Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.86% lower at 17,700, signalling that Dalal Street is likely to open significantly lower on Wednesday.

Asian shares were trading mixed after hawkish comments from Federal Reserve Chair Jerome Powell to curb sticky inflation dampened investor sentiments. The Nikkei 225 index was upp 0.19% and the Topix was up 0.06%. The CSI 300 index fell 0.44% and the Hang Seng index tanked 2.31%.

Indian rupee strengthened by 5 paise to 81.91 against the US dollar on Monday.

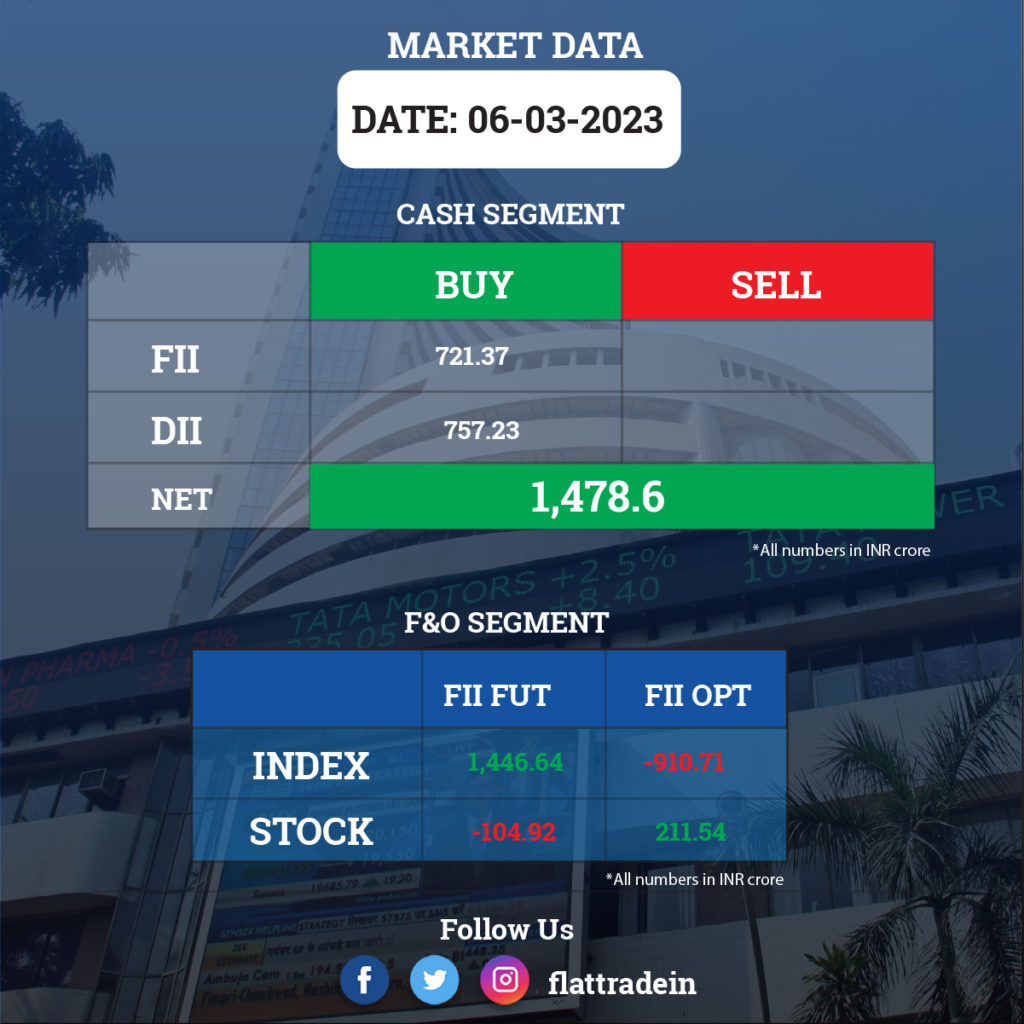

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The company has tapped a top executive from McLaren Strategic Ventures as chief executive officer for its newly created financial services unit that is preparing for a listing in India, Bloomberg reported citing people familiar with the matter. Hitesh Sethia is due to join Jio Financial Services as its CEO and managing director, said the sources.

Sun Pharmaceutical Industries: The company has completed the acquisition of biopharmaceutical company Concert Pharmaceuticals. Concert is developing deuruxolitinib, which is a novel, deuterated, oral JAK1/2 inhibitor for treatment of adult patients with moderate to severe alopecia areata.

Power Grid Corporation of India: The company has received its board approval for over Rs 4,000 crore investment in two projects. The company has received board approval for investment of Rs 524 crore for Eastern Region Expansion Scheme-XXIX scheduled to be commissioned by November 2025, and Rs 3,546.94 crore related to transmission system for Kurnool Wind Energy Zone/Solar Energy Zone (AP) scheduled to be commissioned by November 2024.

ZEE Entertainment Enterprises Ltd (ZEEL): The broadcaster said that it has “mutually” settled disputes with the Indian Performing Rights Society (IPRS) and the insolvency petition filed against ZEEL by the latter has been withdrawn before NCLAT. “There is no penalty paid and no material impact on the financial position of the Company,” the company added.

Jindal Stainless Ltd (JSL): The company said that it will invest Rs 120 crore to set up rooftop solar capacities at its Jajpur and Hisar facilities. While a project of 21 megawatt peak (MWp) will be set up in Jajpur, another 6 MWp rooftop solar capacity will be installed at company’s unit in Hisar, JSL said. The two rooftop solar plants will be generating about 795 million units of electricity, with a carbon abatement potential of 5,64,450 tonnes in a span of 25 years. Both the projects are scheduled to be completed by March 2024 and the energy generated will be for captive usage.

Oil companies: The government, in the latest review, has hiked the windfall profit tax levied on crude petroleum to Rs 4,400 per tonne from Rs 4,350. The special additional excise duty on diesel has been reduced to Rs 0.5 a litre from Rs 2.5, while it has been slashed to ‘nil’ on Aviation Turbine Fuel. The new tax rates come into effect from 4 March 2023.

Jet Airways: The Jalan-Kalrock consortium is in talks with aircraft OEMs to order 200 aircraft, Mint reported. The development has come in the wake of the National Company Law Appellate Tribunal (NCLAT) decision, in which it declined to halt the ownership transfer as requested by the lenders, the report said. The official announcement of the order may come around June, people familiar with the matter said.

LTI Mindtree: The IT services company announced the inauguration of a new delivery center in Krakow, Poland, as part of its strategy to expand presence in Eastern Europe. This 500-seater, state-of-the-art center at Ocean Office Park – Krakow, will support the company’s capabilities in the region and bring LTI Mindtree’s world-class services closer to its customers in the travel, transportation, and hospitality industries.

Allcargo Logistics: The company has acquired the remaining 38.87% stake from its partner at an enterprise value of Rs. 373 crore. With the acquisition, Allcargo Logistics will take its stake to 100% in the contract logistics business. The acquisition price is based on the agreement that wassigned with ACCI JV partners in 2016.

Separately, the company’s board has declared an interim dividend of Rs 3.25 per equity share having a face value of Rs 2 per share. The interim dividend will be paid to all the shareholders of the company on or after March 16 (Thursday). The record date will be March 15, 2023.

One97 Communications Limited (Paytm): During the Andhra Pradesh Global Investors Summit 2023, the company said that it has signed an MoU with the state government in the areas of industrial development, financial Inclusion, public health, cyber security and prevention of financial frauds.

Indraprastha Gas: The company has signed joint venture agreement with Genesis Gas Solutions, a subsidiary of Vikas Lifecare, to set up India’s smart meter manufacturing plant with capital expenditure of Rs 110 crore. Initially, this plant will have installed capacity to manufacture 1 million meters annually, and is planned to be operational by April 2024.

Ajanta Pharma: The meeting of the company’s board of directors is scheduled be held on March 10 to consider the proposal for buyback of the equity shares.

KPI Green Energy: The company has signed a 20-year Hybrid Power Purchase Agreement (PPA) for 1.845 MWAC capacity with Garrison Engineer-based in Jamnagar under its independent power producer segment.

NBCC India: The company has received three construction and development projects worth Rs 541 crore including development of new industrial estate in union territory of Jammu & Kashmir worth Rs 217.27 crore, and construction of Institute of Chemical Technology in Bhubaneswar worth Rs 300 crore.

Lumax Auto Technologies: The company has received its board approval for investment of up to Rs 225 crore in subsidiary Lumax Integrated Ventures, and extension of corporate guarantee in favour of Kotak Mahindra Investments for securing credit facilities or debt of up to Rs 250 crore to be availed by Lumax Integrated Ventures.

G R Infraprojects: The company announced the receipt of provisional completion certificate for the project — four laning of Aligarh-Kanpur section of NH-91 in Uttar Pradesh on hybrid annuity mode under Bharatmala Pariyojana executed by GR Aligarh Kanpur Highway, a wholly-owned subsidiary of the company. The project has been declared fit for entry into commercial operation with effect from 24 February 2023.

Artson Engineering: The company has received purchase order for Rs 14.49 crore for supply of pressure vessels from Tata Projects. The contract is expected to be completed within 10 months.

LGB Forge: The company’s Chief Executive Officer, A Kamal Basha, has resigned due to personal reasons. The board has accepted his resignation and he has been relieved from his services from March 6.

RBL Bank: The private sector lender has elevated and appoined Deepak Ruiya as Deputy Chief Financial Officer, after untimely demise of Amrut Palan who had been serving as a Chief Financial Officer. Ruiya who held the position of Head-Financial Control, has been associated with the bank for the past 8 years.

Jaypee Infratech: National Company Law Tribunal (NCLT) has approved the resolution plan of Suraksha Reality, and Lakshdeep Investments and Finance (resolution applicants) for Jaypee Infratech. The NCLT also passed an order for reconciliation of amount of Rs 750 crore deposited by Jaiprakash Associates.

Coffee Day: The securities and appellate tribunal (SAT) has granted a stay on the imposition of penalty of Rs 26 crore by Sebi.

Ashoka Buildcon: The infrastructure company has received an order from North Bihar Power Distribution Company (NBPDCL) and the accepted contract value for the project is Rs 366 crore.