Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.25% higher at 17,679.50, signalling that Dalal Street was headed for a positive start on Thursday.

Asia Pacific shares were mixed after the minutes of the recent Fed’s monetary policy meeting showed that the US central bank members want to increase interest rates to curb inflation. The S&P/ASX 200 were trading 0.35% down. China’s CSI 300 index was up 0.12%, the Shanghai Composite index was 0.11% higher and the Hang Seng climbed 0.63%. Japanese markets will be closed on Thursday for the Emperor’s birthday.

Indian rupee weakened by 6 paise to 82.85 against the US dollar on Wednesday.

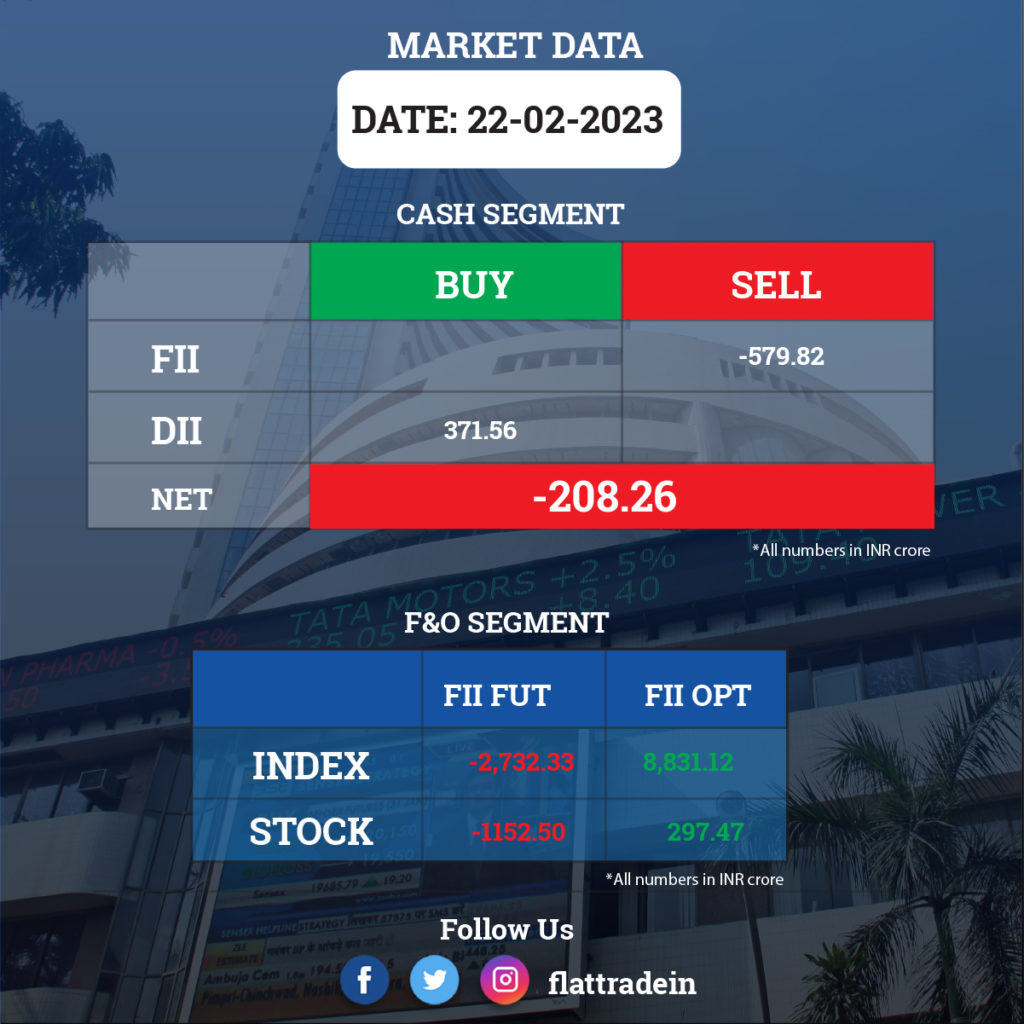

FII/DII Trading Data

Stocks in News Today

Mahindra CIE Automotive: The automotive components supplier has recorded a massive 153% year-on-year growth in consolidated profit at Rs 195 crore for the quarter ended December 2022. Consolidated revenue for the quarter at Rs 2,247 crore grew by 35% over a year-ago period. On the operating front, EBITDA increased by 62.2% YoY to Rs 292.4 crore with a margin expansion of 221 bps for the quarter. The company has an exceptional gain of Rs 37.87 crore in the reported quater against a loss of Rs 12.8 crore in the year-ago period.

ZEE and IndusInd Bank: The National Company Law Tribunal (NCLT) on Wednesday admitted an insolvency petition filed against Zee Entertainment Enterprises Limited (ZEEL) filed by the IndusInd Bank after the company failed to repay Rs 83 crore under a debt service reserve account agreement (DSRA) to the bank. ZEE is currently undergoing a merger with the Sony India which is pending with the regulatory authorities and the court.

Adani Green Energy: Sri Lanka’s Board of Investment approved two wind power plants by Adani Green Energy Ltd with a total investment of $442 million, according to a statement issued by the board, Reuters reported. “The two wind power plants of 350 MW are scheduled to be commissioned in two years and accordingly, they will be added to the national grid by 2025,” the statement added.

Orient Cement: Orient Cement has terminated its Memorandum of Understanding (MoU) with Adani Power on Wednesday to set up a cement grinding unit in Maharashtra. Adani Power Maharashtra (APML) has requested the company not to pursue the venture further, for setting up a cement grinding unit, as they are unable to obtain the required MIDC clearances for sub-leasing the parcel of land required for the cement grinding unit, due to legal issues.

Also, the timelines as agreed upon as per the Memorandum of Understanding (MoU) have crossed. The company has accepted the position of APML and accordingly, the said non-binding MoU stands terminated. In September 2021, the CK Birla Group company has entered into a non-binding MoU with APML for exploring the possibility of establishing a cement grinding unit at Tiroda in Maharashtra.

Tata Steel: The company has acquired 4.69 crore shares of its indirect subsidiary Neelachal Ispat Nigam at Rs 64 apiece, aggregating to Rs 300 crore in the first tranche of investment.

Hero MotoCorp: The two-wheeler maker has initiated operations of its public charging infrastructure in Bengaluru, Delhi and Jaipur. Vida, powered by Hero, has set up nearly 300 charging points at 50 locations across the three cities for public use.

Wipro: Wipro Lab45, the innovation lab of Wipro, announced the launch of its decentralized identity and credential exchange (DICE) ID, which puts users in control of their personal data and enables faster, easier and secure sharing of private information online.

Greaves Cotton: The company Greaves Cotton has announced leadership expansion across retail, finance, and e-mobility businesses, to steer the next phase of growth. This includes the appointment of Narasimha Jayakumar as CEO of retail business, Sandeep Divakaran as CEO of Greaves Finance, and Chandrasekar Thyagarajan as CFO of Greaves Electric Mobility.

Biocon: Kotak Mahindra Bank’s arm Kotak Special Situations Fund, managed by Kotak Investment Advisors has announced an investment of Rs 1,070 crore in Biocon. Biocon will use the proceeds to finance Biocon Biologics’ acquisition of the biosimilars business of its partner Viatris to create a global vertically integrated biosimilars player.

Sonata Software: The company’s North America arm will buy 100 per cent stake in Quant Systems Inc, a Texas based IT services corporation for an upfront payment of $65 million and will pay up to $95 million over 2 years for achievement-based earn-outs.

Zomato: The online food delivery platform announced its latest offering ‘Zomato Everyday’ to offer customers affordable home-cooked meals made by “home-chefs.” The new offering will provide meals starting Rs 89 and is currently available in the select areas of Gurugram only.

Lemon Tree Hotels: The company has signed a licence agreement for a 47-room property in Bhopal under its brand ‘Lemon Tree Hotel’. The hotel is expected to be operational by December 2023. This hotel will feature 47 well-appointed rooms, a restaurant, a banquet, a gym and other public areas. Subsidiary Carnation Hotels will be operating this hotel.

Gujarat Gas: Raj Kumar, Chief Secretary, Government of Gujarat is appointed as Chairman of Gujarat Gas. The appointment of Kumar has been made in view of the letter received from the Energy & Petrochemicals Department, Government of Gujarat.

Barbeque-Nation Hospitality: UTI Mutual Fund has bought an additional 0.14% stake or 54,829 equity shares in the casual dining chain via open market transactions on February 21. With this, its shareholding in the company rose to 9.1753%, up from 9.0346 percent earlier.

HG Infra Engineering: The company has secured a project in Himachal Pradesh from Rail Vikas Nigam and the project worth is Rs 466.11 crore. The construction period is 30 months and the project entails the construction of foundations, substructure and superstructure along with river training/protection work, earthwork and allied works for viaduct 1 & 2 in between chainage, in connection with the Bhanupali-Bilaspur-Beri new railway line in Bilaspur of Himachal Pradesh.

Sarda Energy & Minerals: South Eastern Coalfields has issued a Letter of Acceptance to the company against its bid for the re-opening, salvaging, rehabilitation, development and operation of Kalyani underground mines, in Chhattisgarh on a revenue sharing of 4.5 percent basis. The necessary agreements will be executed in due course as per the terms of the Letter of Acceptance.