 27 to consider the buyback of equity shares of the company and dividend for FY23. The company will also announce financial results for the quarter and year ended March 31, 2023, on the same day.

L&T Technology Services: Life Insurance Corporation of India increased its shareholding in the company to 5.01% from 4.99%.

New India Assurance Company: The finance ministry appointed Smita Srivastava as general manager and director of the company, with effect from April 24, 2023.

360 ONE WAM: The company’s wholly owned subsidiary, 360 ONE Portfolio Managers, has received the approval of International Financial Services Centres Authority to act as non-retail, fund management entity. The 360 ONE unit will now be able to undertake fund management, portfolio management services, etc. at IFSC GIFT CITY.

Torrent Pharmaceuticals: The company redeemed non-convertible debentures of Rs 145 crore out of the total NCDs of 195 crores issued and repaid on April 24.

Choice International: The Choice Group announced plans to launch operations in 10 locations across North India in the first half of 2024 fiscal.

Century Textiles and Industries: The company said its consolidated revenue was down 0.18% YoY at Rs 1,208.54 crore in Q4FY23. Net profit rose 68.78% YoY to Rs 145.27 crore in Q4FY23. The company received net gain of Rs 134.21 crore as exceptional item during the quarter. Ebitda fell 3.63% YoY at Rs 61.58 crore in the reported quarter. Ebitda margin stood at 5.1% in Q4FY23 as against 5.28% in the eyar-ago period. The company’s board recommended a dividend of Rs 5 per share for the FY23.

Mahindra Logistics: Consolidated revenues was up 16.9% YoY at Rs 1,272.51 crore in Q4FY23. Consolidated net profit fell 96.82% to Rs 0.2 crore in Q4FY23. Ebitda was up 23.85% at Rs 63.72 crore in Q4FY23. Ebitda margin stood at 5.01% Q4FY23 as agaisnt 4.73% in the year-ago period.